How Does Life Insurance Work?

If you have an active life insurance policy and you pass away, your beneficiary receives a death benefit. There are different types of life insurance policies, each with different benefits and drawbacks. Having a guide to break down how each type works, along with how the death benefit is paid out, can make the complexities of life insurance easy to understand.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Financially Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: August 31, 2022

- Updated: June 8, 2023

- 7 min read time

- This page features 9 Cited Research Articles

- Edited By

What Is Life Insurance?

Life insurance is a legally binding contract between you and an insurance company. As long as your premiums are paid, a death benefit will be paid to your beneficiary if you pass away while your policy is active.

According to a 2022 Insurance Barometer study conducted by LIMRA and Life Happens, 106 million adults lack proper insurance coverage. This is due to common misconceptions about life insurance, such as assuming it’s too expensive or confusing.

- 81% thought life insurance was too expensive

- 65% aren’t sure how or what type of life insurance to purchase

- 75% have other financial responsibilities

Your age, health and type of insurance you choose will determine the premium cost. A premium is the monthly cost of keeping your life insurance policy active. The older you are, and the more coverage you want, the more expensive your premiums will be.

People typically overestimate the cost of life insurance, thinking it will cost them thousands of dollars. But if you’re a healthy 30-year-old looking for $250,000 of coverage for a 10-year term, your premium could cost as low as $12.40 a month.

Understanding how life insurance works, along with what’s covered, can help you choose a life insurance policy.

What Does Life Insurance Cover?

Life insurance policies cover natural and accidental deaths.

However, some policies have conditions that deny coverage in specific situations. For example, if the policyholder passes away from committing suicide within the first two years their policy was instated, then they may be denied coverage. You should discuss the guidelines of coverage with your insurance provider before you purchase a policy.

If you choose a type of permanent life insurance, you can borrow from your policy while you’re still alive. The funds can go toward anything from retirement goals to unexpected medical costs. If your beneficiary receives the death benefit, they can use it to cover a variety of expenses.

- Funeral and burial costs

- The average cost of a funeral with a viewing and burial service is $7,848.

- Mortgage payments

- The average 30-year fixed-rate mortgage rate has nearly doubled in 2022.

- College tuition

- On average, college tuition costs $10,338 for an in-state public college. Out-of-state or private colleges are over $20,000.

- Outstanding debt

- The average American has $90,460 in debt.

Account for all the expenses you need covered if you were to pass away. If you don’t, your family members could be financially unprepared for your loss.

How Do the Different Types of Life Insurance Work?

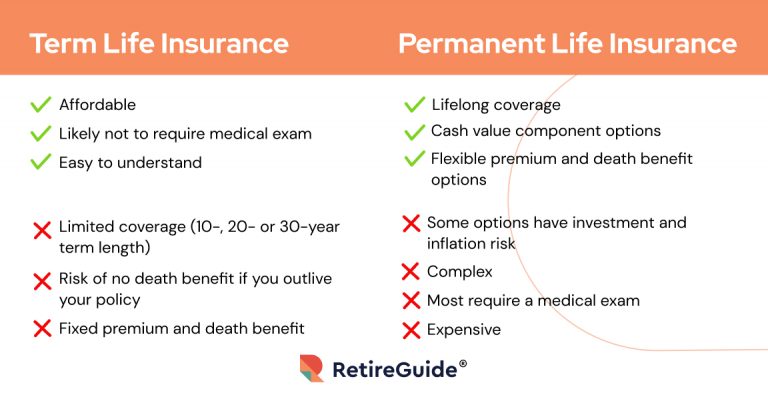

There are two main types of life insurance — permanent and term life. The main differences between each type are the coverage length and policy flexibility.

Term life insurance has limited coverage up to 30 years. All permanent policies have lifetime coverage. Several key terms can help you understand how each type of life insurance works.

- Death benefit

- This is the coverage amount on your life insurance policy. Your death benefit is what your beneficiary receives when you pass away.

- Premium

- A premium is the amount you are charged, typically monthly, for your life insurance policy to remain active.

- Flexible

- If your death benefit or premium is flexible, it means the amounts can be changed.

- Fixed

- If your death benefit or premium is fixed, you cannot change either amount.

- Cash value component

- Permanent life insurance policies have a cash value component. Some of your premium payment goes into this account and grows tax deferred. You can typically borrow from your cash value account while you’re still alive.

A term life policy has a fixed premium and death benefit amount. Term life policies do not have a cash value component.

There are two main types of permanent life insurance — whole and universal. They have different rules when it comes to their premiums and death benefit, but both have a cash value component.

How Term Life Insurance Works

Term life insurance only offers coverage for a limited amount of time. These are called term lengths. You can typically choose a term length between 10, 20 or 30 years of coverage.

Your death benefit amount and premium cost is set with a term life policy. Premiums for a term life policy are more affordable compared to a permanent policy.

If the policyholder passes away during the term length, the beneficiary will receive a death benefit. If the policyholder outlives the policy’s term length, there will be no death benefit.

How Universal Life Insurance Works

Universal life insurance offers lifetime coverage with a tax-deferred cash value component.

With a universal policy, you have a flexible premium and death benefit amount. You can even skip premium payments if you wanted to.

Since universal life insurance has flexible premiums and coverage that never expires, your death benefit comes with little risk.

But because universal life insurance policies offer flexible lifelong coverage with a cash value component — premiums can be expensive.

How Whole Life Insurance Works

Similar to universal life insurance, whole life insurance also offers lifetime coverage, with a tax-deferred cash value component.

But with a whole life policy, your premiums and death benefit amounts are fixed. If your premiums are paid on time, you have guaranteed coverage for life.

Because whole life insurance policies offer lifelong coverage with a cash value component, the premiums can be expensive.

Whole life is the most popular type of permanent life insurance policy, according to the Insurance Information Institute.

How Does Life Insurance Pay Out?

Life insurance can pay out in one of four ways — in a lump-sum payment, specific income payout, annuity or a retained asset account. If you include all essential paperwork when filing your payout claim, you should receive your death benefit payment within 30 to 60 days.

- Lump-sum payout

- You receive 100% of the death benefit in one payment.

- Specific income payout

- You receive the death benefit in installments, not all at once. For example, if the death benefit is $250,000, you could choose to get $25,000 a year for ten years.

- Annuity

- You can convert your death benefit into an annuity, meaning you’ll get guaranteed payments throughout the rest of your life.

- Retained asset account

- The benefit will be left with your insurance company in an interest-bearing account. You can access these funds with a checkbook.

Remember that insurance companies have regulations in place for payouts. For example, if the policyholder was murdered, there could be roadblocks with getting your insurance payout.

This doesn’t mean most life insurance policies don’t pay out. In 2021 alone, life insurance death benefits payouts totaled $97.1 billion.

Pros and Cons of Life Insurance

The biggest pro of all life insurance policies is that they financially protect your family once you’re gone. Without a life insurance policy in place to provide a death benefit, your loved ones may not be able to cover expenses without your income.

A disadvantage of life insurance is the cost. Premium prices are often unaffordable for a permanent policy. While there are affordable options, like a term policy, you may be paying for a policy that won’t protect your loved ones in the long run.

There are other pros and cons as well, depending on what type of life insurance you choose.

How Much Life Insurance Do I Need?

A simple rule to estimate how much life insurance you need is by taking your annual income and multiplying it by seven or 10. For example, if you make $60,000 a year, you should get a life insurance policy with at least $420,000 of coverage.

If you want to get more detailed, you could follow the DIME rule for a coverage estimate. The DIME rule is an acronym which helps you remember what to account for.

- D stands for debt. Account for your outstanding debt and funeral expenses.

- I stands for income. Take your income and multiply it by seven or 10.

- M stands for mortgage. Determine how much you still owe.

- E stands for education. Estimate how much it will cost to send your kids to college.

You can also use a life insurance calculator if you need help calculating how much life insurance you need.

9 Cited Research Articles

- Lincoln Heritage Funeral Advantage. (2022). How Much Does a Funeral Cost? Retrieved from https://www.lhlic.com/consumer-resources/average-funeral-cost/

- DeMatteo, M. (2021, November 18). The Average American Has $90,460 in Debt—Here’s How Much Debt Americans Have at Every Age. Retrieved from https://www.cnbc.com/select/average-american-debt-by-age/

- Powell, F. et al. (2021, September 12.) See the Average College Tuition in 2021-2022. Retrieved from https://www.usnews.com/education/best-colleges/paying-for-college/articles/paying-for-college-infographic

- Kadetskaya, T. (2021, August 31). How Long Does It Take for Life Insurance to Pay Out Death Benefits? Lawyers Explain How to Get Your Check Fast. Retrieved from https://life-insurance-lawyer.com/how-long-for-life-insurance-to-pay/#:~:text=When%20a%20claim%20is%20delayed,claims%20are%20still%20unfairly%20delayed

- Life Happens. (2021). Life Insurance Barometer Study. Retrieved from https://lifehappens.org/research/life-insurance-is-on-peoples-minds/

- Insurance Information Institute. (n.d.). Benefits and Claims. Retrieved from https://www.iii.org/publications/triple-i-insurance-facts/life-annuity-financial-data/benefits-and-claims

- Insurance Information Institute. (n.d.). What Are the Different Types of Permanent Life Insurance Policies? Retrieved from https://www.iii.org/article/what-are-different-types-permanent-life-insurance-policies

- CNN. (n.d.). Ultimate Guide to Retirement. Retrieved from https://money.cnn.com/retirement/guide/insurance_life.moneymag/index11.htm

- Progressive Casualty Insurance Company. (n.d.). What Affects the Cost of Life Insurance? Retrieved from https://www.progressive.com/answers/how-much-is-life-insurance/

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696