What Is a 403(b) Retirement Plan?

A 403(b) plan is a type of retirement plan available to public school employees, certain ministers and employees of certain 501(c)(3) tax-exempt organizations. The plan permits workers and employers to contribute to the plan. Learn how they compare to other retirement plans.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: September 14, 2020

- Updated: March 20, 2025

- 5 min read time

- This page features 9 Cited Research Articles

- Edited By

What Is a 403(b)?

A 403(b) retirement plan is a tax-deferred retirement savings account available to certain employees. Tax-deferred means you don’t have to pay income taxes on the money you put into it, but you should expect to pay taxes on the money you withdraw later.

- Employees of 501(c)(3) organizations: tax-exempt nonprofit organizations considered public charities, private foundations or private operating foundations under the tax code

- Public school employees (including those organized by Native American tribal governments)

- State college employees

- University employees

- Eligible employees of a religious institution

- Ministers employed by a 501(c)(3) organization

- Ministers not employed by a 501(c)(3) organization but who function as ministers in day-to-day professional responsibilities with their employers

- Ministers who are self-employed

When you enroll in a 403(b) plan, you can opt to have your employer withhold a portion of your paycheck and have it redirected to the plan. Your employer can also elect to contribute to your plan.

These contributions live in invested annuity contracts or mutual fund custodial accounts — a brokerage account that invests in mutual funds, stocks and bonds.

How Do 403(b) Plans Work?

403(b) plans automatically receive a portion of your paycheck so it can grow tax deferred. Sometimes, your employer will match your contribution up to a certain percentage.

You can also choose to invest in a few select options. 403(b) plans serve as a well-rounded savings account as part of a retirement plan.

Roth 403(b) plans and traditional 403(b) plans have different tax and required minimum distribution (RMD) rules.

Traditional 403(b)s give you a tax break upfront, while Roth 403(b)s make your withdrawals tax-free, meaning you get your tax break later on.

Traditional 403(b)s require you to take RMDs once you turn 73. The money taken out of your account will be taxable.

Roth 403(b)s currently call for RMDs once the owner of the account dies. However, starting in 2024, RMDs won’t be required for Roth 403(B) accounts at all.

The types have similar pros and cons, despite having tax and RMD differences.

- Allows flexible contributions

- Optional loans and hardship distributions

- Tax advantages

- Traditional or Roth options

- Employer matching

- Limited investment options compared to a 401(k)

- Potentially high fees

- Not always subject to the Employee Retirement Income Security Act of 1974 (ERISA), which lowers standard protection

- Contributions have an annual cap

- Subject to 10% penalty if you access your funds before you turn 59½

403(b) Contribution Limits

Contribution limits for 403(b) plans are the same as for 401(k) plans. You’re allowed to invest up to $22,500 in a 403(b) plan in 2023. The IRS caps your contributions and your employer’s contributions at $66,000 for the year.

If you’re aged 50 or older, you can make “catch-up” contributions — up to $7,500 in 2023. Your annual contribution limit is $30,000.

If you work for certain nonprofits and have 15 years of service, you could make smaller catch-up contributions even if you are younger than 50.

*Ad: Clicking will take you to our partner Annuity.org.

Comparing 403(b) Plans to Other Retirement Plans

When comparing a 403(b) plan to other retirement accounts — like a 401(k), 457(b) or Roth IRA — it’s important to consider your tax goals, desired investment options, the institution offering the plan and contribution limits.

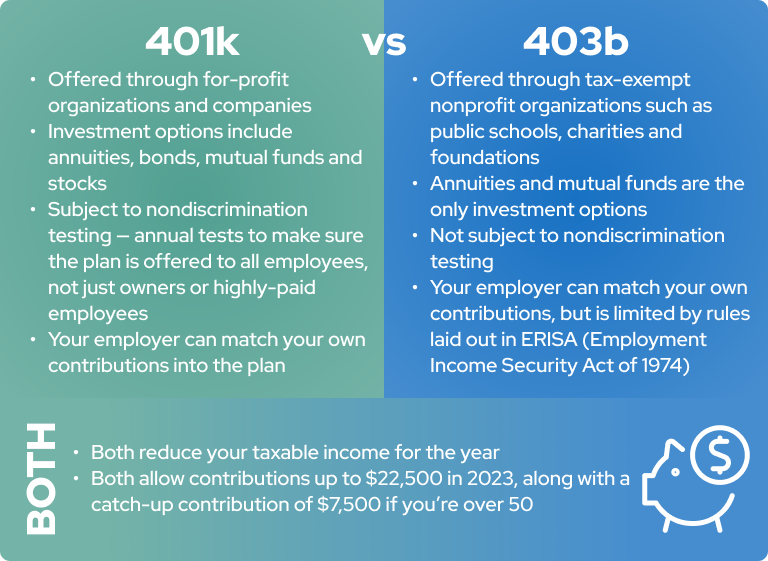

403(b) vs. 401(k)

The major difference between a 401(k) and a 403(b) plan is based on where you work. A 403(b) plan will be offered by certain tax-exempt nonprofit organizations. A 401(k) plan will be offered by for-profit companies and organizations.

There are other differences to consider. In rare cases, employers may offer both a 401(k) plan and a 403(b) plan to their employees. In those cases, you and your employer may contribute to both plans.

457(b) vs. 403(b)

457(b) plans and 403(b) plans have the same purpose — to grow your retirement savings tax deferred. But the two plans have different tax rules and penalties.

For example, both plans shelter contributions from capital gains taxes, meaning you’ll only pay taxes on withdrawals. They both typically only offer annuities and mutual funds as investment products.

Consider the similarities and differences between a 457(b) and 403(b) plan before opening an account.

| 457(b) | 403(b) |

|---|---|

| Offered by state and local governments and certain nonprofit groups | Offered by public educational institutions (public schools, community colleges, colleges and universities), certain nonprofits, churches or church-related groups |

| The limit of total contributions is $22,500 annually | The limit of total contributions is $66,000 annually between you and your employer |

| Allowed to make penalty-free withdrawals at any age once you leave the employer sponsoring your 457(b) | Only allowed to make penalty-free withdrawals once you turn 59 ½ |

403(b) vs. Roth IRA

Roth IRAs are more accessible, have no RMDs (starting in 2024) and offer a wider range of investment products when compared to a 403(b) plan. Roth IRAs also offer tax advantages with your withdrawals instead of offering upfront tax advantages like a 403(b) plan.

Consider the pros and cons of each account to determine which fits your needs.

Differences Between Roth IRA and 403(b)

- More investment options

- Withdrawals are not taxed

- Job status doesn’t change account status

- Earnings grow tax-deferred

- Smaller contribution limit

- Doesn’t lower taxable income

- No matching funds

- Larger contribution amount

- Automatically comes out of your paycheck

- Lowers taxable income

- Tax-deferred growth on earnings

- Employer matching available for some plans

- Limited investment options

- Not available to everyone, depends on your employer

- Must make RMDs when you turn 73

- Withdrawals are taxed

403(b) FAQs

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

9 Cited Research Articles

- The Human Interest Team. (2023, February 8). Contribution Limits for 403(b) Retirement Plans. Retrieved from https://humaninterest.com/learn/articles/contribution-limits-for-403b-retirement-plans/

- Internal Revenue Service. (2023). IRC 403(b) Tax-Sheltered Annuity Plans. Retrieved from https://www.irs.gov/retirement-plans/irc-403b-tax-sheltered-annuity-plans

- Internal Revenue Service. (2022, November 7). Retirement Topics - 403(b) Contribution Limits. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-403b-contribution-limits

- Internal Revenue Service. (2022, November 1). Retirement Plans FAQs on Designated Roth Accounts. Retrieved from https://www.irs.gov/retirement-plans/retirement-plans-faqs-on-designated-roth-accounts

- Sato, G. (2022, May 2). What’s the Difference Between 401(k) and 403(b) Plans? Retrieved from https://www.experian.com/blogs/ask-experian/403b-vs-401k-whats-the-difference/

- The U.S. Senate Committee on Finance. (2022). SECURE 2.0 Act of 2022. Retrieved from https://web.archive.org/web/20230219013533/https://www.medicare.gov/sites/default/files/2022-03/02110-medigap-guide-health-insurance.pdf

- Internal Revenue Service. (n.d.). Retirement Topics - 403(b) Contribution Limits. Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-403b-contribution-limits

- Internal Revenue Service. (n.d.). Retirement Plan and IRA Required Minimum Distributions FAQs. Retrieved from https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- U.S. Securities and Exchange Commission. (n.d.). 403(b) and 457(b) Plans. Retrieved from https://www.investor.gov/additional-resources/retirement-toolkit/employer-sponsored-plans/403b-and-457b-plans

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696