Whole Life vs. Universal Life Insurance

Whole life and universal life insurance policies both provide financial windfalls for beneficiaries when a policyholder dies. Whole life has fixed premiums and benefits, while universal life has more long-term financial flexibility.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Financially Reviewed By

Eric Estevez

Eric Estevez

Owner of HLC Insurance Broker, LLC

Eric Estevez is a duly licensed independent insurance broker and a former financial institution auditor with more than a decade of professional experience. He has specialized in federal, state and local compliance for both large and small businesses.

Read More- Published: September 8, 2022

- Updated: May 8, 2023

- 6 min read time

- This page features 8 Cited Research Articles

- Edited By

What Are the Differences Between Whole Life and Universal Life Insurance?

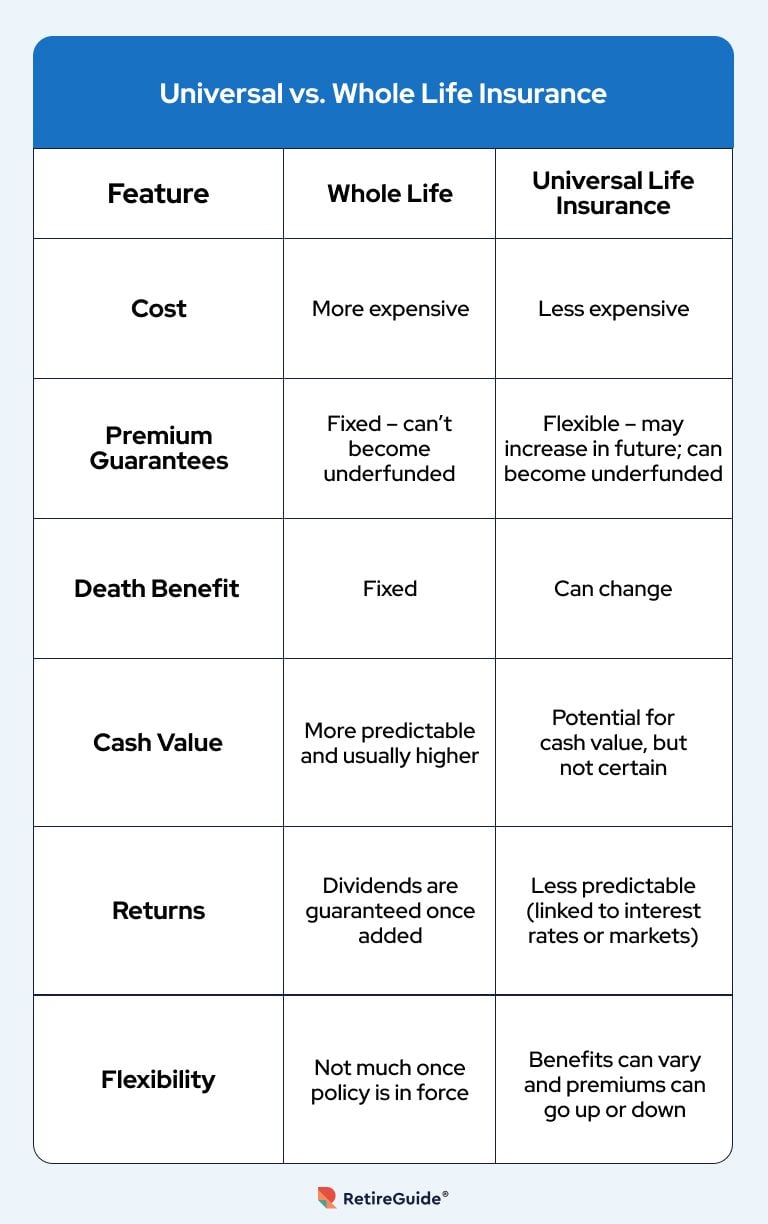

Whole life and universal life insurance policies are similar in that they’re both lifelong, permanent insurance coverages that also carry cash values. But they have distinct differences. The major differences are premium costs, flexibility and the accumulated value of the policies.

Whole life policies have more expensive premiums, but they allow policyholders to build up money from their premium payments in a cash fund available for future use. Over time, policyholders can take their money out as a lump-sum payment or as a loan against the cash value.

Some whole life insurance policies pay out a share of the insurance company’s profits as scheduled dividends, which increase the cash value of the policy.

Universal life insurance is more flexible than whole life but carries fewer guarantees of increased cash-in value or lower premiums. Universal life policies accumulate their cash-in value, but not at a pre-set rate or amount.

Value varies because policy growth is usually tied directly to the performance of money market funds, an investment fund provided by the insurance company, or an index fund such as the S&P 500. As markets rise and fall, the policy cash-in value moves up and down as well.

Life insurance policies aren’t a one-size-fits-all financial investment. Whole life and universal life policies each have their pros and cons.

Pros and Cons of Whole Life

One defining characteristic of whole life policies is consistency. Financial terms don’t change.

Policyholders know at the beginning exactly what their monthly or annual premium payments will be for the life of the policy. This is also true for the dollar value of death benefits.

Whole life policies are usually inflexible about changing the amount of premiums and death benefits.

- Provides fixed premium amount

- Guarantees coverage for life, as long as premiums get paid

- Can provide cash-in value in the future

- Can provide annual dividends for extra growth

- Higher premiums than most other types of life insurance policies

- Less flexibility for increasing coverage amount

- Less flexibility to add extra features

Insurers offer various whole life policies, but the main two are participating or non-participating.

A participating whole life policy pays annual dividends to the policyholder or accumulates value for a future cash-in. Dividends are not guaranteed.

A non-participating whole life policy doesn’t share in the profits of the insurance company and won’t pay any dividends, but it guarantees the full policy amount upon on the death of the policyholder.

Pros and Cons of Universal Life Insurance

Universal life’s selling point is its flexibility. It treats the three key parts of a policy (premiums, cash value and death benefits) separately, making for many options for a policyholder.

Initial premiums are often lower for universal life policies than they are for whole life policies, but they’re usually not guaranteed to stay at the same rate for the duration of the policy. They can rise. The disadvantage of universal life policies is their volatility.

Some insurance companies offer universal life policies that counter unpredictability by guaranteeing a specific coverage amount and premium with no cash-in value. This can be a lower-cost option than whole life.

- Initial premiums are usually lower than those for whole life

- Flexibility to use cash value to maintain future premiums

- Possible to increase life cover (subject to age and medical evidence)

- Policy amount can benefit from strong investment market returns for a larger cash-in value

- Possible cost savings with guaranteed universal life

- Premiums usually not guaranteed

- No dividends — cash-in linked to money market or investment markets

- Lack of certainty — the ultimate value depends on that day’s market valuations

Some policies link future premium amounts to how much cash value accumulates. If the value reduces, there may be an increase in premiums. This usually happens after a review at a specified time in the future, such as after five or 10 years.

Once the policy accumulates a cash value, you may be able to suspend premiums for a time. However, that brings a risk that the cash value runs out and the policy lapses with no value. It’s also possible to cash-in part or all the cash-in value in the future.

How Do I Choose Between Whole Life and Universal Life?

Choosing between a whole life policy and a universal life policy depends on your priorities. Are you more concerned with cost, cash value or flexibility?

Whole life is attractive if you foresee a future financial obligation to meet, whatever the premium price. Obligations may include paying off a large debt, such as a mortgage or a car loan, or leaving money for dependents after your death.

If guaranteed premiums are important, whole life may also be the answer, although it’s worth comparing with guaranteed universal life insurance if a future cash value isn’t important.

If flexibility is important, universal life is the option. Policyholders can reduce or increase their coverage amount once the policy is in place, although increases are usually subject to providing new medical evidence. Increased coverage comes with more expensive premiums.

What If I Have One or the Other Plan Already?

If you have either type of insurance in place and are considering a different policy, don’t cancel your existing policy first. The reason? Price.

Because you’re older today than when you bought your insurance, premiums for a new policy are likely to be more expensive than when you were younger (assuming the coverage amounts are equal). This will certainly be true if your health is worse now than it was when you purchased your existing policy.

Check with your current insurance company to see if you can alter your policy to meet your additional needs. For example, if you have a universal life policy, you may be permitted to increase the death benefit. You should also be able to increase the premiums to build up the cash value more quickly if that’s your priority.

Sometimes you’ll be better off buying a second policy to meet your new needs while keeping your existing one in place.

Alternatives to Universal and Whole Life Insurance

The obvious alternative to universal or whole life insurance is term life insurance, but term insurance is not an apples-to-apples comparison because it has zero cash value until you die — and term polices have a fixed duration.

Some life insurance companies offer convertible term insurance, which lets you convert the death benefit value to permanent insurance, such as whole life or universal life, without having to provide medical evidence. Premiums at the time of conversion will be based on your older age, but at least you won’t have to worry about not being eligible for coverage because of worsened health.

Term insurance is beneficial only if death benefits are the goal. If building up reserve money is the goal, other kinds of investments may be better options than term insurance.

Consider whether to maximize your contributions to retirement plans, such as a 401(k), an individual retirement account or a health savings plan. Any contributions you make to these plans build wealth over a lifetime and save you in annual income taxes.

Other insurance-based alternatives include adjustable life insurance and a 1035 exchange, which allows a policyholder to transfer funds from an existing policy (or from an annuity or an endowment) to a new policy without having to pay taxes.

8 Cited Research Articles

- Texas Department of Insurance. (2020, February 26). Life Insurance Guide. Retrieved from https://www.tdi.texas.gov/pubs/consumer/cb018.html

- Michigan Department of Insurance and Financial Services. (2019, November). Understanding Life Insurance: Should You Purchase, Change, or Cancel a Policy? Retrieved from https://mn.gov/commerce/insurance/other/life-insurance/old/term-vs-permanent.jsp

- National Association of Insurance Commissioners. (2019, October 4). Whole Life. Retrieved from https://content.naic.org/cipr-topics/life-insurance

- Insurance Information Institute. (n.d.). What are the different types of permanent life insurance policies? Retrieved from https://www.iii.org/article/what-are-different-types-permanent-life-insurance-policies

- New York Department of Financial Services. (n.d.). Types Of Life Insurance Policies. Retrieved from https://www.dfs.ny.gov/consumers/life_insurance/types_of_policies

- California Department of Insurance. (n.d.). Life Insurance Guide. Retrieved from http://www.insurance.ca.gov/01-consumers/105-type/95-guides/07-life/life-ins-guide.cfm

- Minnesota Commerce Department. (n.d.). Term vs Permanent Life Insurance. Retrieved from https://mn.gov/commerce/insurance/other/life-insurance/old/term-vs-permanent.jsp

- Washington State Office of the Insurance Commissioner. (n.d.). A consumer’s guide to: Life Insurance. Retrieved from https://www.insurance.wa.gov/sites/default/files/documents/life-insurance-guide.pdf

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696