57% of Americans Expect to Work in Retirement

A 2023 survey by RetireGuide explores Americans’ expectations and concerns about working in retirement. Check out the full findings below, along with tips to create a passive retirement income.

- Written by Christian Simmons

Christian Simmons

Financial Writer

Christian Simmons is a writer for RetireGuide and a member of the Association for Financial Counseling & Planning Education (AFCPE®). He covers Medicare and important retirement topics. Christian is a former winner of a Florida Society of News Editors journalism contest and has written professionally since 2016.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: June 1, 2023

- Updated: October 20, 2023

- 6 min read time

- This page features 3 Cited Research Articles

- Edited By

According to research by the Stanford Center on Longevity, the median retirement savings for pre-retirees and retirees is $128,000, meaning that most won’t have sufficient funds to retire full-time at age 65.

But seniors may have to work during their golden years if they don’t have sufficient retirement funds. To examine Americans’ expectations and attitudes around retirement work, we surveyed 1,043 adults on the subject.

Check out our study below to learn more about Americans’ expectations, motivators, and concerns for working in retirement.

- 57% of Americans expect to work in retirement

- 1 in 4 people fell behind on their retirement plan in the last two years

- 54% of people would work in retirement to afford the cost of living

- 53% of people worry about health issues while working in retirement

American Expectations for Working in Retirement

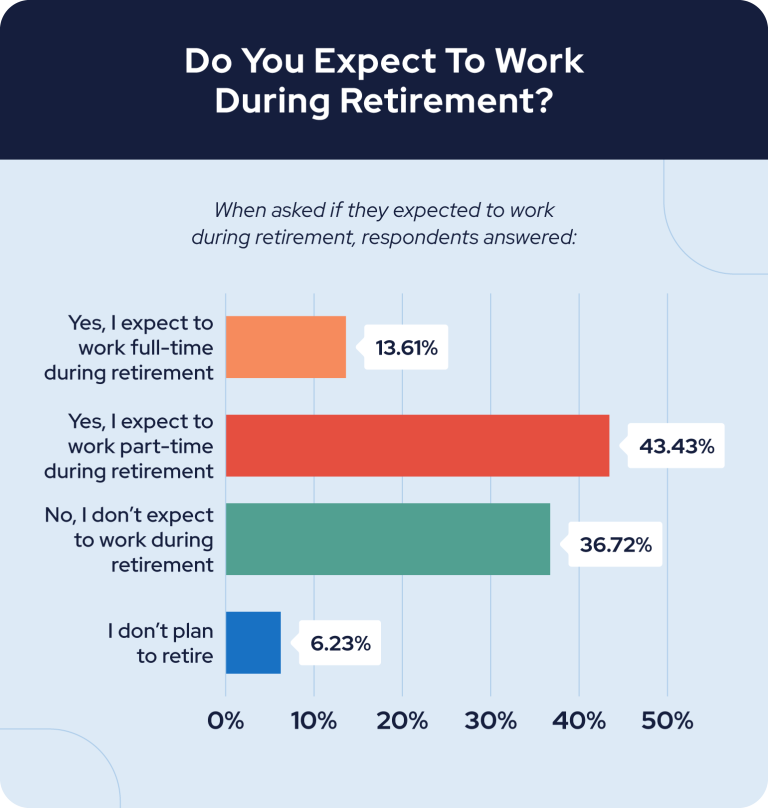

When American respondents were asked whether they expected to work during retirement, about 57% reported they would. 43.43% reported they expect to work part-time, while 13.61% expect to work full-time.

Men were about 7% more likely than women to plan to work during retirement. While about 61% of men planned to work either part- or full-time in retirement, only 54% of women felt the same way.

As adults approach retirement age, their expectation to work goes up. Adults ages 30–60 were 10% more likely to expect to work during retirement than those ages 18–29. This might suggest that the typical American can’t stay on track with their retirement plans over a long period.

*Ad: Clicking will take you to our partner Annuity.org.

26% of People Fell Behind on Their Retirement Plan Over the Last Two Years

Between recession fears, high inflation and layoffs across certain economic sectors, we wanted to learn more about how the past two years have impacted American retirement plans.

Over the last two years, about 3 in 10 people have stayed on track with their retirement plans. An additional ~14% even plan to retire earlier than expected.

On the other hand, 26% of our respondents report planning to retire later than they expected, and 18% will retire with less savings than expected. Perhaps more concerning, roughly 12% of our respondents do not expect to retire at all.

The number of people falling behind on their retirement plans could be partly due to not using sufficient professional planning. According to the Stanford Center on Longevity, the most common retirement planning resource Americans used was their own instincts at 72%.

Affording Cost of Living is the #1 Reason People Would Work in Retirement

To learn more about the main reasons people will be working during retirement, our respondents reported the following answers.

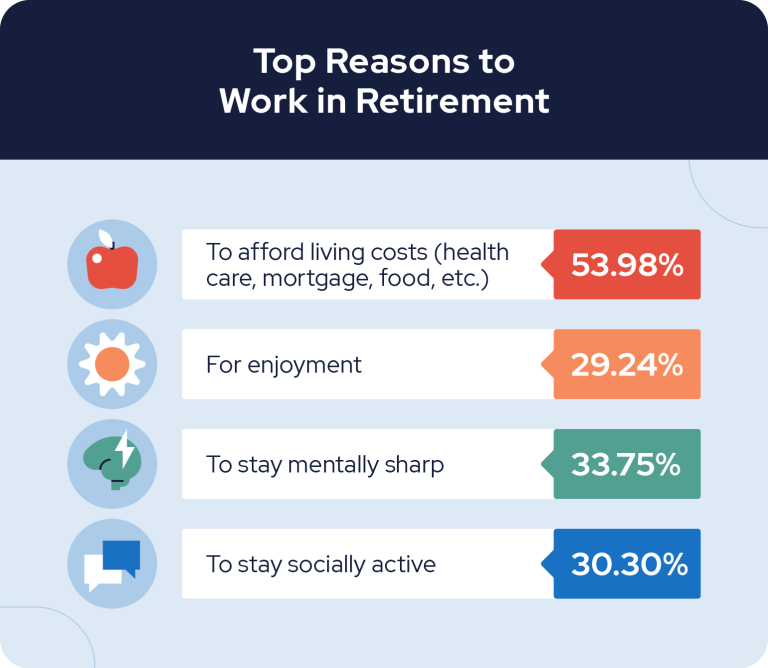

About 54% of respondents reported that affording costs of living would be their main motivator for working during retirement, but many respondents also had personal or recreational reasons as motivators.

1 in 3 people wanted to work to stay mentally sharp, while 30.3% would work to stay mentally sharp. Nearly 3 in 10 respondents acknowledged that they’d work for enjoyment.

Men were more likely to associate retirement work with enjoyment, while women were more likely to see retirement work as an essential source of income. Men were 10% more likely than women to say they’d work during retirement mainly out of enjoyment, while women were 10% more likely than men to say they’d mainly work to afford the cost of living.

Top Worries About Retirement Work

Whether planned or not, working past retirement age can be challenging. We asked our participants what their top concerns would be about working in retirement.

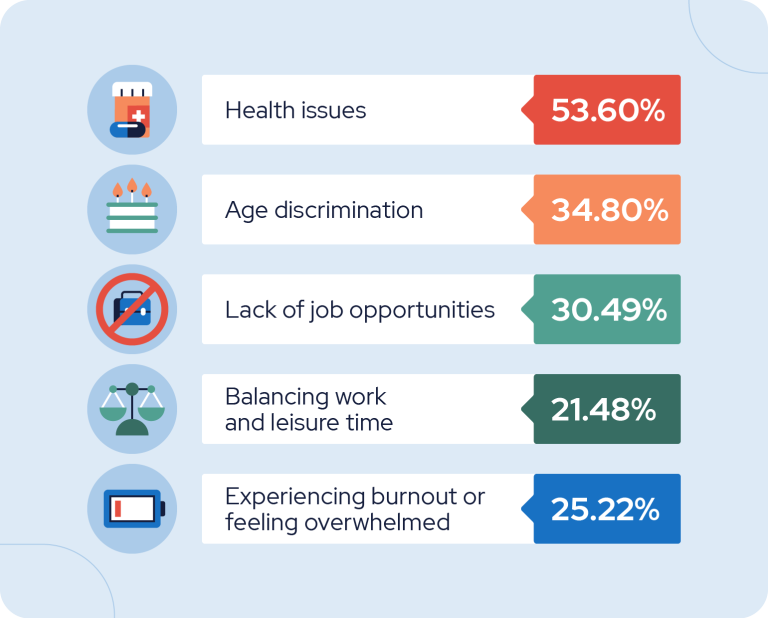

The top concern for about 54% of respondents is dealing with health issues while working during retirement. Another 34.80% worry about facing age discrimination, while 30.49% fear a lack of job opportunities.

Both men and women shared the same worries about retirement work, but women were significantly more worried about health issues. While 49.80% of men reported they’d be concerned about health issues while working in retirement. 57.14% of women reported the same, indicating about a 7% difference.

If you work during retirement, try to avoid physically intensive jobs that could exacerbate health issues. According to the CDC, 41.3% of those ages 55–64 who worked in 2018 experienced work-related health issues. Before you start working, consult with a medical professional to ensure you aren’t risking your health.

*Ad: Clicking will take you to our partner Annuity.org.

6 Ways to Supplement Your Income

While most Americans expect to work during retirement, many are doing so to pay the bills. To supplement your retirement income, consider creating multiple income streams.

Some helpful passive income ideas include:

- Purchasing dividend stocks:

- Dividend stocks will result in quarterly payouts that increase depending on your investment amounts.

- Buying a local business:

- Do your research to find a profitable local business worth investing in. Once you’re the owner, hire someone to run the business to create a true source of passive income.

- Renting out your home:

- Since about 80% of adults ages 65 and older own their homes, renting can be a great source of extra income. If you’re often away from your home or have an extra room, consider finding renters. Just do your research to ensure you’re renting to trustworthy people.

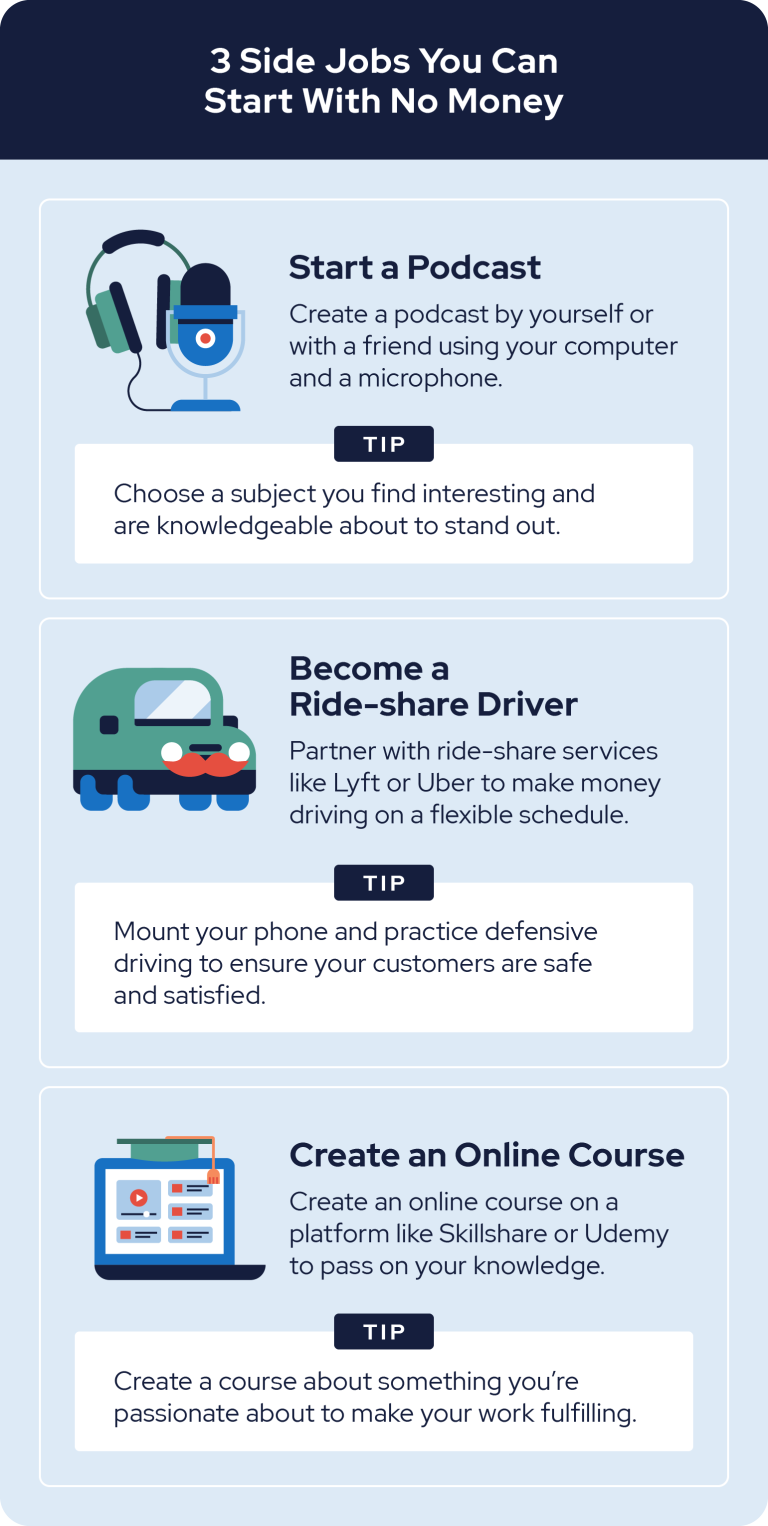

While creating sources of passive income can take significant upfront investments, there are side hustles you can do for no money at all.

Some side jobs you can start with no money include:

- Podcasting:

- Everyone has a story to tell. Create a podcast by yourself or with a friend using your computer and a microphone. If you develop an audience, you can monetize your podcast through ads, subscriptions, or merchandise.

- Ride-share driving:

- Partner with services like Lyft or Uber to make money driving on a flexible schedule.

- Online course creation:

- Create an online course on a platform like Skillshare or Udemy to pass on your knowledge and make money while you’re at it.

While there are many income opportunities, try to focus on building one income stream at a time. Once you’ve solidified that income stream, you can move on to the next. Otherwise, you risk burning out if you try to take on too much too fast.

Planning Ahead for Retirement

The more proactive you are about money management, the less likely you are to have to work during retirement. Ideally, any retirement work you do will be because you want to, not because you have to.

To inform your investment strategy and build a substantial retirement savings egg, check out our full guide on retirement investing.

Methodology

The survey of 1,043 adults aged 18+ was conducted via SurveyMonkey for RetireGuide on April 28, 2023. Data is unweighted, and the margin of error is approximately +/-5% for the overall sample.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

3 Cited Research Articles

- Stanford Center on Longevity. (2022, October). Disconnected: Reality vs. Perception in Retirement Planning. Retrieved from https://longevity.stanford.edu/wp-content/uploads/2022/09/Planning-Ahead-1.pdf

- Free, H, et al (2020, April 3). Lifetime Prevalence of Self-Reported Work-Related Health Problems Among U.S. Workers — United States, 2018. Retrieved from https://www.cdc.gov/mmwr/volumes/69/wr/mm6913a1.htm?s_cid=mm6913a1_w

- U.S. Census Bureau (2023). Housing Vacancies and Homeownership. Retrieved from https://www.census.gov/housing/hvs/index.html

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696