Life Insurance Riders

Life insurance riders — such as accelerated benefit riders, family riders and accidental death riders — are add-ons for most life insurance policies to fit your specific needs. Attaching a life insurance rider to your policy typically increases your monthly premiums, but there are some companies that offer riders for free. One rider will likely benefit you better than another. Learn how to determine which rider you need, along with its cost efficiency.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Financially Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: May 22, 2020

- Updated: February 22, 2023

- 10 min read time

- This page features 5 Cited Research Articles

- Edited By

What Is a Life Insurance Rider?

Life insurance riders are optional extra benefits you can add to your term, whole or universal life insurance policy. Whether or not you can add the rider depends on your insurer.

Each rider you add typically raises the price of your policy, but riders also allow you to tailor a basic policy so that it better fits your needs.

Riders may allow you to buy extra coverage without being examined by a doctor again, convert a term life policy to a whole life insurance policy or allow a larger payout if you are injured or killed in an accident.

The Importance of Riders

Riders offer flexibility and customizable coverage that basic life insurance policies lack. While the point of life insurance is to protect your loved ones in the future, not every basic policy is perfectly tailored to meet all your needs. A rider helps fill gaps and guarantees financial protection for you and your loved ones.

For example, say you’ve suddenly become disabled and can no longer work to make premium payments. With a basic policy, your coverage would lapse. However, if you had the premium waiver rider, your policy would not lapse if you missed payments due to a disability and you would continue to be covered. A disability may not be an issue now, but it could hinder your finances if you became disabled later in life.

Keep in mind that riders can help with many extenuating life changes, not just disabilities. Thinking ahead with riders can help you ensure you’re financially protected. If you don’t explore the wide range of customizable life insurance riders, you could leave holes within your coverage and be in trouble later on.

How To Determine Which Riders You Need

Consider your family, health, lifestyle and budget when trying to determine which riders you need while planning for your retirement.

If you’re struggling to narrow down your needs when selecting a rider, consult with a life insurance advisor before making a purchase. This way, you can make sure you’re not wasting money on a rider you may not necessarily need.

- Family

- If you have a child or family members to care for, you may want to consider riders specifically made for families. The family income rider will provide your loved ones with a monthly income. You could also insure your child on your policy with a child rider.

- Lifestyle

- If you have a dangerous lifestyle or career, you may want to consider the accelerated benefits rider or accidental death and dismemberment rider. The accelerated benefits rider allows you to access benefits while you’re still alive to pay for medical procedures or long-term care.

- Health

- If you have poor health, or a family history of illnesses, you could consider a long-term care rider to cover costs not covered by Medicare.

- Budget

- Some riders are included in your premium, or free, which can make them a no brainer to add to your policy. However, some riders, like the return of premium rider, can increase your premium cost by a large margin. In those cases, you may want to reconsider if the rider is worthwhile.

The Most Common Life Insurance Riders

“There are a few popular insurance riders you’ll come across when shopping for life insurance: guaranteed insurability, waiver of premium and accidental death,” R.J. Weiss, a Certified Financial Planner™ professional and founder of The Ways to Wealth told RetireGuide.

The guaranteed insurability rider allows you to purchase more coverage without going through medical underwriting. This can be helpful if your health changes later in life and you need to increase your coverage. If you have a medical exam done and find health issues, your premiums will increase. Skipping the medical underwriting eliminates that risk.

The waiver of premium rider will keep your policy active if you miss premium payments due to an illness or disability. This rider will keep your policy from lapsing.

The accidental death and dismemberment (AD&D) benefit rider provides your beneficiary with an additional payout if you were to pass away or become injured. There are rules to qualify for the AD&D payout that varies depending on your insurer.

There are specific instances when you’d likely want to consider some of the common riders. However, make sure they fit your needs — don’t add them to your policy based on popularity alone.

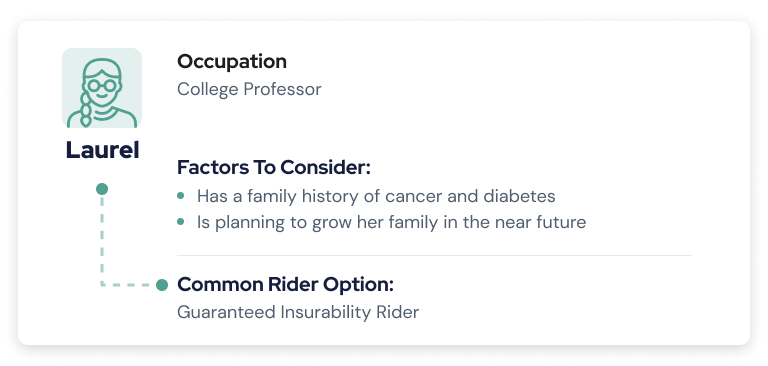

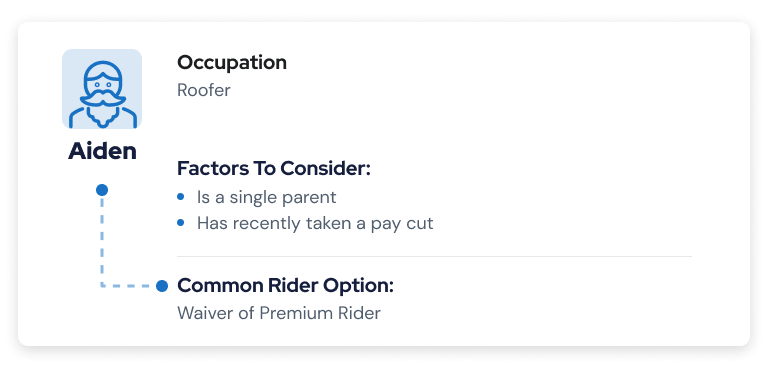

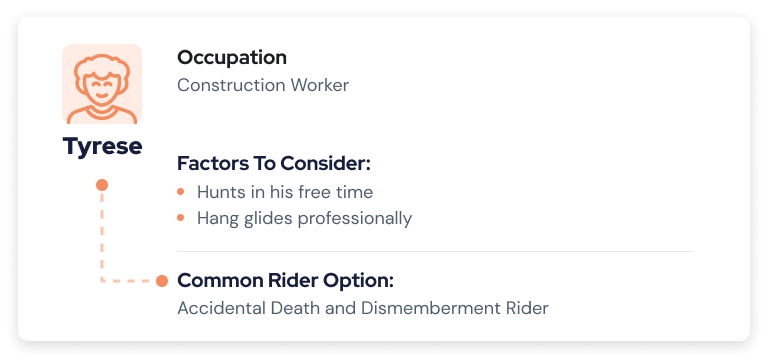

Below are some examples of individuals who may want to consider common riders.

Your health and lifestyle are the key factors in choosing one of the common life insurance riders. According to a 2022 report from the U.S. Department of Labor, roofers, hunters and construction workers all had a high account of nonfatal injuries. If your hobbies or career put you at risk, you’d benefit from considering an accidental death and dismemberment rider or a waiver of premium rider.

There are a few popular insurance riders you'll come across when shopping for life insurance: guaranteed insurability, waiver of premium and accidental death.

Other common riders you could also consider if they fit your needs: the accelerated death benefit, long-term care, child term, return of premium and the term conversion.

Accelerated Benefit Rider

Accelerated benefit riders, also known as living benefits, allow all or a portion of the policy’s proceeds to be paid out to you if a specific event happens. These events may include being diagnosed with a terminal illness, the need for long-term care or an illness or injury that leaves you incapacitated. Planning how to pay for future medical or care costs can help keep your finances secure as you age.

An accelerated death benefit rider may be included in a basic life insurance policy but is most often offered as an optional rider.

These riders are usually added to universal life insurance policies or other permanent life insurance policies. But, some insurance companies have begun making them an option for term life insurance policies. And they may be available in certain group term and group permanent life insurance policies.

- Accelerated Death Benefit Rider

- Provides access to your death benefit if you are diagnosed with a terminal illness. You still pay premiums so your beneficiaries can access what is left of the death benefit.

- Chronic Illness Rider

- Allows you to access benefits early for daily living expenses if you become disabled through a chronic illness.

- Critical Illness Rider

- Allows early access to benefits to treat certain illnesses.

- Long-Term Care Rider

- Provides monthly payments if you require a long-term nursing home stay or home health care.

- Waiver of Premium for Disability Rider

- Your monthly premiums are set aside if you can’t earn a living because of an illness or injury.

More than 3 million Americans are covered by accelerated benefit riders, according to the Alabama Department of Insurance.

Long-Term Care Insurance Rider

A life insurance policy with a long-term care (LTC) rider allows you to access part or all of your death benefit to pay for long-term care while you’re still alive. In most cases of traditional health insurance, like Medicare, long-term care isn’t covered

According to the Administration for Community Living, those turning 65 have roughly a 70% chance of needing some type of long-term care services later in life. With such a high chance of needing coverage, consider a LTC rider and the potential consequences if you don’t have coverage. For example, a home health aide would cost $5,462 per month in 2023, according to Genworth’s Cost of Care Survey.

Child Term Rider

A child rider can cover unexpected expenses from your child’s death. These might be medical and funeral expenses. They are generally inexpensive, and one child rider will cover all the children in your family.

Return of Premium Rider

A return of premium rider gives you back your premiums if you outlive your life insurance policy. You can only get a return of premium rider with a term policy, not a permanent policy, since permanent policies last your entire life.

If you don’t have a return of premium rider and your term policy ends, there will be no death benefit. This type of rider makes your premiums significantly more expensive, according to the Insurance Information Institute.

Term Conversion Rider

A term conversion rider allows you to convert your term life insurance into a permanent life insurance policy without needing a new medical exam. Term life policies usually set a time limit on converting, so you should make the conversion before the deadline.

By having the option to skip a medical exam, your health won’t affect your premium price. If you predict you’ll have a health condition later in life, like diabetes or cancer, a term conversion rider may be appealing to you.

Let’s say you originally purchased a 20-year term policy after having your first child. The original plan may have been to provide a death benefit to ensure your child is financially protected if you were to pass away. However, as you age, you may realize there are more expenses you need covered throughout your entire life. Converting your term policy to a permanent policy through the rider might be beneficial in this case.

Other Life Insurance Riders

Insurers offer a wide range of other riders designed to meet a long list of situations in which you may need to access your benefits. This includes but isn’t limited to the cost of living, overloan protection, family income, spousal and estate protection riders. The riders available vary depending on your insurer and the policy you choose.

- Cost of Living Rider

- Allows you to purchase more life insurance each year to keep up with inflation.

- Overloan Protection Rider

- Helps you avoid a policy lapse due to excessive loan balances exceeding cash values within the policy.

- Family Income Rider

- Pays a monthly income to family members if the insured dies.

- Spousal Rider

- Pays a death benefit if your spouse dies.

- Estate Protection Rider

- Helps offset estate taxes if your death benefit goes to your estate.

Keep in mind that this isn’t an exhaustive list: other beneficial options may be available.

Are Insurance Riders Worth It?

If you choose a rider that suits your needs and it’s within your budget — it’s probably worth it. If the rider is free — it’s definitely worth it. If a rider raises your premium by a large amount, it may be a good idea to consider other options.

If you’re not sure if the rider is a good deal, feel free to consult with a life insurance agent to settle any concerns. Researching your options to ensure you understand how to customize your policy with riders is a great way to give you peace of mind that your loved ones are protected in the future.

“It depends on the rider and the individual’s circumstances. Riders can add value by increasing the death benefit or providing coverage for certain causes of death,” Weiss told RetireGuide. “However, riders can also increase premiums. Overall, they’re a way to personalize your policy, so it’s worth looking into the options offered by your insurer.”

While no one can predict the future, consider all possibilities and their likelihoods seriously. That’s what life insurance and the riders are for — predicting future financial issues and finding solutions for them. If you find your insurer offers riders that will provide more protection to your loved ones later on, you should try to get a quote for them.

It depends on the rider and the individual’s circumstances. Riders can add value by increasing the death benefit or providing coverage for certain causes of death. However, riders can also increase premiums. Overall, they're a way to personalize your policy, so it's worth looking into the options offered by your insurer.

5 Cited Research Articles

- U.S. Department of Labor. (2022, November 9). Employer-Reported Workplace Injuries and Illnesses – 2021. Retrieved from https://www.bls.gov/news.release/pdf/osh.pdf

- Genworth Financial. (2022, June 2). Cost of Care Survey. Retrieved from https://www.genworth.com/aging-and-you/finances/cost-of-care.html

- Administration for Community Living. (2020, February 18). How Much Care Will You Need? Retrieved from https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

- Insurance Information Institute. (n.d.). What Are the Different Types of Term Life Insurance Policies? Retrieved from https://www.iii.org/article/what-are-different-types-term-life-insurance-policies

- National Association of Insurance Commissioners. (n.d.). Life Insurance. https://content.naic.org/consumer/life-insurance.htm

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696