Best Fixed Annuity Rates for June 2025

RetireGuide brings you the best, most up-to-date fixed annuity rates from the nation's top providers. Some of the highest annuity rates belong to top-rated insurance companies, although there is not always a direct relationship.

- Written by Jennifer Schell, CAS®

- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: June 3, 2020

- Updated: June 17, 2025

- 6 min read time

- This page features 4 Cited Research Articles

Best Annuity Rates This Week

Multi-year guaranteed annuities, also known as MYGAs, are fixed annuities that lock in a stable interest rate for a specified time period. Surrender periods usually last three to 10 years.

Because MYGA rates change daily, RetireGuide and its partners update the following tables below frequently. It’s important to check back for the most recent information.

Below are current best annuity rates.

| Term | Rate | Provider | Product | AM Best Rating |

|---|---|---|---|---|

| 1-Year | 6.00% | Global Atlantic | ForeCare Fixed Annuity (LTC) | A |

| 2-Years | 5.25% | Mountain Life Insurance Company | Secure Summit | B |

| 3-Years | 6.00% | Mountain Life Insurance Company | Secure Summit | B |

| 4-Years | 5.30% | Americo Financial Life and Annuity Insurance Company | Platinum Assure | A |

| 5-Years | 6.15% | Wichita National Life Insurance | Security 5 MYGA | B+ |

| 6-Years | 5.50% | Americo Financial Life and Annuity Insurance Company | Platinum Assure | A |

| 7-Years | 5.80% | Mountain Life Insurance Company | Secure Summit | B |

| 8-Years | 5.40% | Clear Spring Life and Annuity Company | Preserve Multi-Year Guaranteed Annuity | A- |

| 9-Years | 5.40% | Clear Spring Life and Annuity Company | Preserve Multi-Year Guaranteed Annuity | A- |

| 10-Years | 5.80% | Mountain Life Insurance Company | Secure Summit | B |

*Ad: Clicking will take you to our partner Annuity.org.

Several factors determine the rate you’ll receive on an annuity. Annuity rates tend to be higher when the general level of all interest rates is higher.

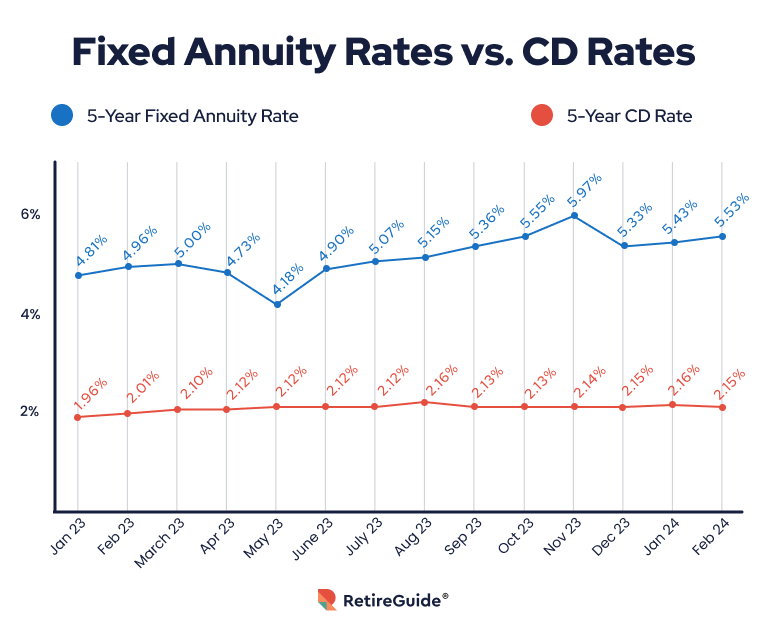

Annuity Rates vs. CD Rates

When shopping for fixed annuity rates, you might find it helpful to compare rates to certificates of deposit (CDs), another popular option for safe, reliable growth.

Both products have interest rates that vary over time and follow trends set by the Federal Reserve’s raising or lowering of interest rates. In general, fixed annuity rates outpace the rates for CDs of a similar term.

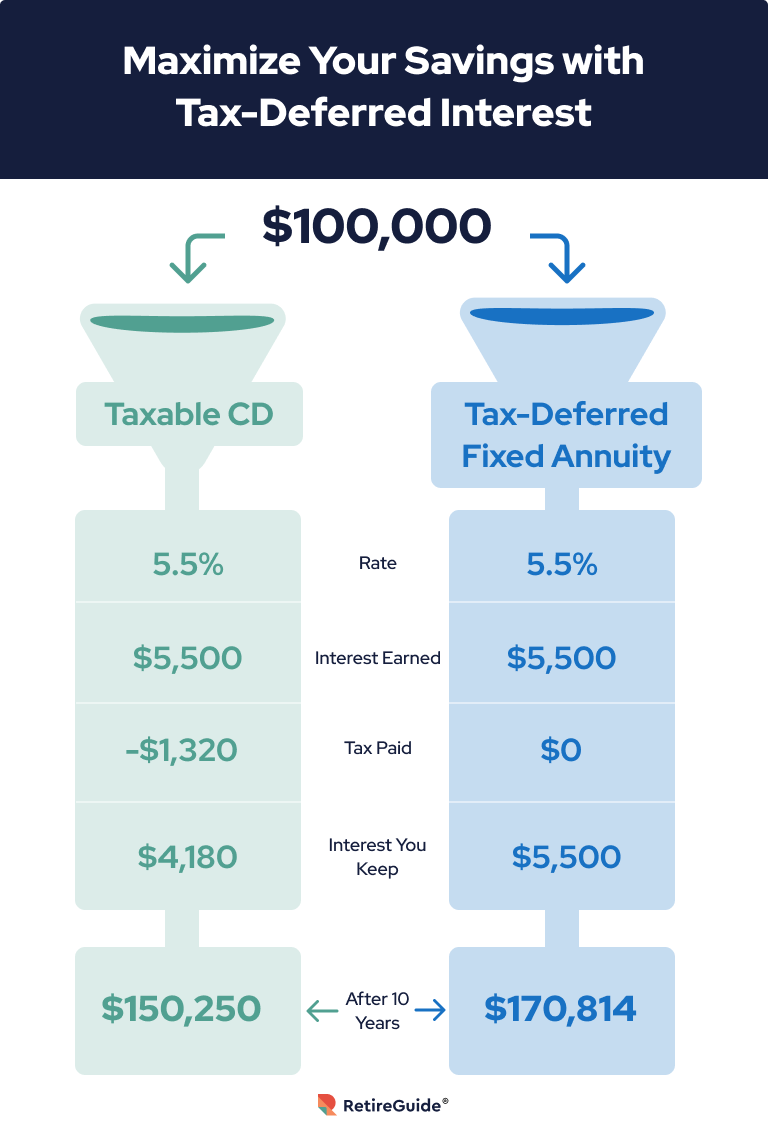

Aside from earning a higher rate, a fixed annuity might provide better returns than a CD because annuities have the advantage of tax-deferred growth. This means you won’t pay taxes on the interest earned until you start receiving payments from the annuity, unlike CD interest, which is counted as taxable income each year it’s earned.

Tax-deferred growth can make a big difference in how much your savings grow because more money is left in the account to compound the interest.

How Annuity Rates Work

Fixed annuities work by accumulating growth at a guaranteed rate for a certain amount of time before converting to a stream of income. The rates annuity companies offer change frequently and tend to mirror long-term bond interest rates.

When bond rates increase, annuity rates also tend to rise. That’s because insurance companies invest most of the money they receive as annuity premiums in fixed-income securities like conservative bonds.

The Federal Reserve raised interest rates several times throughout 2022 and 2023 in an attempt to combat inflation. This led many experts to believe that the Fed would lower rates in 2024.

However, at a policy forum in April 2024, Federal Reserve chair Jerome Powell suggested that rates might not come down for some time. Powell said that the Fed isn’t sure when interest rate cuts might occur, as inflation has yet to fall to the Fed’s benchmark of 2%.

These interest rate predictions, which can correlate with annuity rates, suggest that 2024 could be a good time to purchase a fixed annuity before rate cuts happen.

Remember that the best annuity rates today may be different tomorrow. It’s important to check with insurance companies to confirm their specific rates.

*Ad: Clicking will take you to our partner Annuity.org.

Comparing Annuity Rates

When comparing annuity rates, it’s important to conduct your own research and not solely pick an annuity simply for its high rate.

Annuities can be complex, each with its own benefits and risks that affect its rates.

- Consider the type of annuity.

- Each annuity type has a different range of average interest rates. For example, a 4-year fixed annuity could have a higher rate than a 10-year multi-year guaranteed annuity (MYGA). This is because fixed annuities might offer a higher rate for the first year and then reduce the rate for the remainder of the term, while MYGAs guarantee the rate for the whole term.

- Only compare annuity rates from financially strong insurance companies.

- The guarantee on an annuity is only as good as the company that issues it. If the company you buy your annuity from goes broke or bust, you could lose money. Check a company’s financial strength by consulting nationally recognized impartial rating agencies, like AM Best. Most experts recommend only considering insurers with a rating of A- or above for long-term annuities.

- Remember that your age and health affect your annuity rate.

- Annuity income rises with the age of the purchaser because the income will be paid out in fewer years, according to the Social Security Administration. Don’t be surprised if your rate is higher or lower than someone else’s, even if it’s the same product.

Other Considerations Beyond Annuity Rates

Annuity rates are just one factor to consider when buying an annuity. Ideally, you want to look for a high rate but also for a low minimum investment amount, low fees and an annuity that’s backed by a company with a history of financial stability.

- Fees

- Understand the fees you’ll have to pay to administer your annuity and if you need to cash it out. Cashing out can cost up to 10% of the value of your annuity, according to the Wisconsin Office of the Commissioner of Insurance. On the other hand, administrative fees can add up over time. Make sure you calculate the cost as part of your overall return.

- Inflation

- Inflation can eat up your annuity’s value over time. You could consider an inflation-adjusted annuity that boosts the payouts over time. Understand, though, that it will significantly reduce your initial payouts. This means less money early in retirement but more as you age.

- Protection

- Unlike CDs, annuities are not insured by the federal government. However, your payouts are protected by your state’s guaranty association. The amount that’s guaranteed varies from state to state. The National Organization of Life & Health Insurance Guaranty Associations can help you find out how protected your investment is.

Frequently Asked Questions About Annuity Rates

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

4 Cited Research Articles

- Cox, J. (2024, April 16). Fed Chair Powell Says There Has Been a "Lack of Further Progress" This Year on Inflation. Retrieved from https://www.cnbc.com/2024/04/16/powell-cites-lack-of-progress-this-year-in-reaching-feds-inflation-goal.html

- U.S. Securities and Exchange Commission. (2024). Annuities. Retrieved from https://www.investor.gov/introduction-investing/investing-basics/glossary/annuities

- ELCO Mutual Life & Annuity. (2023, April 19). Tax Deferral: The Power of Compound Interest. Retrieved from https://www.elcomutual.com/news/tax-deferral-power-compound-interest

- Wisconsin Office of the Commissioner of Insurance. (2018, February). Consumer’s Guide to Understanding Annuities. Retrieved from https://oci.wi.gov/Documents/Consumers/PI-214.pdf

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782