Compare Life Insurance

There is no one-size-fits-all life insurance policy. The best way to choose a policy is by learning how to compare the benefits and drawbacks of each type. There are two main types of life insurance to consider — term and permanent. There are five types of permanent policies and two types of term policies.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Financially Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: September 2, 2022

- Updated: October 7, 2023

- 9 min read time

- This page features 8 Cited Research Articles

- Edited By

Factors To Consider When Comparing Life Insurance

You should consider your overall health, coverage length, average costs of a policy, death benefit amount and plan flexibility when comparing life insurance policies. Your lifestyle determines many of these factors.

For example, if you have young children, you’ll likely want a death benefit amount that will financially protect your children while they’re dependents. You may consider a term life insurance policy with a term length of at least 20 years and a high death benefit in case you suddenly pass away.

If you’re an older adult with no children and looking to build cash value as you near retirement, a whole life insurance policy may better suit you. A whole life insurance policy is a permanent type of life insurance that offers a cash value component.

- Your Health

- Some life insurance policies require a medical exam to determine your risk level. If you’re found to have health risks, such as being a regular smoker, your premiums will increase, or you could be denied coverage. Choosing a life insurance policy without a medical exam will lower your premium costs and help guarantee acceptance. If you’re in good health, a medical exam should not be an issue.

- Coverage Length

- You can choose the length of coverage for a term life insurance policy. Common term lengths are 10, 20 or 30 years. All permanent life insurance policies provide lifelong coverage.

- Average Costs

- Term policies are generally the most affordable, according to U.S. News. Most permanent policies are more costly due to lifelong coverage with the option to build cash value. The exact cost of your policy depends on your age, coverage amount and type of policy.

- Death Benefit Amount

- Policies typically have a limit on your death benefit amount. For example, the Trendsetter Super term policy with Transamerica Life Insurance has a death benefit range of $25,000 to $10 million in coverage. Use a life insurance calculator if you don’t know how much coverage you need. You should consider your debt, income, mortgage and education costs when calculating your coverage.

- Plan Flexibility

- Some term life policies are convertible, meaning you can make them permanent for lifelong coverage. Some permanent policies are more flexible compared to others. For example, with universal life insurance policies, you can adjust your premium or benefit amount. This is not an option with whole life insurance policies.

Choosing a policy with an affordable premium should be priority. According to the Insurance Information Institute, no matter what policy you choose, if you stop paying your premiums your coverage could lapse. If you pass away while your coverage is lapsed, your insurer is not required to pay the death benefit to your beneficiaries. This would render your policy unusable.

*We may be compensated if you click this ad.

How Much Do Life Insurance Policies Typically Vary?

Term and permanent life insurance policies are very different. The two key differences are the term lengths and cost.

With a permanent life insurance policy, you have lifelong coverage, but the premiums are more expensive. With a term life insurance policy, you have coverage for a limited time, but the premiums are typically more affordable.

Keep in mind that the cost of life insurance premiums fluctuate depending on a wide range of factors.

When it comes to comparing the four permanent life insurance policies, the differences aren’t as stark. In fact, most are similar in functionality. But this isn’t to say they’re all identical. You should still carefully consider each type.

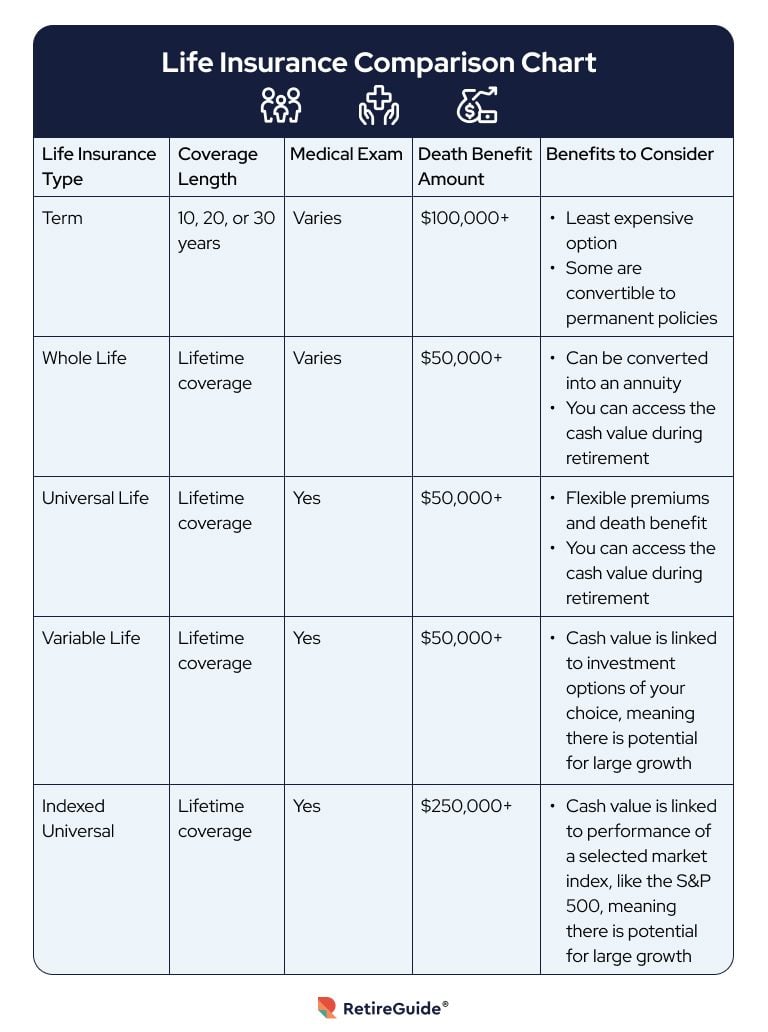

Comparing Life Insurance Types

There are two types of term policies — level term and decreasing term.

Level term policies have a set death benefit amount and premium rate, whereas decreasing term gradually decreases the premium rate and death benefit until the term ends.

The most popular type of term policy is level term, according to the Insurance Information Institute.

Because level term policies are most common, we will use this type to compare to permanent policies.

The four permanent policies being compared are whole life, universal life, variable life and indexed universal life.

Term vs. Permanent

The three biggest factors when comparing term and permanent policies are the coverage length, premium costs and the cash value component.

Term life has coverage for a limited time, which is determined when you purchase the policy. Typically, the term length options are 10, 20 or 30 years. Term policies do not build cash value. If you’re a healthy 50-year-old, your monthly premium for a term policy could be as low as $30.

All permanent policies have lifelong coverage and a cash value component. Some permanent policies can be more flexible than others. The premium rate for permanent policies can be up to 15 times more expensive than term life premiums.

Term vs. Whole Life

Term is the most popular type of life insurance overall and whole life is the most popular type of permanent life insurance, according to the Insurance Information Institute. Both have a fixed premium and death benefit amount, and both have options that don’t require a medical exam.

The difference between term and whole life insurance is the coverage length, cost and cash value component. Whole life offers lifelong coverage with accumulating cash value, which makes the premiums more costly.

| Term Insurance Policy | Whole Life Insurance Policy |

|---|---|

| Set term length (10, 20 or 30 years) | Lifetime coverage |

| Fixed premium and death benefit amount | Fixed premium and death benefit amount |

| More affordable | Can be expensive |

| Typically offers an option without medical exam | Typically offers an option without medical exam |

| Has cash value component |

Term vs. Universal Life

Term and universal life insurance policies are very different. Universal life insurance has a flexible premium and death benefit, meaning you can alter the amounts. Universal also provides lifelong coverage with a cash value account. Lastly, it requires a medical exam. This means if you have a threatening health condition, it may be better to consider other options.

Term life insurance doesn’t always require a medical exam and is more affordable compared to universal life insurance. Your premiums and death benefit amount are fixed, meaning they cannot be changed. With term life insurance, you only have coverage for a set period, not lifelong.

| Term Insurance Policy | Universal Life Insurance Policy |

|---|---|

| Set term length (10, 20 or 30 years) | Lifetime coverage |

| Fixed premium and death benefit amount | Flexible premium and death benefit amount |

| More affordable | Can be expensive |

| Typically offers an option without medical exam | Medical exam required |

| Has cash value component |

Term vs. Variable Life

Variable life is more complex than term life by having an investment risk. Your cash value, premiums and death benefit amount are linked to the performance of investments. You should only consider variable life insurance if you have strong investment strategies. Both term and variable life have a death benefit for your beneficiaries, but variable life has more of a focus on building your cash value.

Variable life is also known to be more expensive compared to term life, and it requires a medical exam. If you’re looking to have more control over your investments and potentially have higher cash value growth — variable life insurance could be a good fit for your goals. If you only want a simple and more affordable life insurance for a set period — term life insurance would be easier to manage.

Term vs. Variable Life Comparison Chart

| Term Insurance Policy | Variable Life Insurance Policy |

|---|---|

| Set term length (10, 20 or 30 years) | Lifelong coverage |

| Fixed premium and death benefit amount | Premium and death benefit amount can fluctuate due to investment performance |

| More affordable | Likely to be expensive due to additional fees and expenses |

| Typically offers an option without medical exam | Medical exam required |

| Cash value is linked to invested options offered by your insurance company |

Term vs. Indexed Universal

Indexed universal life insurance is more flexible compared to term, but there is potential stock market risk. Indexed universal offers lifelong coverage, and you can adjust the premium and death benefit amount. There is a cash value component that is linked to the performance of a market index, like S&P 500.

If performance is good, your cash value could grow exponentially. However, there is a cap on your cash value earnings and returns aren’t guaranteed. Indexed universal life insurance is also likely to require a medical exam.

Term life offers coverage for a set period, typically up to 30 years. The premium and death benefit are fixed. There isn’t a cash value component, which means there is little to no risk with term life compared to indexed universal. You’re also likely able to find an option without a medical exam with term life. Because term life insurance is simpler, it will be more affordable compared to indexed universal life insurance.

| Term Insurance Policy | Indexed Universal Life Insurance Policy |

|---|---|

| Set term length (10, 20 or 30 years) | Lifelong coverage |

| Fixed premium and death benefit amount | Flexible premium and death benefit amount |

| More affordable | Likely to be expensive due to additional fees and expenses |

| Typically offers an option without medical exam | Medical exam required |

| Cash value growth linked to performance of a selected market index, like the S&P 500 |

Comparing Permanent Life Insurance Types

There are two core similarities between the four main permanent life insurance types. They all have lifelong coverage with a cash value component.

The biggest differences are whether they have a fixed or flexible premium and death benefit amount, how their cash value grows, the average cost and whether they require a medical exam.

Universal, variable life and index universal life insurance all have a flexible premium and death benefit amount, as well as require a medical exam.

Whole life insurance is the only type of permanent life insurance with a fixed premium and death benefit amount and offers options without a medical exam requirement.

Variable life insurance and indexed universal both have more risk by having cash value accounts linked to investments or an index market. These options are also likely to be the most expensive due to additional fees.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

8 Cited Research Articles

- Cain, S.L. & Lobb, J. (2022, August 12). Cheapest Life Insurance Companies of 2022. Retrieved from https://www.usnews.com/insurance/life-insurance/cheap-life-insurance#:~:text=Policy%20type%3A%20Term%20life%20insurance,pay%20more%20for%20longer%20terms

- Maxwell, T. (2022, April 30). Why Is Whole Life Insurance More Expensive Than Term Life? Retrieved from https://www.experian.com/blogs/ask-experian/why-is-whole-life-insurance-more-expensive-than-term-life/#:~:text=Whole%20life%20premiums%20can%20range,keep%20up%20with%20the%20premiums

- Insurance Information Institute. (n.d.). What Are the Different Types of Term Life Insurance Policies? Retrieved from https://www.iii.org/article/what-are-different-types-term-life-insurance-policies

- Insurance Information Institute. (n.d.). What Are the Different Types of Permanent Life Insurance Policies? Retrieved from https://www.iii.org/article/what-are-different-types-permanent-life-insurance-policies

- Insurance Information Institute. (n.d.). If I Can’t Pay My Premium, What Should I Do? Retrieved from https://www.iii.org/article/if-i-cant-pay-my-premium-what-should-i-do

- Progressive Casualty Insurance Company. (n.d.). Types of Life Insurance Explained. Retrieved from https://www.progressive.com/answers/life-insurance-types/

- Progressive Casualty Insurance Company. (n.d.). How Much Does Life Insurance Cost? Retrieved from https://www.progressive.com/answers/how-much-is-life-insurance/

- Transamerica Life Insurance Company. (n.d.). Term Life Insurance. Retrieved from https://www.transamerica.com/insurance/term-life-insurance

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696