6 Important Medicare Changes for 2022

- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Published: March 7, 2022

- 7 min read time

- This page features 11 Cited Research Articles

Economic and political factors influence Medicare changes every year. In 2022, you can expect rising premiums, deductibles and coinsurance rates, as well as a wider range of coverage for some health concerns.

From record-breaking stock market fluctuations to early retirements due to the COVID-19 pandemic, we’ve lived through a lot of changes in the last few years. 2022 has proven that those changes aren’t likely to slow down anytime soon.

Medicare changes, in particular, are likely to leave an impact on those 65 and older in the coming year. Whether you’ve chosen to continue working past 65, you’re on your way to becoming an expatriate or you’re happily retired, the new Medicare changes may affect both your health care coverage and, potentially, your wallet.

Understanding these changes can help you prepare for them. Continue reading to learn what you need to know about Medicare changes for 2022.

- Premiums increased for Medicare Parts A, B and D, and decreased for Part C (Medicare Advantage).

- Part B premiums increased by $21.60 — the highest increase in history. This increase will likely be offset by Social Security’s 5.9 percent COLA increase.

- Deductibles and coinsurance for Parts A and B also rose higher than they were in 2021.

- Coverage changes include an increased number of telehealth services, additional help covering insulin and the potential coverage for an Alzheimer’s drug.

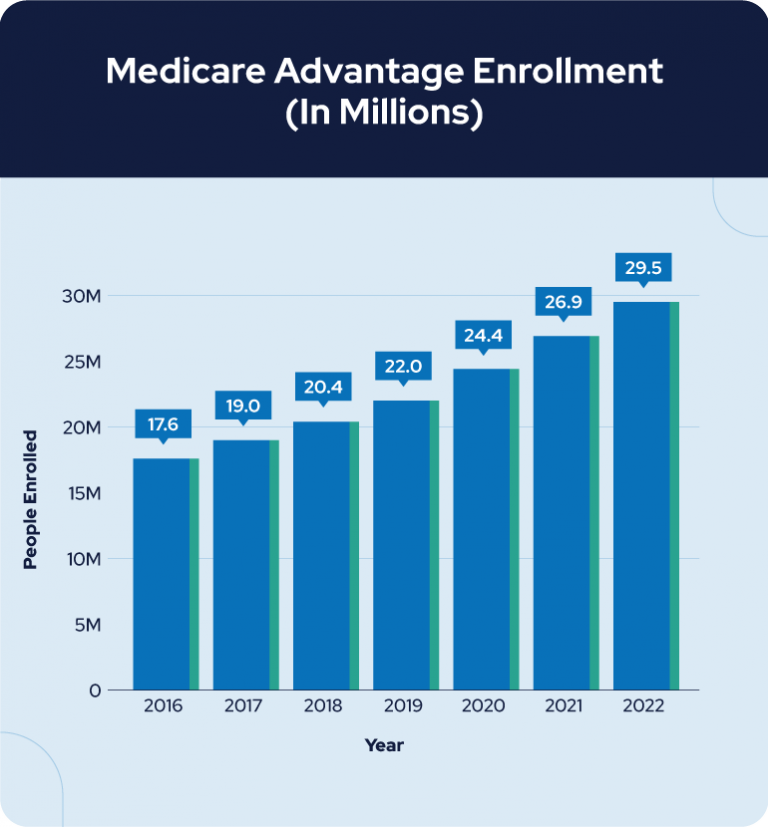

- It’s estimated that 29.5 million people will enroll in a Medicare Advantage plan in 2022 — an increase of roughly 10 percent.

1. Medicare Premiums for 2022

Premiums are just one of the many Medicare changes for 2022. These numbers are updated on a yearly basis and depend on a variety of factors. According to the Centers for Medicare and Medicaid Services (CMS), reasons for higher premiums include:

- Increased utilization of health care and rising prices in the industry

- Accumulation of contingency reserves due to the potential use of Aduhelm™, an Alzheimer’s drug, among Medicare policyholders

- Actions to lower the Medicare Part B premium in 2021, resulting in a $3 per month and per beneficiary increase in premiums through 2025

The Medicare Part B premium in 2022 will see a particularly high increase — the largest in Medicare history — from $148.50 to $170.20, a $21.60 increase.

Immigrants, green card holders and others with fewer than 40 quarters of work history or married to someone with fewer than 40 quarters of work history will also see a climb in Medicare Part A monthly premiums. Those who have worked between 30 and 39 quarters can expect to pay $274 per month in premiums, an increase of $15. Those who’ve worked fewer than 30 quarters will have to pay $499 per month in order to keep their coverage, an increase of $28.

These increased Medicare premiums may seem daunting, however, they are partially offset by the 5.9 percent increase in the Social Security Administration’s Cost-of-Living Adjustment (COLA) for 2022.

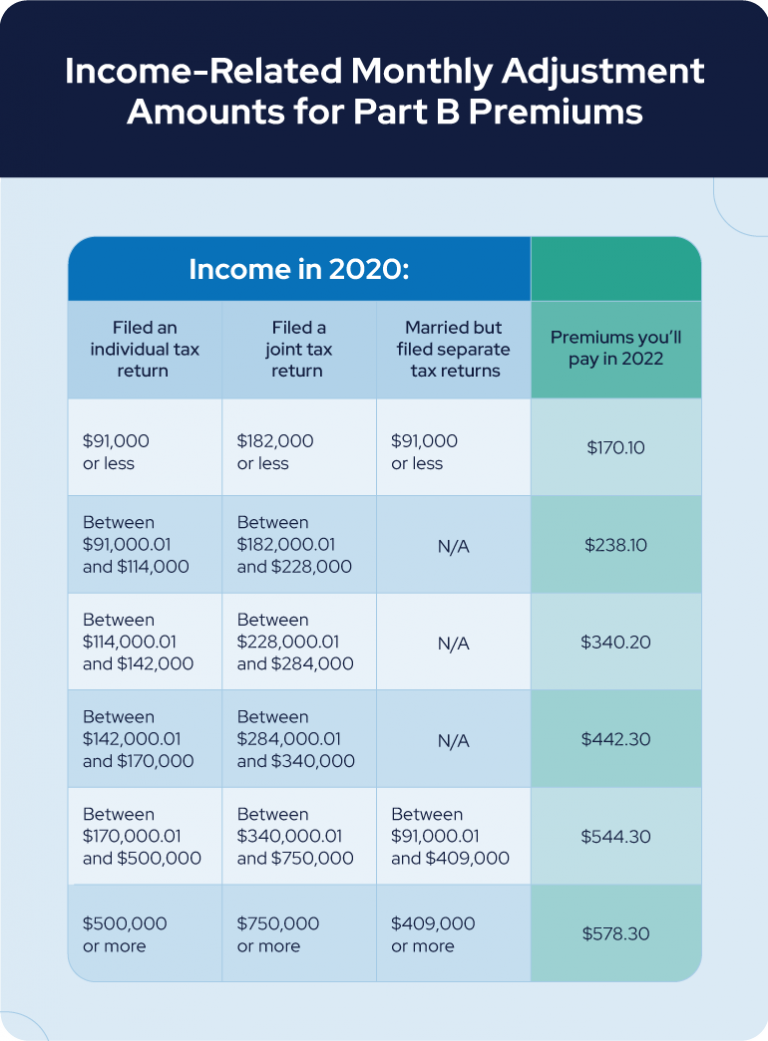

Keep in mind that your premium might cost more if you made $91,000 or more in 2020 and filed an individual tax return. If you filed a joint tax return with a spouse, you’ll pay a higher premium if you made more than $182,000 in 2020. View the chart below for 2022 income-related monthly adjustment amounts.

If, after looking over the chart, you’re still unsure what your Medicare Part B premium will look like in 2022, talk with a Medicare advisor. They can help you understand, based on your income in 2020, how much premium you’ll need to pay in 2022.

2. Medicare Deductibles and Coinsurance in 2022

Increased premiums are just one of the Medicare changes happening in 2022. You can also expect a slight increase in deductibles and coinsurance for both Medicare Part A and Part B as seen in the chart below.

While these are the base deductible and coinsurance amounts, there are also certain conditions associated with different rates. For example, after paying your Part B deductible, you’ll be responsible for paying a 20 percent coinsurance for Medicare-approved procedures.

Because your deductibles and coinsurance are likely to change from year to year, make sure you understand how these changes may affect you. The last thing anyone wants is to get an unexpected hospital bill that exceeds what you were expecting to pay out of pocket. Fully understanding yearly changes can help you make a wise decision about keeping your current coverage or altering your coverage to better fit your needs.

New Medicare Benefits

Specific Medicare benefits can change every year. As new medications are approved by the Food and Drug Administration, coverage for these new medications has to be determined. Likewise, new technologies can change different aspects of the health care industry, which in turn can change what is covered under specific Medicare plans.

In 2022, some of these new medications and technologies have shaped new Medicare benefits. These benefits include increased telehealth coverage, additional help with insulin costs and the potential coverage of a new Alzheimer’s drug.

3. Increased Number of Covered Telehealth Services

As the COVID-19 pandemic stretches on, the need for telehealth services has followed suit. Medicare coverage has responded positively to this need and continues to grow because of it. However, it hasn’t yet been determined how long these benefits will remain, as many covered services have been labeled by the Centers for Medicare and Medicaid Services as only temporary.

4. Additional Help Covering Insulin Costs

In 2021, the Centers for Medicare and Medicaid Services introduced the Part D Senior Savings Model, in which Medicare beneficiaries with diabetes would pay no more than $35 per month for needed insulin.

In 2022, this model has greatly expanded. In fact, every U.S. citizen eligible for Medicare in any of the 50 states, Puerto Rico or Washington, D.C. will have the opportunity to participate in this model.

By using the Medicare Plan Finder or by talking with a Medicare advisor, you can find a prescription drug plan that participates in the Part D Senior Savings Model.

5. Potential for Alzheimer’s Drug Coverage

On January 11, 2022, the Centers for Medicare and Medicaid Services announced their proposal to cover monoclonal antibody medication that targets Alzheimer’s disease. However, CMS will only cover this medicine if those taking it are in a qualifying clinical trial. At this time, Aduhelm™ is the only monoclonal antibody medication approved by the Food and Drug Administration.

If the proposal is approved, all qualifying clinical trials will be posted on the CMS website on their Medicare Coverage Center page.

6. Medicare Advantage Changes

If you’re enrolled in a Medicare Advantage plan (Part C) or are considering enrolling in one, you should also be aware of changes for Medicare Part C in 2022. One specific change this year is the average premium, which decreased from $21.22 to $19.

Medicare Advantage plans often include a wide range of benefits, including hearing aids, free access to fitness centers and coverage for emergencies. These benefits, and many more, will continue to be available in the coming year.

Because of these benefits, enrollment in Medicare Advantage continues to grow. Part C plans are estimated to reach an enrollment of 29.5 million people in 2022, compared to 26.9 million people in 2021.

According to CMS, the percentage of supplemental plans for those with a chronic condition will also increase from 19 percent to 25 percent. This will provide more options for those with chronic illnesses across the country.

Getting Help With Your 2022 Medicare Coverage

Understanding when you can enroll for Medicare, what coverage you might need and how much it may cost you can be overwhelming. With the current Medicare changes for 2022, you also might benefit from switching plans or enrolling in additional coverage.

If you feel overwhelmed by your options, talk with a Medicare advisor to help you through the decision-making process. They can ensure you’re getting the best coverage at the best price. An advisor can also talk you through what’s available with different plans, how certain benefits can assist your specific needs and explain enrollment dates and deadlines.

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

888-694-0290