How To Apply For Medicare: A Step-by-Step Guide

There are three types of Medicare plans, and they all have different enrollment periods and ways to sign up. This guide provides step-by-step tips for navigating the often confusing Medicare application process.

- Edited By

Savannah Pittle

Savannah Pittle

Senior Financial Editor

Savannah Pittle is a professional writer and content editor with over 16 years of professional experience across multiple industries. She has ghostwritten for entrepreneurs and industry leaders and been published in mediums such as The Huffington Post, Southern Living and Interior Appeal Magazine.

Read More- Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: October 26, 2020

- Updated: October 9, 2023

- 12 min read time

- This page features 4 Cited Research Articles

- Reviewed By

More than 65 million Americans are currently enrolled in Medicare. Based on that statistic alone, you probably know someone who has dealt with the Medicare enrollment process, or you’ve done it yourself. Understanding how to apply for Medicare can be frustrating, especially when you consider that beneficiaries may be overwhelmed with their options. A 2022 study noted that the average Medicare participant has almost 40 Medicare Advantage plans to choose from.

| Step 1. | Find out if you're eligible for Medicare. |

| Step 2. | Enroll in Original Medicare (Parts A and B). |

| Step 3. | Sign up for your MyMedicare.gov account. |

| Step 4. | Consider Medicare Advantage. |

| Step 5. | Consider Medicare Part D prescription drug coverage. |

| Step 6. | Consider Medigap supplemental insurance. |

Step 1: Determine Your Medicare Eligibility

Most people become eligible to apply for Medicare when they turn 65. There are some instances where those under the age of 65 are also eligible. Some may even be automatically enrolled in certain Medicare plans.

- Receive Social Security retirement benefits or Railroad Retirement Board benefits for at least four months before turning 65.

- Are under the age of 65 and received Social Security or Railroad Retirement Board disability benefits for at least 24 months.

If you fall into one of those two categories, no further action is required because you will automatically be enrolled in Medicare Part A and Part B — often referred to as “Original Medicare.” Your Medicare coverage will begin the first day of the month you turn 65.

I suggest scheduling an appointment with a local agent near you. Medicare can be confusing at first and a local agent can help guide you in which option may be best for your needs. There is also no extra charge associated with using an agent.

It’s important to note that, after enrolling, you still have options to switch your coverage to a Medicare Advantage plan or add on prescription drug coverage via Medicare Part D.

If you do not fall into one of the above categories, follow these steps to assist you in starting your Medicare journey.

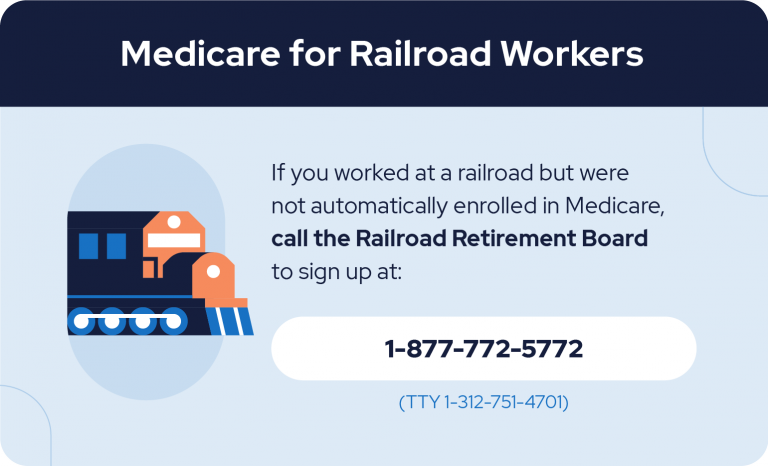

And if you worked at a railroad but were not automatically enrolled, call the Railroad Retirement Board at 1-877-772-5772 (TTY 1-312-751-4701) to sign up.

Step 2: Enroll in Original Medicare (Part A and Part B)

Adults ages 65 and older who are not automatically enrolled in Medicare Part A and Part B must sign up through the Social Security Administration (SSA).

The best time to sign up for Medicare is during the seven-month window known as your initial enrollment period (IEP). It begins three months before the first day of the month of your 65th birthday. The window of time also includes your birth month and ends three months after your birthday. For example, if your birthday is on August 25, the window begins on May 1 and ends on November 25.

- A copy of your birth certificate

- Your driver’s license or state I.D. card

- Proof of U.S. citizenship or proof of legal residency

- Your Social Security card

- W-2 forms (if still actively employed)

- Military discharge documents (if you previously served in the U.S. military before 1968)

- Information about current health insurance types and coverage dates

How To Sign Up for Medicare Part A

- Fill out the online application on the Social Security Administration’s website.

- Call Social Security at 1-800-772-1213 (TTY 1-800-325-0778), 7 a.m. to 7 p.m., Monday through Friday.

- Visit your local Social Security office. You can use the Social Security office locator to find your nearest location.

Medicare Part A is known as hospital insurance because it helps cover the costs of inpatient hospital care as well as some skilled nursing facility time, home health care and hospice care.

Most people who paid Medicare taxes for a minimum of 10 years while working in the United States can receive Medicare Part A for free.

How To Sign Up for Medicare Part B

- Filling out the online application on the Social Security Administration’s website.

- Calling Social Security at 1-800-772-1213 (TTY 1-800-325-0778), 7 a.m. to 7 p.m., Monday through Friday.

- Visiting your local Social Security office. You can use the Social Security office locator to find your nearest location.

Medicare Part B is known as medical insurance because it provides financial support to pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment and some preventive services.

Signing up for Part B does require a monthly premium, so applicants have the option to decline Part B during the enrollment process.

Step 3: Create Your MyMedicare.gov Account

After completing your initial Medicare enrollment, you must create a MyMedicare.gov account to manage your coverage online. The account registration process is quick, easy and provides a variety of benefits, such as:

- Checking your enrollment status.

- Getting details about the plans you’re enrolled in and what they cover.

- Updating your personal information.

- Entering your health records and prescription drugs.

- Viewing Medicare claims.

- Printing replacement Medicare cards.

- Sharing information with your providers.

The information within this account will be useful for registering for any additional Medicare coverage, including Part C, Part D and Medigap.

Step 4: Consider Medicare Advantage (Part C)

Once you are enrolled in Medicare Part A and Part B, you have the option to switch to a Medicare Part C plan — also known as Medicare Advantage — to replace your Original Medicare coverage. Medicare Advantage plans offer all of the same benefits found in Parts A and B, but some plans include other benefits, such as prescription drug coverage, dental and vision. But not all Medicare Advantage plans offer the same benefits.

- Call Medicare at 1-800-633-4227 (TTY 1-877-486-2048).

- Use the online Medicare Plan Finder tool. Click the “Enroll” button next to the plan’s name and follow the instructions.

- Contact the plan provider and request a paper enrollment form. Fill it out and return it to the insurance company.

- Call the company that offers the plan you want or visit their website.

To complete your enrollment in a Medicare Advantage plan, you will need to provide your Medicare number and the date your Part A and Part B coverage began.

Step 5: Consider for Medicare Part D (Optional)

Medicare Part D is the optional prescription drug coverage available to anyone with Medicare Part A and Part B. There are a variety of Part D plans to compare and choose from.

- Through a standalone Part D plan

- As part of a Medicare Advantage plan that includes prescription drug coverage

- Call Medicare at 1-800-633-4227 (TTY 1-877-486-2048).

- Search the Medicare Plan Finder. You can enroll in a plan by clicking the “Enroll” button next to the plan’s name.

- Contact the insurance company that offers the Part D plan via their website or call the phone number listed on the Medicare Plan Finder page.

- Request and fill out a paper application from the insurance company.

Be sure to have your Medicare number and the date your Part A and Part B coverage started in order to sign up for your Medicare Part D plan.

Step 6: Consider Medigap (Optional)

Optional supplemental insurance policies known as Medigap help cover deductible costs, out-of-pocket copays and coinsurance expenses that Medicare does not cover. To be eligible for enrolling in Medigap, you must first be enrolled in Medicare Part A and Part B.

- Go to Medicare’s online Medigap finder

- Enter your zip code

- Provide your age, gender and tobacco usage for more accurate pricing

- Review the basic costs and benefits of different Medigap plans

- Once you identify a plan you like, click “View Policies"

- Compare the different insurance companies that offer policies for that plan

- Obtain consultations from a few of the companies by connecting with them through their contact page

- Apply for a policy

Note that prices may vary widely, so secure multiple quotes before making a purchase.

Medicare Enrollment FAQs

Due to the many variables involved in optimizing the Medicare enrollment process, questions often arise. These questions are some of the most commonly asked.

How Do I Apply for Medicare Online?

- Create a My Social Security account if you don’t have one already.

- Visit the Social Security Administration’s Apply for Benefits page.

- Click “Start a New Application.”

- Follow the instructions to complete your enrollment.

When Should I Sign Up for Medicare?

Most people sign up for Medicare during the seven-month initial enrollment period (IEP) around their 65th birthday. But not everyone is able to enroll in that window of time, so there are alternative Medicare enrollment periods throughout the year. It’s helpful to be aware of the specifics of each time window so you can plan accordingly.

| Type of Enrollment | Annual Date Range | Eligible Changes |

|---|---|---|

| Medicare Open Enrollment | Oct. 15 to Dec. 7 |

|

| Medicare Advantage Open Enrollment | Jan. 1 to March 31 |

|

| Medicare General Enrollment | Jan. 1 to March 31 |

|

| Medicare Special Enrollment Period | Depends on eligibility |

|

Should I Delay Enrolling in Part B?

Some people opt to initially decline enrollment in Part B because it requires a monthly premium. Others chose to delay Part B because they receive group health insurance through their — or their spouse’s — employer.

Once you stop working or that employer-based healthcare coverage ends, you have eight months to sign up for Part B. After that, you’ll face a late enrollment penalty.

To enroll in Part B after your group health insurance ends, you will need to complete Form CMS-40B (Application for Enrollment in Medicare – Part B) and return it to the Social Security Administration. You may also want to request a special enrollment period, which will require you to fill out a Form CMS-L564 (Request for Employment Information).

What if I Still Have Existing Insurance Through My Employer?

Individuals who have existing health insurance through their current employers — or their spouse’s employer — may choose to keep that coverage and make Medicare their secondary insurance. Because most group health plans cover the types of medical services included in Medicare Part B, many people in this situation opt to delay their Part B enrollment in order to save money on the Part B monthly premiums.

Upon your — or your spouse’s — retirement, you will be eligible for a Special Enrollment Period, during which you can then enroll in Part B. See the response above (“Should I Delay Enrolling in Part B?”) for additional details.

How Long Does Medicare Enrollment Take?

The enrollment process is unique for each person, but with a qualified Medicare planner in your corner, the actual application process shouldn’t take long. After submitting an application, most beneficiaries receive their Medicare card about three weeks later. If you were automatically enrolled in Medicare Part A and Part B, typically your card will arrive in your mailbox about two months prior to your 65th birthday.

What If I Can’t Afford My Medicare Premiums?

Multiple Medicare Savings Programs are available to people with low incomes. The programs can help cover the costs of your Part B premium, as well as other Medicare costs, including deductibles, copays and coinsurance. These programs are operated by Medicaid at the state level. Reach out to your local Medicaid office to see if you qualify for assistance.

Are There Late Enrollment Penalties?

If you delay enrollment in Medicare Part A, Part B or Part D, you may face late enrollment penalties. Note that some of these fees will be applied to your premiums for long as you receive Medicare benefits. Considering that 66.5% of American bankruptcies are caused by medical expenses, taking steps to avoid extraneous healthcare fees makes sense.

Unless you have group health insurance from your current employer or your spouse’s current employer, the best way to avoid late enrollment penalties is to sign up for Medicare during your initial enrollment period.

Although the concept may be daunting, following this step-by-step guide to applying for Medicare should provide you with a solid footing to successfully complete your enrollment. As you begin your application, our Medicare Simulator can give you the chance to compare a variety of Medicare plans to identify the best Medicare strategy for you.

4 Cited Research Articles

- Medicare.gov. (n.d.) Ready to sign up for Part A & Part B. Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/sign-up/ready-to-sign-up-for-part-a-part-b

- Social Security Administration. (n.d.). Medicare Benefits. Retrieved from https://www.ssa.gov/benefits/medicare/

- Tarazi, W. et. al. (2022, March). Medicare Beneficiary Enrollment Trends and Demographic Characteristics. Retrieved from https://aspe.hhs.gov/sites/default/files/documents/f81aafbba0b331c71c6e8bc66512e25d/medicare-beneficiary-enrollment-ib.pdf

- U.S. Department of Health and Human Services. (2014, October 10). When should I sign up for Medicare? Retrieved from https://www.hhs.gov/answers/medicare-and-medicaid/when-should-i-sign-up-for-medicare/index.html

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696