The Senior’s Guide to Self-Employment After 65

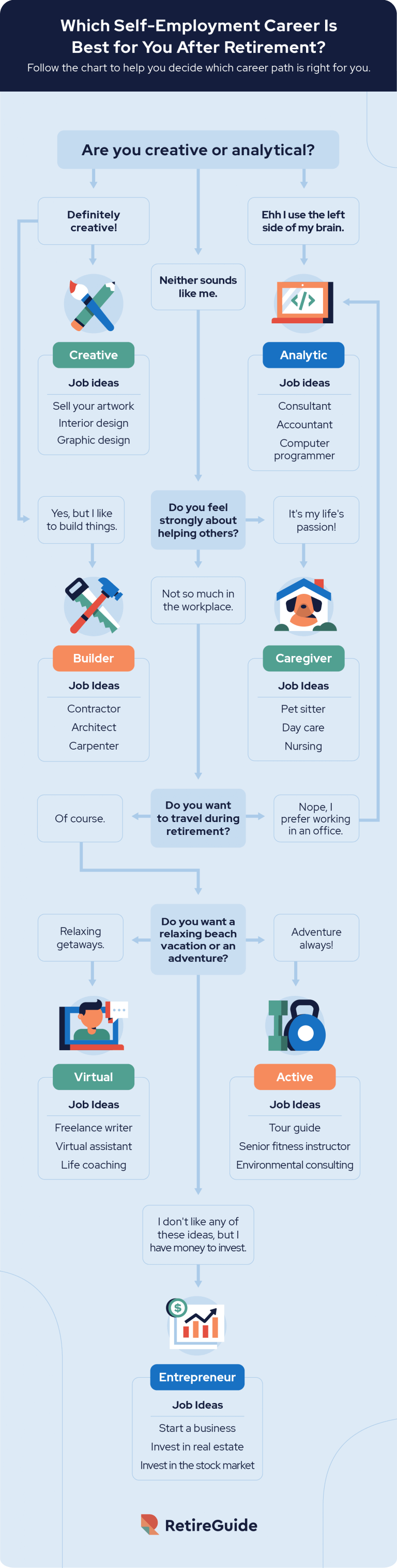

It’s important to understand how being self-employed can affect your income tax, Social Security collection and Medicare benefits. If you’re a retiree trying to decide which self-employment endeavor is right for you, check out our self-employment flowchart to decide which option is best for you.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Financially Reviewed By

Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Published: September 30, 2021

- Updated: October 20, 2023

- 11 min read time

- This page features 12 Cited Research Articles

If you’re becoming self-employed after the age of 65, it’s important to know how it can impact your taxes, Medicare and Social Security benefits. Our guide breaks down all of this so you know what to expect.

We also cover the best self-employment options and the benefits you can receive from taking this leap back into the workforce after retirement. In case you’re on the fence about which option is right for you, we included a flowchart to help you decide which self-employment career is your best option.

What Does It Mean To Be Self-Employed?

Being self-employed means you are your own boss and the boss of other employees if you own your own business. In other words, self-employed individuals don’t earn a standard salary from an employer. Instead, they earn a salary from their own business or profession. Being self-employed after the age of 65 can have certain implications on taxes and benefits.

The IRS states that you must meet certain criteria to be considered self-employed. The individual must be part of a trade or business as the sole proprietor, a partner or as an independent contractor. A person that has a part-time business in addition to their regular job can be considered part-time self-employed in addition to being full-time employed when filing taxes.

An example of being part-time self-employed would be if someone worked as a sales manager full time throughout the week, but on the weekends made extra money running a tutoring business for high school students. This individual would be considered self-employed as a part-time tutoring business owner.

Is Your Lifestyle Future-Proofed?Secure the lifestyle you've always imagined post-retirement. Discover annuity options that can make it a reality.

*Ad: Clicking will take you to our partner Annuity.org.Can a Retired Person Be Self-Employed?

If you retire from your normal 9-5 job to become self-employed, you can still collect your Social Security and Medicare benefits. If you’re self-employed, the individual is still expected to pay income taxes on the salary you make. There are many self-employment options for recently retired individuals, which we’ll cover next.

Self-Employment Ideas for After Retirement

Many retirees are reentering the workforce but ditching the traditional office setting for self-employment.

This decision is giving many retirees the flexibility to pick their own hours, travel the world, and spend time with loved ones. Self-employment allows them to do all this while staying active and bringing in an extra income. Thankfully, there are opportunities in many career verticals, from art and business to education and real estate.

Are you someone that wants to find a new self-employment path, but doesn’t know where to begin? Well, we’ve got you covered with the best business ideas to start after retirement.

1. Real Estate

There are many benefits to owning or managing real estate properties. Investing in real estate has the potential to generate a passive income, increase tax deductions and diversify your financial portfolio. If you have tenants then you can even put your rental income toward your mortgage.

If you have the funds to purchase a new rental property, but don’t feel up to the task of routine maintenance then you can even outsource this work to a property manager or other staff.

2. Business Consultant

If you’re an expert in your subject or have an advanced degree, then consulting can be a great self-employment option. Lots of corporations want to take advantage of retirees’ years of experience. Many organizations will pay consultants more than full-time employees because they’re able to forgo paying for benefits.

Something to keep in mind is that consulting opportunities sometimes present themselves sporadically. It’s important to remember that this income isn’t always steady or consistent, so plan accordingly.

3. Child Caregiver

With many families in the US living in two-income households, child care is a common need for many parents. Babysitting for your friends and family is a great way to earn extra money while connecting with your loved one.

You can either run a daycare service in your home or commute to other families’ houses. If you plan on running a child care business out of your home, check to see if you need a license and what the limitations are in your state.

4. Business Owner

After retirement is the perfect time to start the business of your dreams and expand your long-term finances. When you own a business, you’re given more tax breaks and are able to deduct more business expenses compared to working for someone else.

Before diving into a new business venture, it’s important to evaluate if it has the potential to make you enough extra income. Having niche experience in a specific industry can help make your business more successful than young entrepreneurs just starting out.

Lock In Today’s Best Fixed Annuity RatesStart with a free annuity consultation to learn how annuities can help fund your retirement.

*Ad: Clicking will take you to our partner Annuity.org.5. Freelance Writing

Becoming a freelance writer is a great way to have a flexible schedule while making an extra monthly allowance. This career path allows you to work from anywhere, write across various industries and dictate your hourly rate.

There are lots of options for freelance writers, from writing for magazines and creating website copy to guest blogging and proofreading corporate statements. All you need is a passion for writing, great attention to detail and a computer to get started on your new self-employment path.

6. Online Course Creator

Online courses have soared in popularity with the rise of skill-sharing sites and the availability of online college programs, giving students increased accessibility for taking their classes online. If you have knowledge to share in a certain area or trade, then creating an e-book or video series for a course could be your perfect side project.

You can sell your course through your own website or an online marketplace such as Coursera or SkillShare to make some extra money. It’s important to reach your target audience and to market your course correctly to make a larger income.

7. Artwork Seller

Whether you’re a jewelry designer, a painter or a pottery maker, you can turn your hobby into a career by selling your work online or in stores.

Selling your artistic goods allows you to make money while you focus on your passion project. You can have your work displayed in local galleries, coffee shops or on your own Etsy shop.

8. Life Coach

Many seniors make great life coaches because of their decades of life experiences and lessons learned. You’ll be able to make a significant impact on someone’s life by giving them the wisdom they need to overcome any obstacle in their way.

If you were successful in your industry, then you could niche down to mentor younger people in their careers. For example, you can specialize in helping people live a healthier life, improve their mental health, get organized and so much more.

9. Pet Sitter

Being a pet sitter or dog walker has little to no start-up costs, making it a great side hustle for retired individuals. Pet owners will pay high rates to ensure their furry friend is safe and taken care of well. Providing pet care is easier than ever with popular pet sitter apps like Rover hitting the market.

There are lots of opportunities and flexibility in the pet care industry. You can either board pets at your home, take dogs on walks, provide day care services, groom animals or provide daily check-ins.

10. Virtual Assistant

Many small businesses use virtual assistants to help make phone calls, create spreadsheets, keep financial information organized and write reports. These assistants are able to do all these tasks from the comfort of their own homes.

As a virtual assistant, you can specialize in the job areas that you love and avoid mindless tasks you don’t enjoy. It doesn’t cost much to get started in this job and you’ll have the freedom to travel while working.

11. Tutor

If you’re a retired teacher, professor, or librarian, then becoming a tutor or teaching assistant could be the perfect self-employment idea for you after retirement. Even if you don’t have a background in teaching, you can still be a great tutor if you have extensive knowledge in a particular subject.

As a tutor, you can set your own wages, hours and what subjects you want to specialize in. There are opportunities to work with all age ranges, from little kids working on reading to grad students finishing their thesis.

Deciding which self-employment path is best for you can be tricky when there are so many options. With this in mind, we created a self-employment career path flowchart to help you make the best decision.

Income Tax for Self-Employed Seniors

If you’re self-employed, you’ll need to continue to pay taxes on income, Social Security and Medicare. However, if you’re over the age of 65 there are a different set of rules when filing income tax.

Do Seniors Pay Self-Employment Tax?

What is a Simplified Employee Pension (SEP) IRA?Any self-employed individual that makes a net earning of more than $400 must report income and file taxes with the IRS. It’s important to make sure you have an individual taxpayer identification number (ITIN) or Social Security number handy during the tax filing process.

The self-employment Federal Insurance Contributions Act (FICA) taxes are split between Social Security and Medicare at a rate of 15.3 percent of your wages. To break it down further, 12.4 percent of your total income will contribute to Social Security and 2.9 percent will contribute to Medicare.

If you are self-employed or are a small business owner, it is encouraged that you make quarterly payments to avoid penalties. The reason for this is that it’s easier to make an error or underpay when you’re self-employed because your taxes aren’t deducted from your salary and you have to do the calculations on your own.

How To Calculate Self-Employment Taxes

57% of Americans Expect to Work in RetirementDetermine your net income and apply the 15.3 percent tax rate to earnings that are subject to taxes. If you’re filing taxes over the age of 65, you can use a Form 1040-SR instead of using the standard Form 1040. You can use Schedule C on this form to calculate your income tax

Something to keep in mind is if you work in a trade or are “self-employed in a business involving manufacturing, merchandising or mining, gross income from that business is the total sales minus the cost of goods sold” according to the IRS.

Self-Employment and Social Security

You can continue to collect Social Security benefits while earning a self-employment income. Even if you’re self-employed, you’ll still need to continue paying 12.4 percent of your net salary in taxes for Social Security.

Maximum Self-Employed Income Earnings Before Paying Social Security Taxes

Working won’t affect your Social Security benefits even if you’re making a high income beginning the month you reach the full retirement age of 66. However, there is a limit to how much you can make and still receive Social Security benefits if you’re younger than the full retirement age.

According to the Social Security Administration, the normal retirement age (NRA) for anyone born after 1959 is 67 years old. The NRA is the age at which people can receive full Social Security benefits after leaving the workforce. However, you may receive these benefits at the age of 66.

If you earn above the limit of $50,520 a year at your retirement age then Social Security will take one dollar for every three dollars earned.

Lastly, if you’re under your full retirement age then the income limit is $18,960. If you exceed this then Social Security will subtract one dollar from every two dollars of the extra income.

Self-Employment and Medicare

Self-employed individuals will need to continue paying 2.9 percent of their net income to Medicare taxes. There are several other factors that involve Medicare to consider when you’re deciding whether to become self-employed or not after retirement age.

Have you selected your 2024 Medicare plan?Maximize your Medicare savings by connecting with a licensed insurance agent. Annual Enrollment is open until December 7th.Should You Apply For Medicare if You’re Still Working?

Medicare’s initial enrollment period starts three months before the month you turn 65. It includes the month you hit full retirement and ends three months after. This totals to a potential seven-month enrollment time frame.

Generally, you are advised to enroll during this period to avoid future financial penalties for Medicare Part B. On the other hand, there usually isn’t a penalty for signing up for Medicare Part A in a different enrollment period because it’s usually free.

You need to work for an employer that has 20 or more employees to drop this plan without being penalized. If you’re self-employed and don’t have a subsidized health care plan under an employer then you should keep your plan to avoid future fines.

An exception to this rule is if you want to continue contributing to a Health Savings Account fund — once you become a new Medicare beneficiary, you’re not allowed to put money into this fund anymore.

Medicare Premium Deductions for Self-Employed Individuals

If you’re self-employed and receiving Medicare services, you can deduct all Medicare premiums for you and your spouse from your tax statement. Deduct these costs on Schedule 1 of the 1040 form to lower your Adjusted Gross Income.

Medicare premium deductions only affect your income tax, meaning you will still need to pay your standard Medicare and Social Security self-employment taxes.

AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: October 20, 2023Share This Page12 Cited Research Articles

- Internal Revenue Service. (2021, June 28). Questions and Answers for the Additional Medicare Tax. Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/questions-and-answers-for-the-additional-medicare-tax

- Internal Revenue Service. (2021, May 28). Self-Employed Individuals Tax Center. Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

- Internal Revenue Service. (2021, Jan 15). Tax Guide for Seniors Publication 554 (2020). Retrieved from https://www.irs.gov/publications/p554#en_US_2020_publink100043526

- Social Security Administration. (2021, Jan 1). How Work Affects Your Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10069.pdf

- Social Security Administration. (2021, Jan 1). Retirement Benefits. Retrieved from https://www.ssa.gov/benefits/retirement/planner/whileworking.html

- The Rise of Online Learning. (2020, May 2). Forbes. Retrieved from https://www.forbes.com/sites/ilkerkoksal/2020/05/02/the-rise-of-online-learning/?sh=41bc1a0472f3

- Schroder. (2020, Jan). Making retirement

- “Golden” again. Retrieved from https://www.schroders.com/en/us/defined-contribution/thought-leadership/retirement-perspectives/making-retirement-golden-again-part2/

- National Bureau of Economic Research. (2019, Oct ). Contract Work at Older Ages. Retrieved from https://www.nber.org/programs-projects/projects-and-centers/retirement-and-disability-research-center/center-papers/nb19-19a

- TransAmerican Center. (2017, Dec). Wishful Thinking or Within Reach. Retrieved from https://www.transamericacenter.org/docs/default-source/retirement-survey-of-workers/tcrs2017_sr_three-generations_prepare_for_retirement.pdf

- Merrill Lynch. (2014, June 10). Baby Boomers plan to work during retirement. Retrieved from https://www.agewave.com/media_files/06%2013%2014%20Private%20Asset%20Management_Career%20Study%20Press.pdf

- Social Security Administration. Normal Retirement Age. Retrieved from https://www.ssa.gov/OACT/ProgData/nra.html

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696