49+ US Medical Bankruptcy Statistics for 2023

Medical bills are the most common reason for bankruptcies in the U.S. Our medical bankruptcy statistics will teach you everything you need to know about U.S. health care costs, debt and ways to stay financially well.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: August 30, 2022

- Updated: March 20, 2025

- 8 min read time

- This page features 9 Cited Research Articles

- Edited By

In America, medical bills are the most common reason for bankruptcy. In fact, medical bankruptcy statistics suggest that 17% of adults with health care debt had to declare bankruptcy or lose their home because of it as of 2022.

While America already has the most expensive health care of any country, prices are trending upward. Projections by the Centers for Medicare and Medicaid Services (CMS) estimate that healthcare expenditures will reach approximately $6.2 trillion in 2028, a 50% increase from 2020.

Read on to learn everything you need to know about medical bankruptcy, its causes and ways to stay financially afloat in the face of expensive health care costs.

- The average age of a medical bankruptcy filer is 44.9 years old.

- 40% of Americans fear they won’t be able to afford health care in the upcoming year.

- 17% of adults with health care debt declared bankruptcy or lost their home because of it.

- 66.5% of bankruptcies are caused directly by medical expenses, making it the leading cause for bankruptcy.

- As of April 2022, 14% of Americans with medical debt planned to declare bankruptcy later in the year because of it.

General Medical Bankruptcy Statistics

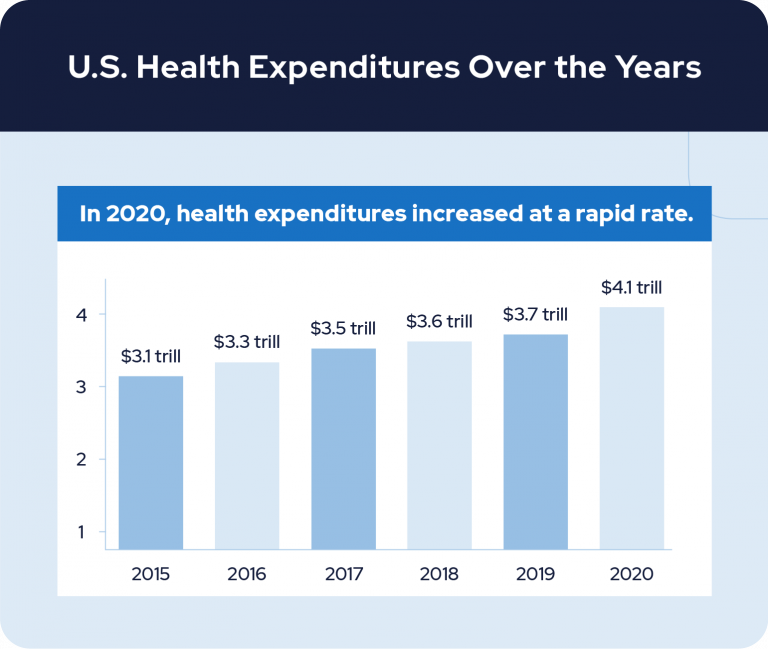

National hospital expenditures totaled over $1 billion in 2020, indicating a trend of rising medical costs. In fact, projections indicate national health spending is to increase by almost 50% from 2020 to 2028.

1. Private health insurance makes up 28% of national health care expenditure at approximately $1 trillion as of 2020. This marks a 1.2% decline from 2019.

2. Out-of-pocket health care spending makes up 9% of national health care expenditure at approximately $400 billion as of 2020. This marks a 1% decline from 2019.

3. Federal health care spending increased by 36% in 2020. This growth was about 5% faster than 2019. This rapid increase is likely due to costs associated with the COVID-19 pandemic.

4. Hospital expenditures totaled approximately $1.2 billion in 2020, a 6.4% increase from 2019.

5. Research suggests that national health spending will reach approximately $6.2 trillion in 2028, an increase of about 50% from 2020.

6. The crowdfunding platform GoFundMe receives over 250,000 medical fundraisers per year on average, resulting in over $650 million raised annually.

7. In 2019, Americans borrowed an estimated $90 billion to pay for health care.

8. In 2021, 71% of Americans agreed that their household pays too much for the quality of health care they receive.

9. In 2021, 9 in 10 of U.S. adults believed the cost of health care would rise the following year.

Medical Bankruptcies in the US

Almost 1 in 5 adults with health care debt either lose their homes or declare bankruptcy. This likely contributes to the fact that nearly half of Americans worry that they will be bankrupt by a major health event.

10. 17% of adults with health care debt had to declare bankruptcy or lose their home because of it.

11. 45% of Americans worry a major health event will bankrupt them.

12. Almost 20% of medical bankruptcy filers report prescription drugs as their largest expense.

13. Medical expenses directly cause 66.5% of bankruptcies, making it the leading cause for bankruptcy. Additionally, medical problems that lead to work loss cause 44% of bankruptcies.

14. As of April 2022, 14% of Americans with medical debt planned to declare bankruptcy later in the year because of it.

15. The average monthly household income for filers of medical bankruptcy is approximately $2,600.

16. One in five families who file for medical bankruptcy are military families.

17. The average age of a medical bankruptcy filer is 44.9 years old.

18. Approximately 60% of medical bankruptcy filers have at least some college education.

While 20% of Americans experiencing health care bankruptcies report prescription drugs as their largest expense, it’s possible for seniors to receive coverage under Medicare Part D.

US Medical Debt Statistics

It’s common for Americans to experience medical debt that never goes away. In fact, approximately one in three Americans with medical debt believe that it’s unlikely they will ever pay their debt off.

19. 5% of Americans with medical debt owe more than $100,000.

20. 32% of Americans with medical debt say it’s unlikely they will ever be able to pay their medical debts.

21. 56% of insured Americans have medical debt, compared to 59% of uninsured Americans.

22. 17% of Americans with medical debt currently aren’t paying it off.

23. Including premiums and deductibles, U.S. adults spend an annual average of $12,500 on medical expenses.

24. On average, couples that retire at age 65 pay a total of $275,000 in medical bills for the remainder of their life.

25. Collective American medical debt totaled almost $200 billion in 2019.

26. About 51% of single-person households with private insurance reported they’d be unable to pay a $6,000 medical bill. 32% reported they’d be unable to pay a $2,000 bill.

27. 6% of adults in the U.S. owe more than $1,000 in medical debt.

28. Collective American medical debt totaled almost $200 billion in 2019.

29. 48% of adults with medical debt used up all or most of their savings to pay it off as of 2022.

Medical debt in large quantities can be difficult to pay off, particularly when it includes high interest rates. This is part of what causes Americans to consider traveling for medical procedures to countries where it’s more affordable.

The State of Health Care Costs in the US

The U.S. spends the most on health care out of any other country. In fact, U.S. health care expenditures account for 20% of its GDP — almost double that of the U.K.’s health care expenditures.

30. U.S. health care expenditure increased by approximately 10% in 2020. That equates to about $12,000 spent per person.

31. From 2009 to 2019, annual health insurance premiums increased by approximately 50%.

32. The average annual worker health care premiums are $6,000 as of 2019. This marks a 20% increase from 2014 premium costs.

33. The average annual employer health care premiums are approximately $15,000 as of 2019. This marks a 22% increase from 2014 premium costs.

34. U.S. health expenditure accounted for about 20% of its GDP in 2020.

35. Medicare spending makes up 20% of national health care expenditure at approximately $830 billion as of 2020. This marks a 3.5% increase from 2019.

36. Medicaid spending makes up 16% of national health care expenditure at approximately $670 billion as of 2020. This marks a 37. 9% increase from 2019.

38. Approximately 50% of Americans reported their health care costs increased from 2020 to 2021.

39. 94% of Americans agree that prescription drugs are costlier than they should be, and 84% believe prescription drugs will increase in price over the next year.

To save on health care costs in retirement, it’s a good idea to compare costs associated with different senior living options. Use our retirement community and assisted living calculator to discover which option is best for you.

The Impacts of Costly Medical Bills

Medical bills can prevent Americans from buying homes and have caused some to skip emergency room visits to avoid incurred costs. In fact, almost 1 in 10 Americans have had to borrow money to cover increased health care expenses.

39. 46% of Americans are delaying buying homes due to medical debt.

40. About 50% of Americans report not knowing the cost of an emergency room visit before receiving treatment.

41. Approximately 41% of Americans forwent visits to the emergency room due to cost in 2019.

42. 77% of Americans worry rising health care expenses will inflict significant damage to the U.S. economy.

43. In 2019, 65 million Americans reported having a health issue but avoiding treatment due to costs.

44. Approximately 12.7 million Americans reported having a loved one die after avoiding health care treatment due to the costs in 2021.

45. In 2021, approximately 30% of American adults reported they wouldn’t have affordable care access if they needed it today.

46. 42% of American adults worry they won’t be able to afford necessary health care services in the next year.

47. Approximately 28 million — or 11% of — Americans reported they had to borrow money in 2021 to cover increased health care costs. This marks a 4% increase from 2020.

48. In 2021, 30% of American adults reported that they were concerned they wouldn’t be able to pay for necessary prescription drugs in the following year.

49. 18% of adults reported they or a family member skipped prescribed medicine to save money at least one time in 2021.

50. In 2020, approximately 40% of surveyed Americans feared they wouldn’t be able to afford medical care in the upcoming year.

While Medicare might cover your medical costs once you’re 65, it’s still a good idea to save for potential emergencies when possible. You may even try to start your own business or practice green senior living to accumulate a financial cushion.

5 Tips To Protect Yourself from Medical Bankruptcy

While the cost of medical bills in the U.S. are on the rise, you can minimize financial harms with our tips below.

1. Invest in Long-term Care Insurance

Studies suggest that 70% of adults will require long-term care services in their lifetime. This can cost around $40,000 to $54,000 a year. Long-term insurance can help you curb these costs and protect your savings.

2. Negotiate When Possible

If you can’t immediately pay a medical bill, try to negotiate with your insurance company. Often, they would rather negotiate a payment plan or a slightly lower price instead of involving debt collectors.

3. Save for Medical Emergencies

Putting money into a tax-advantaged Health Savings Account (HSA) helps you build funds for health care emergencies. When you sign up for Medicare, you can no longer contribute to your HSA, but can continue to use those funds for health care purposes.

4. Check Your Bills for Mistakes

Mistakes or double charges aren’t uncommon in medical bills. If you find something that doesn’t look right, call the billing department for your medical provider and request that they correct it.

5. Prioritize Your Health

The better you take care of your health, the less likely you are to experience medical emergencies in the first place. Eating whole foods, staying active and scheduling regular appointments with your doctor can help you keep your health in great condition.

In the U.S., medical bills are the leading cause of bankruptcies. While this situation is less than ideal, there are ways to stay financially afloat amidst the high cost of health care.

By prioritizing your health savings for emergencies and double-checking your medical bills for mistakes, you can minimize health care costs. To ensure you’re covered financially in retirement, check in with a Medicare advisor today.

For more information about medical bankruptcy, its causes and tips to keep yourself financially stable, check out our infographic below.

9 Cited Research Articles

- Affordable Health Insurance. (2022, February). 1 In 4 Americans With Medical Debt Owe More Than $10,000. Retrieved from https://www.affordablehealthinsurance.com/1-in-4-americans-with-medical-debt-owe-more-than-10000/

- CMS.gov. (2020). NHE Fact Sheet. Retrieved from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

- Kaiser Family Foundation. (2022, June). Health Care Debt In The U.S.: The Broad Consequences Of Medical And Dental Bills. Retrieved from https://www.kff.org/health-costs/report/kff-health-care-debt-survey/

- Kaiser Family Foundation. (2019, September). 2019 Employer Health Benefits Survey. Retrieved from https://www.kff.org/report-section/ehbs-2019-summary-of-findings/

- Gallup. (2019). The U.S. Healthcare Cost Crisis. Retrieved from https://news.gallup.com/poll/248081/westhealth-gallup-us-healthcare-cost-crisis.aspx

- Gallup. (2021). West Health-Gallup 2021 Healthcare in America Report. Retrieved from https://www.gallup.com/analytics/357932/healthcare-in-america-2021.aspx

- Himmelstein, D. (2019, March). Medical Bankruptcy: Still Common Despite the Affordable Care Act. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6366487/

- Himmelstein, D. (2009). Medical Bankruptcy in the United Stats, 2007: Results of a National Study. Retrieved from https://pnhp.org/new_bankruptcy_study/Bankruptcy-2009.pdf

- United States Census Bureau. (2020). Survey of Income and Program Participation (SIPP). Retrieved from https://www.census.gov/programs-surveys/sipp.html

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696