Best States To Retire Tax-Wise

Different states come with different retirement advantages. For many, this includes advantageous taxes. Some states will not tax your Social Security or pensions, while other states have no income tax at all. The best state to retire in tax-wise will vary depending on your circumstances.

- Written by Christian Simmons

Christian Simmons

Financial Writer

Christian Simmons is a writer for RetireGuide and a member of the Association for Financial Counseling & Planning Education (AFCPE®). He covers Medicare and important retirement topics. Christian is a former winner of a Florida Society of News Editors journalism contest and has written professionally since 2016.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: May 25, 2022

- Updated: October 2, 2023

- 6 min read time

- This page features 6 Cited Research Articles

- Edited By

States That Do Not Tax Retirement Income

Every state taxes its residents a little differently. But when looking for the best states to retire, there are several that stand out since they do not tax some retirement income. This can have a sizeable impact on your retirement lifestyle.

Social Security

According to AARP, most states do not tax Social Security. This can have a huge impact on your retirement income, especially if you are planning to rely heavily on Social Security after you retire.

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

However, even states that don’t tax Social Security may still be very expensive due to other factors. For example, Florida has no state income tax but partially makes up for that with high property taxes.

Pensions

There are some states that will not tax your pension or other forms of retirement income, like a 401(k). Since pensions are considered income, any state with no state income tax falls into this group as well.

- Alabama

- Alaska

- Florida

- Hawaii

- Illinois

- Mississippi

- Nevada

- New Hampshire

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

According to AARP, it should be noted that while Alabama and Hawaii won’t tax your pension, they will tax 401(k) and IRA distributions.

Military Income

Most states do not tax military income, but there are several regions of the country that may partially tax it. However, those areas are shrinking.

According to Yahoo, five more states eliminated income tax on military retirement in 2022: Arizona, Indiana, Nebraska, North Carolina and Utah. Altogether, there are 35 states that do not tax military income at all.

- Colorado

- Delaware

- Georgia

- Idaho

- Kentucky

- Maryland

- Montana

- New Jersey

- New Mexico

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

*Ad: Clicking will take you to our partner Annuity.org.

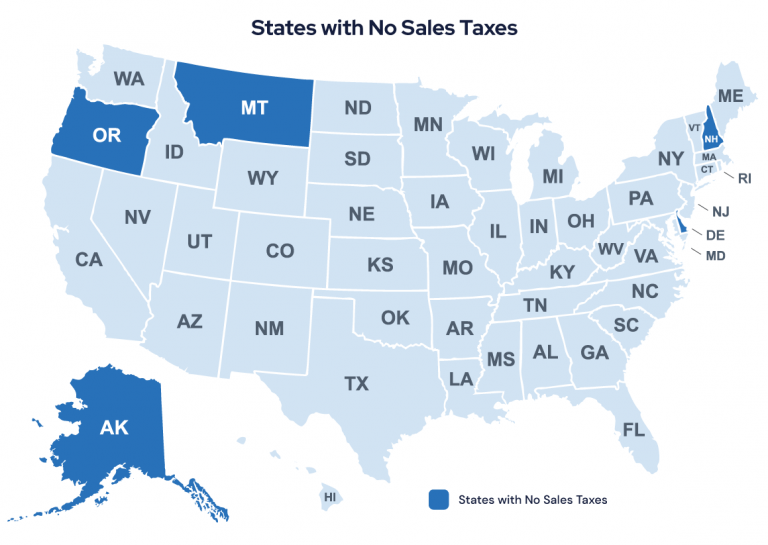

States with the Highest and Lowest Sales Tax Rates

States with low-income tax rates often try to make up the difference with higher sales tax rates.

Retail sales taxes are relatively easy to understand — usually, it is a flat percentage of your purchase price. But critics argue that sales taxes hurt people with less money and slower income growth — two qualities that may include many retirees.

| Highest Tax States | Sales Tax Rate | Lowest Tax States | Sales Tax Rate |

| Louisiana and Tennessee (Tie) | 9.55% | Maine | 5.5% |

| Arkansas | 9.47% | Wisconsin | 5.43% |

| Washington | 9.29% | Wyoming | 5.22% |

| Alabama | 9.24% | Hawaii | 4.44% |

| Oklahoma | 8.97% | Alaska | 1.76% |

While Alaska has no state sales tax, it allows cities or other jurisdictions to charge local sales taxes.

Not all purchases are subject to sales taxes, but that varies by state. All but 13 states don’t tax groceries. Illinois is the only state to tax prescription drugs, but at least nine states do not tax over-the-counter medications.

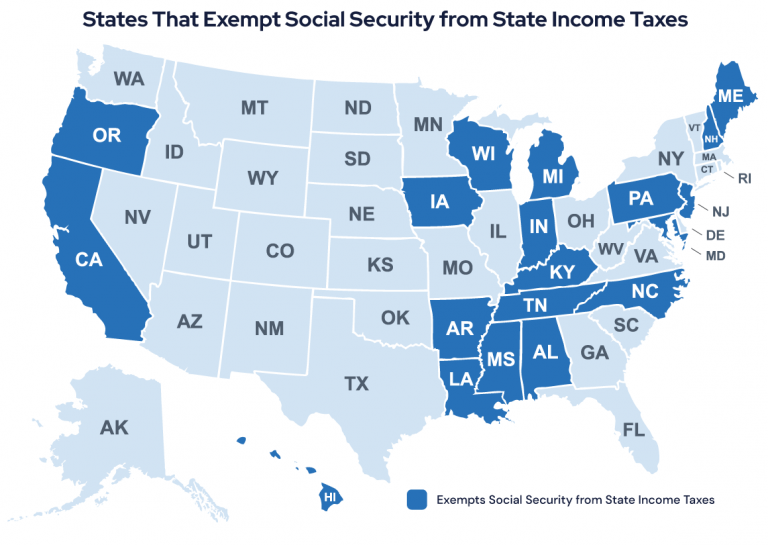

States’ Tax Policies On Your Social Security

Most states levy some type of income tax on your Social Security benefits, but 19 states exempt your Social Security income from state income taxes.

Two states — Utah and Nebraska — tax your Social Security income the same way the federal government does.

First, you add up your adjusted gross income, nontaxable interest and half of your Social Security benefits. This will give you your “combined income.”

If you have other sources of income, and your combined income is $25,000 for single filers or $32,000 for married couples filing jointly, your Social Security is treated like any other income for tax purposes.

Highest and Lowest State Property Tax Rates

All 50 states and the District of Columbia have property taxes. For private citizens, these taxes are based on a percentage of your home’s value. Most states base their tax on 100% of the value, but Nevada bases its property rate on 35% of the assessed value of your home.

| State | Highest Property Tax Rates | State | Lowest Property Tax Rates |

| New Jersey | 2.49% | District of Columbia | 0.56% |

| Illinois | 2.27% | Louisiana | 0.55% |

| New Hampshire | 2.18% | Colorado | 0.51% |

| Connecticut | 2.14% | Alabama | 0.41% |

| Vermont | 1.90% | Hawaii | 0.28% |

All 50 states and the District of Columbia offer some type of property tax relief for retirees. Most states provide exemptions for seniors if you meet age and income requirements.

At least 40 states provide homestead exemptions or tax credits to older property owners. Homestead exemptions reduce the assessed value of your home, effectively lowering your tax rate.

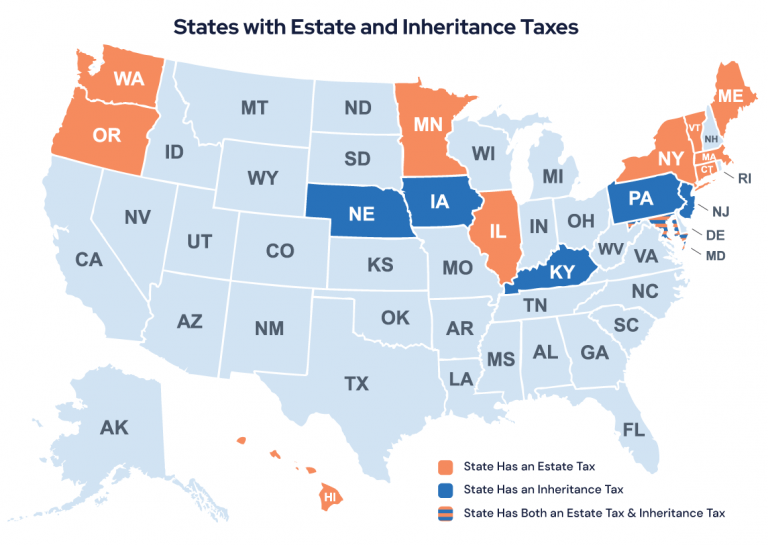

States with Inheritance and Estate Taxes

The estate tax, a tax levied on your estate when you die before it’s distributed to your heirs, is generally associated with the federal government.

“Those thinking of moving should be aware of which states levy estate and inheritance taxes,” said Janelle Cammenga from Tax Foundation. “These are mostly concentrated in the Northeast, although a number of states in the Midwest — in addition to Washington and Oregon — levy them, as well.”

The District of Columbia and 12 states have their own estate taxes and six have an inheritance tax — which taxes the heirs after they receive their share of the inheritance, rather than the estate left behind before it’s distributed.

Maryland is the only state that has both an estate and an inheritance tax.

Estate taxes don’t kick in until the estate is worth a certain amount. Anything below this is considered an exemption. Exemption amounts for estate taxes range from a low of one million dollars in Oregon and Massachusetts to a high of $5.9 million in New York.

There are no exemptions on inheritance taxes.

Most states have a sliding rate on inheritance and estate taxes.

| State | Tax Type | Exemption | Rate |

| Connecticut | Estate tax | $7.1 million | 10.8% - 12% |

| District of Columbia | Estate tax | $4 million | 11.2% - 16% |

| Illinois | Estate tax | $4 million | 0.8% - 16% |

| Iowa | Inheritance tax | N/A | 0% - 15% |

| Kentucky | Inheritance tax | N/A | 0% - 16% |

| Maine | Estate tax | $3 million | 13% - 16% |

| Maryland | Estate Tax and Inheritance tax | Estate tax only: $5 million | Estate tax: 0.8% - 16% Inheritance: 0% - 10% |

| Massachusetts | Estate tax | $1 million | 0.8% - 16% |

| Minnesota | Estate tax | $3 million | 13% - 16% |

| Nebraska | Inheritance tax | N/A | 1% - 18% |

| New Jersey | Inheritance tax | N/A | 0% - 16% |

| Estate tax | Estate tax | $5.9 million | 3.06% - 16% |

| Oregon | Estate tax | $1 million | 10% - 16% |

| Pennsylvania | Inheritance tax | N/A | 0%- 15% |

| Rhode Island | Estate tax | $1.6 million | 0.8% - 16% |

| Vermont | Estate tax | $5 million | 16% |

| Washington | Estate tax | 2.2 million | 10% - 20% |

*Ad: Clicking will take you to our partner Annuity.org.

Frequently Asked Questions About Retirement Taxes

6 Cited Research Articles

- AARP. (2022, April 8). Which states tax Social Security benefits. Retrieved from https://www.aarp.org/retirement/social-security/questions-answers/which-states-do-not-tax-social-security-benefits.html

- Waggoner, J. (2022, March 29). 12 States That Won’t Tax Your Retirement Distributions. Retrieved from https://www.aarp.org/money/taxes/info-2020/states-that-dont-tax-retirement-distributions.html

- Geier, Ben. (2022, January 11). These Five States Just Eliminated Income Tax on Military Retirement. Retrieved from https://www.yahoo.com/video/five-states-just-eliminated-income-203758421.html

- Lankford, K. (2020, November 10). States That Won’t Tax Your Military Retirement Pay. Retrieved from https://www.aarp.org/money/taxes/info-2020/states-that-tax-military-retirement-pay.html

- Loughead, K. (2020, February 3). State Individual Income Tax Rates and Brackets for 2020. Retrieved from https://taxfoundation.org/state-individual-income-tax-rates-and-brackets-for-2020/

- Hill, C. (2019, November 9). The Most Tax-Friendly U.S. State for Retirees Isn’t What You’d Guess – and Neither Is the Least Tax-Friendly. Retrieved from https://www.marketwatch.com/story/this-is-the-least-tax-friendly-state-in-america-for-retirees-and-surprise-its-in-the-midwest-2019-11-06

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696