2023 Tax Brackets

When planning for retirement, the tax bracket that you fall into plays a huge role in the amount of taxes that you owe on your income. Having more sources of income could potentially lead to being placed in a higher tax bracket, resulting in a higher tax burden. Strategizing the timing of receiving specific retirement income and selecting appropriate retirement accounts to invest in can often help lower your tax liabilities.

- Written by Ebony J. Howard, CPA

Ebony J. Howard, CPA

Credentialed Tax Expert at Intuit

Ebony J. Howard is a certified public accountant and freelance consultant with a background in accounting, personal finance, and income tax planning and preparation. She specializes in analyzing financial information in the health care, banking and real estate sectors.

Read More- Edited By

Michael Santiago

Michael Santiago

Senior Financial Editor

Michael Santiago, a senior financial editor, joined RetireGuide in 2023. With over 10 years of professional writing and editing experience, he brings a wealth of expertise in creating content for diverse industries, including travel and healthcare. Having traveled to more than 40 countries across five continents and lived in Europe and Asia for several years, Michael's global perspective enriches his work. He combines his strong writing skills, editorial judgment and passion for crafting accurate and engrossing content to enhance the user experience on RetireGuide.

Read More- Published: April 27, 2023

- Updated: October 20, 2023

- 7 min read time

- This page features 12 Cited Research Articles

- Edited By

- There are seven tax brackets that range from 10% to 37% for each filing status that the IRS adjusts for inflation each tax year.

- The tax rate at which your income will be taxed is determined by your taxable income.

- Certain income that’s taxable on the federal level may be partially taxable or exempt at the state level.

- When planning for retirement, it’s important to understand how the tax brackets affect your income sources, savings in retirement and expenses you must cover.

U.S. Federal Tax Brackets for 2023

According to the Center on Budget and Policy Priorities, the federal government spent an estimated $5.8 trillion on the nation’s gross domestic product in fiscal year 2022, with $4.8 trillion financed by federal revenues.

The U.S. federal government imposes income tax on taxpayers’ earned and unearned income annually to collect revenue and fund various government activities. Taxes must be paid on any source of income that’s considered taxable to the government, including retirement income.

Understanding the tax brackets is important when planning for retirement, as it affects your income sources, retirement savings and expenses.

Currently, there are seven tax brackets, ranging from 10% to 37% for each filing status, and the IRS adjusts these tax brackets for inflation each year. Your taxable income determines the tax rate at which your income will be taxed.

| Tax Rate | Single Filers | Married Filing Jointly Filers | Head of Household Filers | Married Filing Separately Filers |

|---|---|---|---|---|

| 10% | $0 to $10,275 | $0 to $20,550 | $0 to $14,650 | $0 to $10,275 |

| 12% | $10,276 to $41,775 | $20,551 to $83,550 | $14,651 to $55,900 | $10,276 to $41,775 |

| 22% | $41,776 to $89,075 | $83,551 to $178,150 | $55,901 to $89,050 | $41,776 to $89,075 |

| 24% | $89,076 to $170,050 | $178,151 to $340,100 | $89,051 to $170,050 | $89,076 to $170,050 |

| 32% | $170,051 to $215,950 | $340,101 to $431,900 | $170,051 to $215,950 | $170,051 to $215,950 |

| 35% | $215,951 to $539,900 | $431,901 to $647,850 | $215,951 to $539,900 | $215,951 to $323,925 |

| 37% | $539,901 or more | $647,851 or more | $539,901 or more | $323,926 or more |

| Tax Rate | Single Filers | Married Filing Jointly Filers | Head of Household Filers | Married Filing Separately Filers |

|---|---|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 | $0 to 11,000 |

| 12% | $11,001 to $44,725 | $22,001 to $89,450 | $15,701 to $59,850 | $11,001 to $44,725 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 | $59,851 to $95,350 | $44,726 to $95,375 |

| 24% | $95,376 to $182,100 | $190,751 to $364,200 | $95,351 to $182,100 | $95,376 to $182,100 |

| 32% | $182,101 to $231,250 | $364,201 to $462,500 | $182,101 to $231,250 | $182,101 to $231,250 |

| 35% | $231,251 to $578,125 | $462,501 to $693,750 | $231,251 to $578,100 | $231,251 to $346,875 |

| 37% | $578,126 or more | $693,751 or more | $578,101 or more | $346,876 or more |

What Are the Tax Brackets for State Income Tax

Like the federal government, some state governments levy an income tax on taxpayers’ income. Each state has its own individual income tax rate and guidelines for taxing residents and non-residents whose income falls within certain tax brackets.

Unlike federal tax brackets that penalize the married filing separate tax status, some states may double the state tax bracket for those filing separate or single returns. Certain types of income that are taxable at the federal level may be partially taxable or exempt at the state level.

Currently, 43 states impose some form of income tax. Seven states do not levy a state income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas and Wyoming. The state of Washington only taxes capital gains income and New Hampshire only taxes dividends and interest income.

*Ad: Clicking will take you to our partner Annuity.org.

| Income Tax Brackets | |||

|---|---|---|---|

| State | Tax Rates | Single Filers | Married Filing Jointly Filers |

| Florida | none | none | none |

| California | |||

| 1% | $0 | $0 | |

| 2% | $10,099 | $20,198 | |

| 4% | $23,942 | $47,884 | |

| 6% | $37,788 | $75,576 | |

| 8% | $52,455 | $104,910 | |

| 9.30% | $66,295 | $132,590 | |

| 10.30% | $338,639 | $677,278 | |

| 11.30% | $406,364 | $812,728 | |

| 12.30% | $677,275 | $1,000,000 | |

| 13.30% | $1,000,000 | $1,354,550 | |

| Texas | none | none | none |

| Illinois | |||

| 4.95% | $0 | $0 | |

| Virginia | |||

| 2% | $0 | $0 | |

| 3% | $3,000 | $3,000 | |

| 5% | $5,000 | $5,000 | |

| 5.75% | $17,000 | $17,000 | |

| Washington | |||

| Pennsylvia | |||

| 3.07% | $0 | $0 | |

| Tennessee | none | none | none |

| Wisconsin | |||

| 3.54% | $0 | $0 | |

| 4.65% | $13,810 | $18,420 | |

| 5.30% | $27,630 | $36,840 | |

| 7.65% | $304,170 | $405,550 | |

| Maryland | |||

| 2% | $0 | $0 | |

| 3% | $1,000 | $1,000 | |

| 4% | $2,000 | $2,000 | |

| 4.75% | $3,000 | $3,000 | |

| 5% | $100,000 | $150,000 | |

| 5.25% | $125,000 | $175,000 | |

| 5.5% | $150,000 | $225,000 | |

| 5.75% | $250,000 | $300,000 |

How Do Tax Brackets Work?

Tax brackets determine the amount of tax owed on income. The IRS sets a taxable income threshold for each filing status.

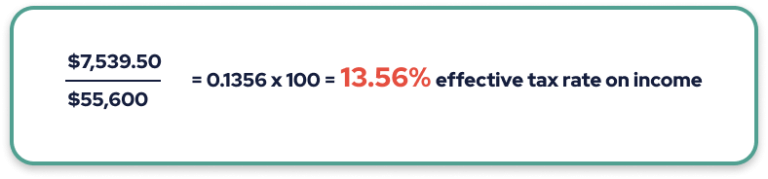

Income falling into each threshold is taxed at the marginal tax rate. For instance, if your taxable income in 2023 was $55,600, the first $11,000 is taxed at 10%, or $1,100, while the next $33,725 is taxed at $12%, or $4,047. The remaining $10,875 is taxed at 22%, equating to $2,392.50. Thus, the total taxes owed on your income at the marginal tax rate would be $7,539.50.

A taxpayer’s marginal tax rate differs from the effective tax rate, which is the average tax rate you pay on a percentage of income, while the marginal tax rate is the rate you pay on your last dollar of income. Typically, the effective tax rate is always lower than the marginal rate. In the example above, the effective tax rate is calculated by dividing the total taxes by the taxable income, then multiplying that amount by 100.

Federal tax brackets apply to various types of retirement income sources based on specific IRS rules.

- Social Security

- Social Security income is taxed based on your total income sources. Individuals with total income between $25,000 to $34,000 or married couples with total income between $32,000 to $44,000 will have 50% of their social security income taxed. Any amount above this is taxed at 85% at the ordinary income tax rates.

- 401(k)s, 403(b)s and Similar Retirement Accounts

- Income 401(k)s, 403(b)s and similar retirement accounts are taxed at the federal ordinary income tax rate when you receive distributions each year.

- IRA

- IRA income taxation depends on whether it was funded with pre-tax or after-tax dollars. Distributions from traditional IRAs funded with pre-tax dollars are taxed at the ordinary income tax rate. However, distributions from Roth IRAs funded with after-tax dollars are not taxed if a five-year holding period is met.

- Pensions

- Pensions funded with pre-tax dollars are taxed at the federal ordinary income tax rate when you receive distributions each year.

- Annuities

- Annuities income is subject to taxation and may be partially taxable or fully taxable based on whether the contributions were made with pre-tax or after-tax dollars. If the contributions were made with pre-tax dollars, then the ordinary income tax rates apply to both the contributions and the earnings portion generated on after-tax contributions.

How Do I Know My Tax Bracket?

In general, to determine which tax bracket you are in, you need to first figure out your total taxable income. Start by calculating your taxable income, which is your estimated income minus any standard or itemized deductions. This can be done by estimating your taxable income less your standard or itemized deductions. Once you calculate your total taxable income, you can compare it to the IRS tax bracket rates based on your filing status.

*Ad: Clicking will take you to our partner Annuity.org.

Strategies To Reduce Your Tax Bill

Retirees have access to several tax planning strategies that can help reduce their tax bill and preserve their retirement income.

- Investing in tax-efficient investments.

- Tax-exempt retirement accounts, such as Roth IRAs funded with after-tax dollars, can provide tax-free withdrawals in retirement. Investing in tax-managed funds and exchange traded funds (ETFs) can also result in lower taxes on capital gains. Municipal bonds offer tax-exempt interest income at the federal level and sometimes at the state and local level.

- Claiming tax deductions and credits.

- Older taxpayers and retirees can claim certain tax deductions and credits on their tax returns. For tax year 2023, taxpayers who are at least 65 years old or blind can claim a credit for the elderly and disabled ranging from $3,750 to $7,500. An additional standard deduction of $1,500 or $1,850 (if a single or head of household filer) can also be claimed. Those age 50 and older can contribute an extra $7,500 to a 401(k) or 403(b) and take an additional $1,000 IRA deduction through a catch up contribution. Individuals aged 55 or older can make an additional $1,000 contribution to their HSA.

- Itemizing deductions.

- Retirees can write off several expenses, such as mortgage interest, property taxesForm 1040, Schedule A to reduce their tax bill. To claim a deduction for medical expenses, the total medical expenses must be above 7.5% of the adjusted gross income.

- Deferring income to later years.

- Retirees can choose to delay the collection of certain sources of retirement income, such as Social Security benefits, to defer taxes on this income. This strategy can reduce the total retirement income taxed in a given year.

- Giving to charity.

- Donating money or investments to qualified charitable organizations can serve as a tax break. The donated money or investment can be written off on Form 1040, Schedule A as an itemized deduction, reducing the taxable income.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

12 Cited Research Articles

- Internal Revenue Service. (2023, April 6). Topic No. 551, Standard Deduction. Retrieved from https://www.irs.gov/credits-deductions/individuals/credit-for-the-elderly-or-the-disabled

- Vermeer, T. (2023, February 21). State Individual Income Tax Rates and Brackets for 2023. Retrieved from https://taxfoundation.org/publications/state-individual-income-tax-rates-and-brackets/

- Internal Revenue Service. (2023, February 1). Publication 969 (2022) Health Savings Accounts and Other Tax-Favored Health Plans. Retrieved from https://www.irs.gov/publications/p969

- Internal Revenue Service. (2022, December 8). 401(k) limit increases to $22,500 for 2023, IRA limit rises to $6,500. Retrieved from https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500

- Miller, S. (2022, October 21). For 2023, 401(k) Contribution Limit Rises to $22,500 with $7,500 ‘Catch-Up’. Retrieved from https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/2023-irs-401k-contribution-limits.aspx

- Internal Revenue Service. (2022, October 18). Rev. Proc. 2022-38. Pages 6 – 9. Retrieved from https://www.irs.gov/pub/irs-drop/rp-22-38.pdf

- Internal Revenue Service. (2022, September 14). Credit for the Elderly or the Disabled at-a-Glance. Retrieved from https://www.irs.gov/credits-deductions/individuals/credit-for-the-elderly-or-the-disabled

- Center on Budget Policy Priorities. (2022, July 28). Policy Basics: Where Do Our Federal Tax Dollars Go? Retrieved from https://www.cbpp.org/research/federal-budget/where-do-our-federal-tax-dollars-go

- Internal Revenue Service. (2022). 2022 Schedule A (Form 1040) Itemized Deductions. Retrieved from https://www.irs.gov/pub/irs-pdf/f1040sa.pdf

- Internal Revenue Service. (2021, November 10). Rev. Proc. 2021-45. Pages 5 – 8. Retrieved from https://www.irs.gov/pub/irs-drop/rp-22-38.pdf

- Center on Budget Policy Priorities. (2020, November 24). Policy Basics: Marginal and Average Tax Rates. Retrieved from https://www.cbpp.org/research/federal-tax/marginal-and-average-tax-rates

- Social Security Administration. (n.d.) Income Taxes and Your Social Security Benefit. Retrieved from https://www.ssa.gov/benefits/retirement/planner/taxes.html

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696