Retirement Life and Leisure

You have a lot of choices when it comes to what to do in retirement. Planning your post-career life should focus on the retirement lifestyle you want to pursue, and planning for that goal. Finding the right retirement lifestyle and leisure activities for you depends on your interests, long-term goals and finances.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Financially Reviewed By

Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Published: August 11, 2021

- Updated: October 24, 2023

- 16 min read time

- This page features 11 Cited Research Articles

Life After Retirement

One of the most important questions to ask yourself when planning for retirement is, “What do I want to do in retirement?” Planning to save for retirement without knowing how you’ll want to spend those savings in your golden years can leave you unprepared for the life you truly want after retirement.

According to the Social Security Administration, for Americans at full-retirement age, men are looking at more than 18 years in retirement, women at more than 20 years. That’s a lot of time, and you’re going to want to be happy with how you spend it.

What Are Your Retirement Living Priorities?

Consider what’s important to you – friends and family, socializing, travel, hobbies and activities. Use this simple checklist of questions to get started. Use it to think about these and other priorities that you place on your life in retirement.

Retirement Lifestyle Checklist- Do you want to continue working – full-time or part-time?

- Do you want to reinvent your life in retirement?

- Do you want to pursue hobbies or other activities?

- Is community important to you?

- Do you want to take part in charitable activities?

- Do you want to travel?

- Do you want to retire abroad?

- Do you want to move to another state?

- Is living somewhere with lower taxes important?

- Do you have health concerns that will affect your retirement lifestyle?

- How important to you is health care quality where you live?

- Will you need more income in retirement?

- How much will your lifestyle cost – and will your finances support it?

- Do you plan to stay in your current home?

- Do you want to live near family or friends?

- Do you want to move into a retirement community?

- Have you planned on assisted living as you age?

- What activities are you passionate about that you want to include in your retirement lifestyle?

Once you determine your priorities in your life after retirement, you will have a better idea of what should be included in your retirement planning strategy.

Living Abroad

Many Americans make the decision to move after they retire, but there’s no reason to limit yourself to staying within the United States.

More than 400,000 U.S. retirees live abroad, according to the Social Security Administration. There are several countries where an American can stretch their retirement dollars while enjoying retirement.

The secret is looking for a balance between your finances, a place you will enjoy living and understanding what goes into becoming an expat – from tax issues to health care. You’ll still have to pay income taxes in the states, and Medicare typically doesn’t cover your health care in a foreign country.

Living abroad isn’t for everyone, but it can be worth looking into if there is a certain dream destination you’ve always thought about living at.

If you’re considering retiring in another country, you should first take an extended vacation there of a month or more and try to live like a local to see if you really could tolerate living there full time. You may find that you’re more comfortable calling the U.S. home base and just travelling frequently.

If you do make the decision to retire abroad there are many countries that welcome expats and offer advantageous tax rates on top of the added benefit of reasonable cost of living. But there are also plenty of nations that make it very difficult for foreigners to move there.

Be sure to extensively research the countries you have in mind.

Is Your Lifestyle Future-Proofed?Secure the lifestyle you've always imagined post-retirement. Discover annuity options that can make it a reality.

*Ad: Clicking will take you to our partner Annuity.org.Moving to Another State

Even if leaving the country is too extreme for you, there are plenty of reasons you might consider moving to another state after you retire, and many retirees choose to do so.

It could be simply that you’ve lived in a cold weather region for years and are ready to enjoy some well-deserved warm weather in retirement. Or you may find that the tax situation in a different state could have a big boost on the amount of money you have left after you retire.

If you’re considering moving within the United States when you retire, be sure to look at how taxes, cost of living, health care and other quality of life issues stack up in the best and worst states to retire in before deciding where to relocate.

Different states will make sense for different retirees. For example, there are certain parts of the country that may tax withdrawals from a 401(k) but not from a pension. Be sure to do some research to determine where your money will go the farthest.

You also may want to look into states that have large retirement-age population, ensuring you the chance to maintain and build new friendships and social connections after you retire. For example, nearly a fifth of all Florida residents are 65 or older according to the Pew Research Center.

Financial Wellness

The average American age 65 and older will spend $974,268 over the rest of their lifetime – or $50,220 per year in 2019 dollars – according to the Bureau of Labor Statistics.

But that average varies depending on where you live – ranging from $857,886 in Mississippi to $1.48 million in Hawaii.

And that’s just the average amount spent. Factor in any special retirement activities you have, and you can quickly see how you’ll need to plan for an income in retirement.

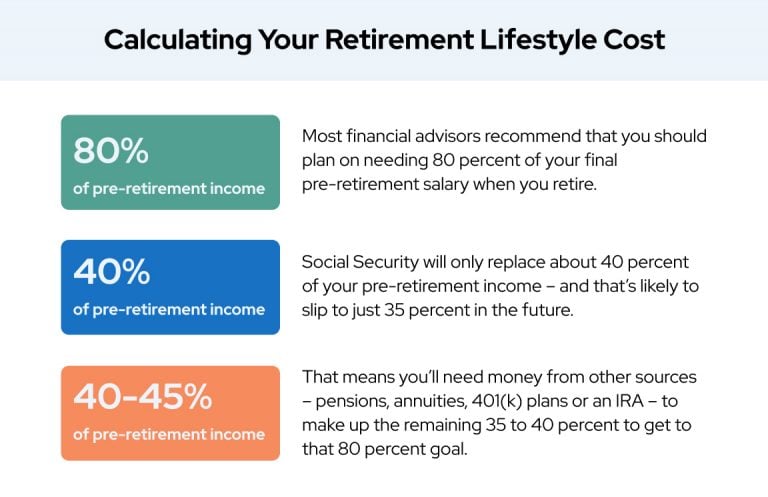

Don’t Rely on Social Security Alone

If you’re like most Americans, you’ve probably gotten comfortable with the security of a regular paycheck. That can change dramatically as soon as you retire.

You can expect your Social Security benefits to be less than half your pre-retirement salary. So you’ll need to cover that difference.

Consider Savings, Annuities and Other Options

Most people will need to have another income stream to make sure they can meet their bills and still enjoy their life in retirement.

Additional Retirement Income StreamsLearn More About Financial Wellness- Pensions

- Pensions have become increasingly rare in the private sector. For those who still have a pension – including many government workers – it can provide a regular source of lifetime income.

- Annuities

- An annuity is a life insurance contract that you purchase which guarantees you a regular income in retirement and a steady stream of income for the rest of your life.

- Retirement Savings

- Most private-sector retirement plans rely on 401(k) plans, individual retirement accounts (IRAs) or similar plans. You contribute money that is invested in the plan throughout your working life. Depending on the type of plan, you typically get a tax break either when you contribute or when you take money out after retirement.

- Veterans pension benefits

- If you meet certain criteria – served during wartime, are 65 or older, have a service-connected disability, little or no income – you may qualify for Veterans Pension benefits through the Department of Veterans Affairs. This is different from your military retirement pension, which pays a lifetime annuity based on the number of years you served.

Retirement Hobbies and Activities

Retirement should be the time of your life to pursue what matters most to you and makes you happy. You’ll need to live within your means, but you can still pursue hobbies and activities that meet those two goals.

Hobbies and Activities to Consider During Retirement- Explore your creativity

- Hobbies from knitting to photography can take on a new life in retirement if you’re passionate about them and have more free time to devote to them. If you’ve ever wanted to write a book or start a blog about something that interests you, now’s the time – without having to worry about turning it into a daily grind.

- Travel

- Free of a limited number of vacation days, your budget may be your only limit to seeing the world. Taking an RV adventure across the country may be an affordable option you can spread out over multiple weeks. Flexible travel dates and group tour packages can reduce the cost of intercontinental travel. Cruises offer activity packed adventures at sea with four-day packages providing affordable options.

- Outdoor adventure

- Retirement is a great opportunity to head out on a weekday and avoid weekend crowds at national and state parks or your favorite fishing hole. National and state parks also offer senior passes in a lot of cases. Check with your local parks for details. Camping, hiking or other outdoor activities can also help you keep in shape while enjoying nature.

- Go back to school

- Keep your mind active in retirement by taking classes at your local community college or university. Retirement is a good time to study a subject you were always interested in but never had the time to delve into. Many colleges and universities allow senior citizens to take or audit classes at reduced tuition rates – and in some cases for free.

- Health and fitness

- Whole retirement communities are built around golf courses. But running, swimming, biking and dozens of other healthy activities are great lifestyles to pursue in retirement. Staying physically active provides long-term health benefits. The U.S. Department of Health and Human Services recommends adults 65 and older get at least two and a half hours of moderate – or 75 to 150 minutes of vigorous – physical activity a week.

- Volunteer

- According to a survey by AARP and Independent Sector, an estimated 42 percent of retirees volunteer in their communities, an organization that works with foundations and nonprofits. Volunteering is a great way to remain active, socialize with people, and contribute to your community while feeling a sense of accomplishment.

The key to finding the right activity or hobby for your retirement lifestyle is to choose activities that you will enjoy – or expand on the ones you’ve enjoyed during your working years.

Focusing on the things you enjoy in life should be as important a part of your retirement planning as the financial strategy that gets you there.

Senior Housing Options

The type of senior housing you choose can make a difference in your retirement lifestyle – from activities you pursue to who you socialize with to how much your new lifestyle will cost.

You may be interested in moving to a senior living community. These areas are typically exclusively open to older Americans, allowing retirees to form relaxed and tight-knit communities.

Age-restricted retirement communities typically have freestanding houses as well as apartments or townhouses aimed at active, older adults. They may feature their golf courses, organized activities, busy social calendars and other amenities.

Many other retirees also opt for aging in place, meaning, they plan to stay in their own home throughout retirement instead of moving to a new community or a facility down the line.

Retirees considering aging in place often make proactive modifications to their homes, from walk-in tubs to rails and secured rugs. They also may have to look into caretaking for any issues they may have difficulty dealing with independently later in retirement.

Some older adults, especially those who are well into retirement, also move to assisted living facilities or communities. These facilities, which can vary from similar to a hospital setting to full-blown apartments, allow seniors to get around-the-clock care and medical services.

If you’ve reached the age or have an illness where you are struggling with day-to-day activities or to care for yourself, then assisted living may make the most sense.

Lock In Today’s Best Fixed Annuity RatesStart with a free annuity consultation to learn how annuities can help fund your retirement.

*Ad: Clicking will take you to our partner Annuity.org.Senior Safety

Safety becomes more and more important as you age, and there are many areas for older Americans to consider to ensure that they are living a safe retirement.

There are many home modifications that can promote safety within your residence. Things like bed rails and chair lifts can make your life much easier and prevent common in-home injuries.

Seniors who live alone or are aging in place also may want to look into home security systems to prevent break-ins and medical alert systems. These devices can bring you instant help if you have a fall or some other in-home injury or medical emergency.

Retirees should also be on the lookout for scams and other forms of elder abuse. Suspicious phone calls or emails could be methods to try to steal from or take advantage of you.

Older Americans should also be aware of their own mobility and mental state. There may come a point where driving yourself or going out on your own is no longer safe to do.

Work

Just because you’ve retired from your main career doesn’t mean that you have to be done working. Many retirees find fulfillment through second careers after they retire.

Continuing to work after retiring in some capacity can bring day-to-day structure to your life as well, which is a major issue for many older Americans.

Finding a job after you retire – whether it’s full time or part time – can help you continue to feel that you are doing something meaningful and offer an engaging way to take some time off of your hands.

Full-Time Work

Depending on your situation, you may be willing to jump into a full-time job after you retire. But it could potentially be much more fun and meaningful than your past career.

Since money is no longer the primary objective of working, you could enter a field that you’ve always wanted to be a part of or find a job with meaningful work that really speaks to you.

It also may make sense to identify a job with flexible hours, allowing you to still live a full retirement lifestyle while working when it pleases you.

In the wake of the COVID-19 pandemic, remote work has seen a rapid rise across the country. This could offer you the chance to get involved with a job, whether for mental stimulation or to make money, without ever having to leave your home.

Part-Time Work

A part-time job in retirement can be a good fit for people who want to keep working, enjoy the downtime that comes with traditional retirement, and have an additional income stream.

3 Reasons People Choose a Part-Time Job in Retirement- Lifestyle

- A desire to be physically active and mentally stimulated or try a new line of work.

- Financial need

- You may need the extra money – or health care benefits – that come with a part-time gig.

- Easing into retirement

- If you like your job but want more free time after retirement, then you may consider talking to your employer about shifting to part time or working as a contractor.

Several part-time jobs are available to older Americans that require minimal training, provide a steady supplemental income stream and keep you active. As with full-time jobs, companies are now offering more opportunities to work from home which can serve as a bridge to retirement.

Top Five Part-Time Jobs for Retirees- Real estate agent

- According to Indeed, the national average salary for a real estate agent is $42 per hour – that includes a commission on the properties they sell. You will have to be licensed.

- Dental hygienist

- You'll need at least an associate's degree in the field and a license to practice. About 17% of dental hygienists are over 55 and earn an average wage topping $35 per hour.

- Freelance consultant

- You can put your career experience to work for yourself by advising others in your field. The average salary is more than $27 an hour.

- Full charge bookkeeper

- More than 73% of people in this part-time job are over age 55 with an average hourly wage of more than $20 – while regular bookkeepers earn about $18 per hour on average.

- Driver

- About 73% of school bus drivers are over the age of 55 with a national average wage of $17 an hour. Taxi drivers and people who work for gig economy rideshares like Lyft or Uber make on average between $14 to $15 an hour.

If you plan to continue working into retirement, talk to your licensed financial advisor about tax implications for any retirement savings or collecting Social Security benefits. These may have an impact on your finances.

Travel

Travel is naturally a major point of excitement for many retirees. Plenty of Americans hope to spend much of their lives in retirement going on their dream vacations and seeing the world.

An important thing to remember about travel in retirement is that it may make sense to frontload it. Travelling and taking vacations often shortly after you retire may make a lot of sense since this is when you are likely to be at your healthiest and most mobile condition.

Think things like international vacations, or weeks or months-long stays away from home. These are easiest to pull off earlier in retirement.

Travel Tips for Seniors- Take the grandest or most extensive vacations you’re interested in early in retirement when you are still mobile.

- Cruise ships are an easy and relaxing way to visit international locations, even if you have low mobility.

- Look into investing in travel insurance, especially if you plan to travel a lot.

- Try to space vacations out to give yourself something to look forward to.

But there are still plenty of fun travel options available years into retirement. Cruises are very popular for older adults, giving you the chance to essentially sail to exotic destinations in a floating hotel and restaurant.

Even those with limited mobility can make the most of a cruise ship vacation.

While many people are interested in travelling abroad, don’t forget that there are many great destinations within the United States as well. These types of trips can be especially beneficial when you are older since they don’t require as much travel or planning.

Technology

There are many types of technologies that can help make your retirement easier, both from a service and recreation perspective.

Many smart home devices and apps are now available, which can be very helpful to older adults. There are services that can allow you to control everything through your mobile device or computer, from the lights of your home to the thermostat. This can simplify dealing with many home issues for seniors.

Technology can have major social benefits as well. There has been a boom since the pandemic in virtual and video conference technology. This can give retirees that chance to join clubs, groups or other social events without having to leave their home.

This not only opens a whole new host of ways to meet people but can also be critical in helping those with mobility issues or chronic conditions stay socially connected.

And there are plenty of apps that can make your life easier. If you can no longer drive or don’t want to, there are a number of transportation apps available that work just like a taxi. There are also food and grocery delivery apps as well.

You can easily cut down on how much time you spend running errands or leaving the house without giving up on any of the goods or items that you need.

AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: October 24, 2023Share This Page11 Cited Research Articles

- McGurran, B. (2021, April 25). 5 Important Tips for How to Retire Abroad. Retrieved from https://www.forbes.com/advisor/personal-finance/5-important-tips-for-how-to-retire-abroad/

- Kiniry, L. (2021, April 12). How to Retire Abroad – According to Those Who Have Done It. Retrieved from https://www.cntraveler.com/story/how-to-retire-abroad

- Indeed. (2021, February 22). 12 Great Part-Time Jobs for After Retirement. Retrieved from https://www.indeed.com/career-advice/finding-a-job/best-jobs-after-retirement

- Stebbins, S. (2021, February 11). Retirement Costs: Estimating What It Costs to Retire Comfortably in Every State. Retrieved from https://www.usatoday.com/story/money/2021/02/11/retirement-costs-comfortable-in-every-state-life-expectancy/115432956/

- Bureau of Labor Statistics. (2020, December). Consumer Expenditures Report 2019. Retrieved from https://www.bls.gov/opub/reports/consumer-expenditures/2019/home.htm

- Fox, M. (2020, September 14). Dreaming of Retiring Abroad? Here’s What You Need to Know. Retrieved from https://www.cnbc.com/2020/09/14/heres-how-to-leave-the-us-and-retire-abroad.html

- Brandon, E. (2020, June 1). 10 Retirement Lifestyles Worth Trying. Retrieved from https://money.usnews.com/money/retirement/slideshows/10-retirement-lifestyles-worth-trying

- Rapacon, S. (2020, March 5). Top 25 Part-Time Jobs for Retirees. Retrieved from https://www.aarp.org/work/job-search/part-time-jobs-for-retirees/

- Hartman, R. (2020, January 8). How to Decide Where to Retire. Retrieved from https://money.usnews.com/money/retirement/baby-boomers/articles/how-to-decide-where-to-retire

- Braverman, B. (2019, June 12). How to Choose a 55+ Active Adult Community. Retrieved from https://www.forbes.com/sites/nextavenue/2019/06/12/how-to-choose-a-55-active-adult-community/?sh=228a95f12e95

- Doherty, P. (2018, October 14). How to Travel the World After You Retire. Retrieved from https://www.travelandleisure.com/travel-tips/how-to-travel-world-after-retirement

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696