Medicare Advantage vs. Medigap

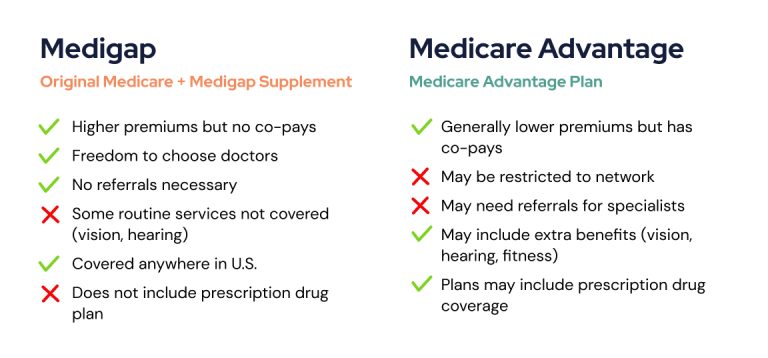

Medicare Advantage and Medigap plans are both sold through private insurers, but there are major differences. Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare, while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage. You can choose to buy one or the other, but you cannot have both a Medigap policy and a Medicare Advantage plan at the same time.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Christian Worstell

Christian Worstell

Medicare Expert

Christian Worstell is a licensed health insurance agent and an established writer in the sector, with articles featured in Forbes, MarketWatch, WebMD and more. His work has positively impacted beneficiaries nationwide and empowers them to make strong health care decisions.

Read More- Published: July 13, 2020

- Updated: May 1, 2025

- 16 min read time

- This page features 8 Cited Research Articles

Key Takeaways- Medicare Advantage is a money-saving choice if you are in good health with few medical expenses. Medigap is generally better for those with serious medical conditions.

- Medicare Advantage replaces Original Medicare Part A and B coverage and includes additional benefits.

- Medigap supplements Original Medicare, helping with some out-of-pocket costs but does not cover prescription drugs or anything else Original Medicare does not cover.

- You cannot have Medicare Advantage and Medigap at the same time, but you can switch between the two plans should your health care costs change.

- Medicare Advantage covers dental and vision. Medigap doesn’t help with these services.

What Coverage Gaps Does Medicare Have?

Original Medicare — Medicare Part A and Part B — has several gaps in coverage. These include services and items that Original Medicare does not cover as well as cost sharing for certain services that require out-of-pocket spending for what is covered.

Medicare Advantage or Medigap plans are designed to fill in some of the gaps.

Examples of What’s Not Covered by Original Medicare- Coinsurance

- Copay

- Cosmetic Surgery

- Deductibles

- Dentures

- Hearing aids and exams

- Long-term care

- Massage therapy

- Most dental care

- Most prescription drugs

- Routine physical exams

- Routine vision exams, glasses and contact lenses

Medicare Advantage and Medigap work in different ways to address some of these gaps. You cannot have both a Medicare Advantage and a Medigap plan at the same time, so considering how each may work for your needs and budget is important.

An easy way to think about the difference between Medigap and Medicare Advantage is that Medigap supplements your Original Medicare coverage, while Medicare Advantage replaces it. Both types of plans are great options, but it’s important to determine which one is best for you.What Is Medicare Advantage?

Medicare Advantage plans are an alternative to Original Medicare. Sold by private insurers, these plans cover everything covered by Original Medicare but may also offer extra benefits . Additional benefits may include prescription drug coverage along with hearing, dental and vision care.

Most Medicare Advantage plans include Medicare Part D prescription drug plans, so there usually isn’t a need to enroll in a separate Part D plan.

You can purchase a Medicare Advantage plan after enrolling in Medicare Part A hospital insurance and Medicare Part B medical insurance. When you enroll, your Medicare Advantage plan takes the place of your Medicare Part A and Part B coverage.

Average Medicare Advantage Costs

The average monthly premium for a Medicare Advantage plan in 2025 is around $17 per month, according to AHIP — a trade association representing health insurance companies. But the average varies widely based on where you live.

Individual state averages range from $0 per month in Alaska to $70.77 in Minnesota, according to the U.S. Centers for Medicare and Medicaid Services. Premiums vary on the plans available where you live, the amount of coverage and other factors.

Premiums are not the only cost to consider when choosing a Medicare Advantage plan.

In addition, you typically have to continue paying your monthly Medicare Part B premium — which in 2025 is $185 or higher depending on your income. This is in addition to any premium you have to pay for your Medicare Advantage plan.

Your maximum out-of-pocket (MOOP) costs also vary by state — from just above $2,600 in Nevada to more than $7,200 in New Jersey.

Pros of Medicare Advantage

Medicare Advantage plans usually have lower monthly premiums than Medigap plans. They may also include prescription drug coverage. You must enroll in a separate drug plan if you choose Medigap.

If dental or vision coverage is important to you, you might choose Medicare Advantage because Medigap doesn’t help with these services. Medicare Advantage may also be better for you if you are flexible on which doctors you are willing to see, as you will have to use in-network health care providers to cut out-of-pocket costs.

Cons of Medicare Advantage

One of the biggest disadvantages of a Medicare Advantage plan is that it limits your choice of doctors, hospitals and other health care providers. Medicare Advantage plans rely on health care provider networks. If you go to a doctor or other provider not in your network, you typically have to pay more of the cost.

While Original Medicare is the same across the United States, Medicare Advantage plans may only cover your health care in a specific area. If you move to a new state, you may have to replace your plan.

A wide variety of Medicare Advantage plans are available, but they are not available in all areas. You may have a confusing number of Medicare Advantage plans to choose from if you live in a densely populated area. You are more likely to have limited options in rural areas.

What Is Medicare Supplement Insurance (Medigap)?

Medigap is intended to cover some of the gaps that Original Medicare doesn’t pay for — coinsurance, copayments and deductibles, for instance.

Original Medicare only pays 80% for Medicare-covered services such as your doctors’ services and any outpatient medical services and supplies. A Medigap plan can help cover some or all of that 20% gap that you have to pay for out-of-pocket.

Medigap cannot be used to pay for anything that Medicare Part A and Part B does not cover. This means you can’t use Medigap to cover prescription drugs or the hearing, vision and dental services that Original Medicare does not cover.

If you have Original Medicare and a Medigap policy, you may also benefit from a Medicare Part D prescription drug plan to help cover prescription drug costs.

Average Costs

The average cost of a Medigap plan varies widely by ZIP code and depends on which plan you choose, your age and your gender.

When shopping for a Medigap policy, compare the prices of the same plans from different insurers. For instance, compare Plan G from one insurer to a Plan G from another insurer. This will give you a clearer picture of different prices for the same coverage.

Ask the insurer about how the plan is priced or “rated.”

Medigap Plan Rating Systems- Community-rated

- Everyone is charged the same price. Premium prices may rise over time due to inflation, but they will not increase based on your age.

- Issue-rated

- The premium is based on your age when you buy the Medigap plan. You’ll pay less if you buy it when you’re younger. Premiums may rise due to inflation, but not because of you getting older.

- Attained-age-rated

- Premiums are lower for younger buyers, but they increase as you get older. They may also increase due to inflation or other factors.

Different Medigap plans cover different out-of-pocket expenses associated with Original Medicare. If you qualified for Medicare after Jan. 1, 2020, you can no longer buy a plan that covers your Part B deductible.

But you can find plans that cover your Part A and Part B coinsurance, additional hospitalization, skilled nursing facility stays, and other out-of-pocket costs.

Most Medigap plans do not have maximum out-of-pocket limits since they effectively cover the gaps in Medicare that cause out-of-pocket spending for hospitalization, doctor visits and other services. You seldom have out-of-pocket costs if you have Medigap.

Two plans — Plan K and Plan L — do have maximum out-of-pocket limits. Plan K’s is $7,220 and Plan L’s is $3,610 for 2025.

Pros of Medigap

Medigap helps cover your out-of-pocket expenses if you decide to stick with Original Medicare.

The biggest advantage of Medigap may be your choice of doctors. You have more doctors and hospitals to choose from since you can go to any provider that accepts Medicare.

If your doctor is not in a Medicare Advantage plan you’re considering and you don’t want to switch doctors, you may want to consider Medigap.

While Medigap premiums are generally higher than those of Medicare Advantage, Medigap will likely charge you lower out-of-pocket expenses. You’ll need to calculate how much you expect to pay for health care over a year and compare that to your annual premium cost.

Finding a Medigap plan that works for you can be less confusing because there are only eight types to choose from. This can simplify enrolling in Medicare.

Cons of Medigap

Costs are the leading disadvantage of Medigap. Medigap plans tend to have higher monthly premiums than Medicare Advantage plans. You also still have to pay your Medicare Part B monthly premiums.

If you didn’t become eligible for Medicare before Jan. 1, 2020, Medigap can no longer pay for your Medicare Part B deductible.

To be eligible for a Medigap plan, you have to be 65 years or older and be enrolled in both Medicare Part A hospital insurance and Medicare Part B medical insurance.

You are not guaranteed that your application for a Medigap policy will be accepted if you don’t purchase a plan when you are first eligible for Medicare. Even if you are accepted after the initial enrollment period, you may have to pay more for a Medigap policy.

Medigap policies are standardized in 47 states and the District of Columbia. But costs may vary state-to-state for the same plan.

Expand

ExpandComparing Medicare Advantage and Medigap

With a Medigap plan, you have access to any doctor or provider who accepts Medicare. By contrast, you may have fewer choices in terms of doctors and health care providers with a Medicare Advantage plan.

Legally, you cannot have Medigap coverage with a Medicare Advantage plan. However, you may be able to switch between the two plans.

Biggest Differences Between Medicare Advantage and Medigap

Medicare Advantage and Medigap plans can provide different options to best suit your circumstances. You should compare Medicare plans carefully to make sure you’re getting the best coverage for your particular financial situation and health care needs.

Comparing Plans: Medicare Advantage vs. Medigap- Choice of Doctors

Medicare Advantage: Requires you to use doctors in the plan’s network or you have to pay more out-of-pocket.

Medigap: You can use any doctor or hospital that accepts Medicare.

- Costs

Medicare Advantage: An average $17 a month premium (for 2025) on top of your Medicare Part B premium.

Medigap: The average Medigap cost is $1,860 per year ($155 per month) in 2023.

- Coverage

Medicare Advantage: Covers Medicare Parts A and B, but most plans provide extra benefits, including vision, dental, hearing and prescription drugs.

Medigap: You still have Original Medicare Parts A and B, and the choice of eight different Medigap plans each providing different levels of coverage

- Out-of-Pocket Limit

Medicare Advantage: Plans must cap annual out-of-pocket costs at $9,350 for in network services and $14,000 for in- and out-of-network services combined.

Medigap: A Medigap policy can ease concerns about Medicare's lack of caps or limits. Each plan has specific benefits with specified out-of-pocket costs. Most plans do not have maximum limits.

- Prescription Drug Coverage

Medicare Advantage: Plans may include prescription drug coverage.

Medigap: You have to buy separate Medicare Part D prescription drug coverage.

- Referrals

Medicare Advantage: You may be required to get a referral from your primary care doctor to see a specialist

Medigap: Referrals from your primary care doctor are not required.

Cost and Coverage Differences

Typically, average monthly premiums for Medicare Advantage coverage tend to be lower than the average for someone with Original Medicare, a Medigap plan and Medicare Part D prescription drug coverage. However, premiums are just one part of the cost and coverage equation.

Medicare Advantage plans frequently provide benefits that Medigap doesn’t. These include vision, hearing and dental services. Most plans also include prescription drug coverage.

If you have Original Medicare with a Medigap plan, you will have to buy an additional Medicare Part D prescription drug plan to help with medication costs. You will also have to buy separate dental and vision insurance or pay out-of-pocket for those services.

Medicare Advantage plans may require you to use doctors and hospitals within their networks. With Original Medicare and Medigap, you are covered as long as the doctor accepts Medicare — regardless of where you are or where you travel in the U.S.

Out-of-pocket costs may be a significant difference to compare when choosing between Medicare Advantage or Medigap. Depending on your health care needs, they can be significantly higher with Medicare Advantage than with Medigap.

Medigap can be a more sustainable choice over time because the more comprehensive plans (such as G) can protect you from high out-of-pocket spending. Medicare allows Medicare Advantage plans to charge enrollees up to $8,000 for annual out-of-pocket spending just for in-network healthcare. This is not affordable when the average Social Security benefit is only $1,660 or so. As people age, high out-of-pocket costs year after year could drain retirement savings, leaving little when one is older and needs health care the most.Have you selected your 2025 Medicare plan?Maximize your Medicare savings by connecting with a licensed insurance agent.How To Decide Between Medicare Advantage and Medigap

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Speaking with a licensed insurance agent about your health situation can help you decide which is best for you. Since you are not allowed to have Medicare Advantage and Medigap at the same time, you must choose carefully to make sure you have suitable coverage for your specific situation.

Weighing what options are most important to you and talking with a licensed insurance agent about your wants and needs can help you make an informed choice between Medicare Advantage and Medigap.

Terry Turner | 1:14 How do I choose between Original Medicare with Medigap or Medicare Advantage? Get Free Help Pricing and Building Your Medigap PlanReplay VideoTerry Turner, senior financial writer and financial wellness facilitator, talks through the differences between Medicare Advantage and Original Medicare with Medigap coverage.

Get Free Help Pricing and Building Your Medigap PlanReplay VideoTerry Turner, senior financial writer and financial wellness facilitator, talks through the differences between Medicare Advantage and Original Medicare with Medigap coverage.Factors To Consider

Medicare Brokers vs. AgentsWhich Medicare plan or combination of plans is right for you depends on your health care needs now and in the future. There are several factors to consider. Talking with an advisor may help you make a more informed decision on the best coverage for you.

Factors To Consider When Comparing Medicare Advantage & Medigap Plans- Monthly premiums

- You’ll still have to pay Medicare Part B premiums, but Medicare Advantage plans will typically cost less per month than the Original Medicare, Medigap and Part D plan required to give you similar benefits.

- Out-of-pocket costs

- You’ll typically have lower out-of-pocket costs with Medigap plans than with Medicare Advantage plans.

- Plan availability

- Not all plans — Medicare Advantage or Medigap — are available in all areas. Make sure you compare the plans that are available where you live.

- Your medical conditions

- If you have health conditions that can generate large out-of-pocket costs, Medigap may be a better route. Medicare Advantage Special Needs Plans (SNP) may be a better alternative for people who are institutionalized, are dual eligible for Medicare and Medicaid or have certain health conditions. Talking with a Medicare advisor can help you understand your options.

- Extra benefits

- Medicare Advantage plans offer extra benefits you don’t get with Original Medicare and Medigap. These include built-in Part D prescription drug coverage, vision, hearing and dental care as well as fitness club access. These benefits differ between plans, so ask what a plan includes.

- Flexibility

- Medicare Advantage and Medicare Part D plans offer annual open enrollment periods that allow you to change plans once a year. You have only one open enrollment period with Medigap — around the time you enroll in Medicare Part B. After that — in most states — insurers can require health exams, charge you more to enroll or deny you coverage.

- Networks

- You can also use Original Medicare and Medigap at any health care provider in the U.S. that accepts Medicare. Some Medicare Advantage plans have national networks, but some may rely on regional networks. You can ask about network coverage when shopping for a plan.

- Travel

- Six of the 10 Medigap plans provide some coverage if you need health care while traveling abroad.

Questions To Help You Decide Between Medicare Advantage and Medigap

You can ask yourself several questions to narrow down whether Medigap or Medicare Advantage might be a better fit for you.

If you’re considering Medicare Advantage, these are some questions you should ask yourself.

Medicare Advantage Questions To Ask Yourself- Am I willing to accept a limited choice of doctors or other health care providers who I can see?

- Do I want insurance to cover dental, hearing or vision care, all included in my premiums?

- Am I relatively healthy, and do I seldom need a doctor visit?

- Am I at low risk of developing a chronic or serious medical condition?

- Am I unlikely to move to another state?

- Do I want prescription drug coverage included in my coverage?

- Are low monthly premiums more important than higher coinsurance or copayments when I get health care?

If you answered “Yes” to the majority of these questions, you may want to focus mainly on Medicare Advantage plans.

Ask yourself the following questions if you are considering a Medigap plan.

Medigap Questions To Ask Yourself- Is my choice of doctors or other health care providers important to me?

- Am I willing to skip having insurance for hearing, vision and dental care?

- Do I go to the doctor frequently or require health care services frequently?

- Do I have — or am I at risk of developing — a chronic or serious medical condition?

- Am I likely to move to another state?

- Am I willing to pay extra for a prescription drug insurance plan?

- Am I willing to pay higher monthly premiums to avoid higher copayments or coinsurance when I get health care?

If you answered “Yes” to a majority of these questions, you may want to learn more about Medigap options.

When making a decision, it’s important to consider your financial situation and the quality of your health. Talking with a Medicare advisor can help guide you to a clearer understanding of what type of Medicare coverage is best for you.

Tom Parkin | 1:31 Can I switch between Medicare Advantage and a Medicare Supplement (Medigap) plan? Get Free Help Pricing and Building Your Medigap PlanReplay VideoLearn whether or not you can switch between Medicare Advantage and Medigap plans from Tom Parkin, a Medicare expert who has more than a decade of experience in the insurance industry.

Get Free Help Pricing and Building Your Medigap PlanReplay VideoLearn whether or not you can switch between Medicare Advantage and Medigap plans from Tom Parkin, a Medicare expert who has more than a decade of experience in the insurance industry.Frequently Asked Questions About Medicare Advantage and Medigap

Can you switch between Medicare Advantage and Medicare Supplement Insurance?It may be possible to switch from Medicare Advantage to Original Medicare with Medigap — but you have to go through multiple steps.

First, you’ll have to drop your Medicare Advantage plan and enroll in Original Medicare. You can do that by contacting your Medicare Advantage plan administrator or calling Medicare at 1-800-633-4273.

Then you’ll have to buy a Medigap plan. That may be difficult or costly if you’ve missed your open enrollment period. Outside that six-month period, you may have to pay more or pass a medical exam. And insurers may be able to deny you coverage.

What is the biggest difference between Medigap and Medicare Advantage?One of the biggest differences between Medigap and Medicare Advantage is that with Medigap, you can see any doctor or go to any hospital that accepts Medicare. That’s about 93% of the health care providers in the country. With Medicare Advantage you are limited to doctors, hospitals and other health care providers in your plan’s network.Do Medicare Advantage and Medigap have the same benefits?Medigap and Medicare Advantage offer different benefits. Medicare Advantage plans often include additional benefits such as vision, dental and hearing coverage that Medigap does not include. Medicare Advantage plans usually include built-in Medicare Part D drug benefits. Medigap, on the other hand, typically offers lower out-of-pocket costs for the things Medicare does cover.Editors Samantha Connell and Hannah Alberstadt contributed to this article.

3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.Last Modified: May 1, 2025Share This Page8 Cited Research Articles

- Centers for U.S. Medicare & Medicaid Services. (2024, November 8). 2025 Medicare Parts A & B Premiums and Deductibles. Retrieved from https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles

- U.S. Centers for Medicare & Medicaid Services. (2024 October). K & L Out-of-Pocket Limits Announcements. Retrieved from https://www.cms.gov/medicare/health-drug-plans/medigap/k-l-out-of-pocket-limits-announcements

- U.S. Centers for Medicare & Medicaid Services. (2024, September 27). Fact Sheet. Retrieved from https://www.cms.gov/files/document/2025-ma-part-d-landscape-state-state-fact-sheet.pdf

- U.S. Centers for Medicare & Medicaid Services. (2024, September 27). Medicare Advantage and Medicare Prescription Drug Programs to Remain Stable as CMS Implements Improvements to the Programs in 2025. Retrieved from https://www.cms.gov/newsroom/fact-sheets/medicare-advantage-and-medicare-prescription-drug-programs-remain-stable-cms-implements-improvements

- White, J. (2020, January 24). Medigap vs. Medicare Advantage: What's the Difference? Retrieved from https://www.thestreet.com/personal-finance/insurance/health-insurance/medigap-vs-medicare-advantage

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Get Medigap Costs. Retrieved from https://www.medicare.gov/costs-of-medigap-policies

- U.S. Centers for Medicare & Medicaid Services. (n.d.). What’s Medicare Supplement Insurance (Medigap)? Retrieved from https://www.medicare.gov/supplements-other-insurance/whats-medicare-supplement-insurance-medigap

- U.S. Centers for Medicare & Medicaid Services. (n.d.). What’s Not Covered? Retrieved from https://www.medicare.gov/providers-services/original-medicare/not-covered

- Edited By

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-749-5443Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696