Medicare Supplemental Insurance (Medigap) Costs

The premium for Medicare Supplemental insurance, or Medigap, varies widely. Several factors impact Medigap costs, including the plan type, where you live and which insurer’s plan you choose.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Savannah Pittle

Savannah Pittle

Senior Financial Editor

Savannah Pittle is a professional writer and content editor with over 16 years of professional experience across multiple industries. She has ghostwritten for entrepreneurs and industry leaders and been published in mediums such as The Huffington Post, Southern Living and Interior Appeal Magazine.

Read More- Reviewed By

Aflak Chowdhury

Aflak Chowdhury

Medicare Expert

Aflak Chowdhury is a Medicare expert and independent insurance broker specializing in group health insurance. He has worked for major providers including Humana and Principal Financial Group and today works mainly in the small group market.

Read More- Published: July 20, 2020

- Updated: April 17, 2025

- 8 min read time

- This page features 4 Cited Research Articles

Key Takeaways- Medigap plans can cost anywhere from $33 to $766, with an average of $217 in 2023.

- Compare costs besides just the premium — including out-of-pocket costs and amount of coverage — when comparing Medigap plans.

- To get an accurate idea of cost and coverage, compare plans with the same letter name against one another since they will provide the same benefits.

What’s the Average Cost of Medicare Supplement Plans?

The average cost of a Medicare Supplemental insurance plan, or Medigap, is difficult to determine because of the wide cost range. Medigap costs depend on the plan you choose, where you live and which insurer you choose. Costs can range from $33 for a high-deductible Plan G in Iowa, to $766 for Plan F in New York. For those who turned 65 on or after Jan. 1, 2020, the max cost is $705 for Plan G in New York. KFF reports the average monthly premium for plan holders was $217 in 2023.

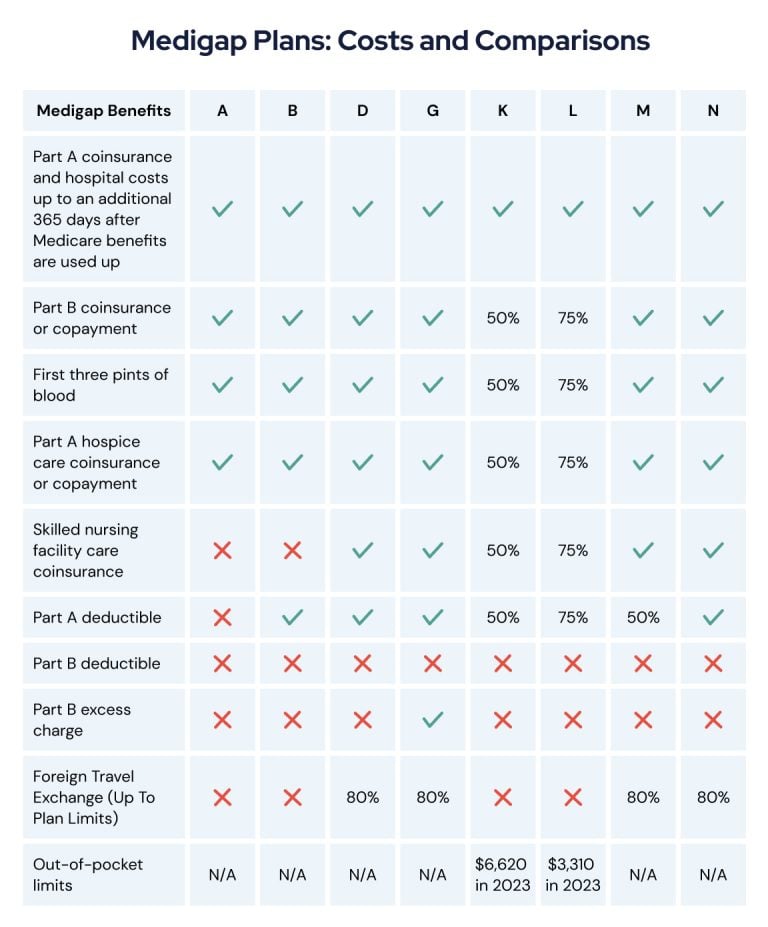

These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage. There are ten different Medigap plans, labeled A through N, with each offering a different set of benefits. The most popular is Plan G.

Medigap can help cover your out-of-pocket costs, including deductibles, coinsurance and copayments.

Medigap Supplemental insurance policies can provide full or partial coverage for:- Some out-of-pocket costs not covered under Medicare Part A and Part B.

- Coinsurance or copayments for Medicare Part B.

- Part A coinsurance and hospital costs for an additional 365 days after Medicare benefits are used up.

- Skilled nursing facility care coinsurance.

- Part A coinsurance or copayments for hospice care.

- Limited foreign travel emergency care.

Medigap plans are administered by private insurance companies that Medicare later reimburses.

This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage.

The more comprehensive the medical coverage is, the higher the premium may be.

Medicare Supplement Cost Factors

The costs of Medigap plans vary from company to company based on several factors, including geographical location. It’s important to consider these when comparing plans.

Factors Affecting Medigap Plan Costs- Monthly Premiums

- Different insurers use different pricing strategies. Community-rated pricing means everyone pays the same premium, regardless of age. Issue-age rating sets the premium based on your age when you first buy a plan. Attained-age rating ties your premiums to your current age — meaning the premiums increase as you get older.

- Deductibles

- If your Medigap plan does not cover the Medicare Part A or Part B deductibles, you will have to pay those out-of-pocket costs.

- Coinsurance and Copays

- Some Medigap policies don’t fully cover all coinsurance and copays associated with Original Medicare, so you may have to pay a share of those costs.

- Out-of-Pocket Costs

- Medigap will only pay for services and items that Original Medicare covers. So, you will still have to pay out of pocket for things like dental, vision and hearing services. Medigap cannot be applied to prescription drugs. But, you can still add a Medicare Part D prescription drug plan to help with those costs.

- Out-of-Pocket Limit

- Two Medigap plans — Plan K and Plan L — have maximum out of pocket (MOOP) limits. Plan K’s MOOP in 2025 is $7,220 and Plan L’s is $3,610.

- Medigap Discounts

- Some insurers offer discounts that can lower your Medigap premiums or other costs. These include you and someone else in your household both having a Medigap plan from the same insurer, a discount for automatic payments or online enrollment.

Medicare Supplement Plan Cost Comparison

Medicare requires each plan type of the same letter to offer basic, standardized benefits. So when comparing prices of Medigap plans, always compare plans with the same letter name against one another — compare Plan A from insurer one with Plan A from insurer two, for example.

Expand

Expand**Plan N pays 100% of the costs of Part B services, except for copayments for some office visits and some emergency room visits.

**Plan C and Plan F are no longer available for anyone who became eligible for Medicare on or after January 1, 2020. Those who had either plan prior to that date can keep their coverage.

***Plans F & G offer a high deductible plan in some states.

Note: Plan C and Plan F are no longer available for anyone who became eligible for Medicare on or after January 1, 2020. Those who had either plan prior to that date can keep their coverage.

While the coverage in Medigap plans is standardized, costs are not.

If you want to save money, it’s important to shop around, compare coverage, get quotes and ask questions.

Costs can vary depending on the plan you choose and where you live. Costs can also range widely between insurers.

Medigap Plan Premium Comparisons (Based on a 65-Year-Old Male Nonsmoker)Medigap Plan New York, NY Indianapolis, IN Des Moines, IA Plan A $207-$414 $115-$400 $107-$314 Plan B $301-$665 $172-$460 $156-$429 Plan D $389-$537 $122-$252 $151-$252 Plan G $325-$825 $115-$493 $114-$495 Plan K $105-$225 $71-$178 $55-$154 Plan L $214-$322 $101-$295 $100-$323 Plan M $356-$524 $88-$197 $86-$171 Plan N $260-$515 $93-$496 $86-$390 However, according to Vice President of Senior Market Sales Brian Hickey, picking the right Medigap plan isn’t all about price.

“There are other factors that should be considered, including rate increase history, financial stability, customer service experiences and claims history,” Hickey told RetireGuide. “Talking to a professional that has experience across all plans is key in making the right decision.”

If you are trying to switch to a better plan and you are in poor health, make sure to ask if the insurer considers your current health status before enrolling.

How Are Medigap Policies Priced?

How an insurance company sets prices can directly impact how much you pay now — and in the future — for your Medigap coverage.

For some insurers, your age may not influence how much you pay in premiums.

Other companies may increase your policy price every year or lock in a rate based on how old you were when you first bought the policy.

Bob Glaze | 1:07 What impact does age have on Medigap costs? Get Free Help Pricing and Building Your Medigap PlanReplay VideoBob Glaze, a licensed insurance agent, explains the impact that age has on Medigap costs.

Get Free Help Pricing and Building Your Medigap PlanReplay VideoBob Glaze, a licensed insurance agent, explains the impact that age has on Medigap costs.Community-Rated or ‘No Age-Related’

Age isn’t a factor with this type of Medigap policy. Your monthly premiums may fluctuate because of inflation, but your age will not impact how much you pay.

Typically, everyone with this type of policy pays the same price, regardless of age.

Issue-Age-Rated or ‘Entry Age-Rated'

The cost for this type of policy depends on how old you are when you first purchase the plan.

Monthly premiums are lower for younger people. But the price won’t increase due to age as you get older.

For example, Amy purchases an issue-age-rated policy when she’s 65 years old and pays $120 a month. Bob starts his coverage at age 72 and pays $170 a month for the same policy.

However, Amy’s premiums won’t increase as she gets older. The price is more or less locked in at the age when your policy was issued, though cost may gradually increase over time due to inflation.

Attained-Age-Rated

The cost of this policy is linked to your current age. Your monthly premiums increase each year as you grow older.

Attained-age-rated policies may be your most affordable option when you first qualify for Medicare. But over time, it can become your most expensive option.

Premiums can also increase due to inflation and other factors.

Have you selected your 2025 Medicare Supplement plan?Maximize your Medicare savings by connecting with a licensed insurance agent.What Determines the Costs of Medicare Supplement Plans?

Several factors can influence how much you pay for a Medigap policy — including the type of plan you select and the insurance company you purchase it from.

Factors That Determine Medigap Premiums- Type of Plan

- Medigap Plan F and Plan C are being phased out. They are no longer available to people who turned 65 on or after Jan. 1, 2020. Some plans charge higher premiums than others. Plans with higher premiums generally provide more comprehensive coverage.

- Insurance Company

- Some insurers may offer special discounts to married couples or nonsmokers. Some companies will provide discounts just for living with somebody over a certain age, regardless of marital status, depending on the state. Or you might qualify for discounts if you pay yearly instead of monthly or set up automatic online bill paying. Some companies offer what’s known as Medicare SELECT. These policies require you to use specific providers, but in return, may offer lower premiums.

- Geographic Area

- The cost of a Medigap policy can vary depending on where you live. Not every type of Medigap insurance plan is available in each state or from every insurance company that offers Medigap policies. Every state is required to offer at least one Medigap plan to people over the age 65.

- How the Plan Is Rated

- Insurance companies can rate plans based on your age. For some plans, your age impacts how much you pay for coverage. For other plans, it does not.

Bob Glaze | 2:25 Is it possible to reduce my Medigap premiums? Get Free Help Pricing and Building Your Medicare PlanReplay VideoBob Glaze, a licensed insurance agent, explains how it's possible to lower your Medigap premiums by finding another provider.

Get Free Help Pricing and Building Your Medicare PlanReplay VideoBob Glaze, a licensed insurance agent, explains how it's possible to lower your Medigap premiums by finding another provider.Frequently Asked Questions About Medigap Costs

Is the cost of Medicare Supplemental insurance tax deductible?Yes. Your Medicare Supplemental insurance (Medigap) premiums are tax-deductible as a below-the-line deduction. It's not mandatory to enroll in Medigap which means you can receive a tax break if it exceeds 7.5% of your adjusted gross income (AGI).How much does Medicare supplemental insurance cost per month?Medigap plans can cost anywhere from $33 per month to $766 per month. Your monthly cost is affected by the state you live in, if you are a smoker, your marital status, your age and your payment plan.Do Medigap costs increase with age?Some, but not all, supplemental insurance policies set rates based on age. For example, a Community-Rated policy is based on inflation rather than age. However, Issue-Age-Rated and Attained-Age-Rated are two types of policies affected by age.Editor Rachel Murphy contributed to this article.

Last Modified: April 17, 2025Share This Page4 Cited Research Articles

- KFF.org. (2024, October 18). Key Facts About Medigap Enrollment and Premiums for Medicare Beneficiaries. Retrieved from https://www.kff.org/medicare/issue-brief/key-facts-about-medigap-enrollment-and-premiums-for-medicare-beneficiaries/

- Medicare.gov. (n.d.). Cost of Medigap Policies. Retrieved from https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap/medigap-costs/costs-of-medigap-policies

- Medicare.gov. (n.d.). How To Compare Medigap Policies. Retrieved from https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies

- Medicare.gov. (n.d.). Medigap Costs. Retrieved from https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap/medigap-costs

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-749-5443Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696