Required Minimum Distribution

A required minimum distribution (RMD) is the amount of money you must withdraw from certain retirement accounts to avoid tax penalties. A specific calculation is used to determine your RMD each year. Starting in 2023, RMDs are required once you turn 73.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: June 30, 2021

- Updated: May 1, 2025

- 5 min read time

- This page features 11 Cited Research Articles

- Edited By

What Is an RMD?

RMDs are an important part of retirement planning and can influence your overall retirement investing strategy as you get older.

You cannot keep money in a tax-deferred retirement account forever. The Internal Revenue Service has specific rules against it, and you can face penalties for breaking or ignoring those rules.

As of 2022, you had to take RMDs by 72. Because of the SECURE 2.0 Act, 2023 saw the RMD age rise to the year you turn 73. This allows you to keep your money tucked away for longer in your IRAs and 401(k)s to allow your savings to grow without being taxed.

Future increases are expected for 2033, when the RMD age will rise to 75, according to the IRS.

| Traditional IRA | 401(k) plan |

| SEP IRA | 403(b) plan |

| SIMPLE IRA | 457(b) plan |

Roth IRAs do not have RMDs until after the owner’s death.

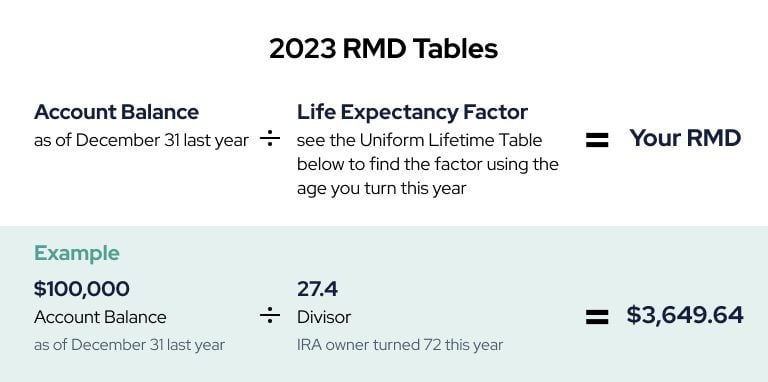

How To Calculate RMD

To calculate your RMD for this year, divide your account balance at the end of last year by the IRS life expectancy factor that corresponds to your age.

There are two different IRS life expectancy tables to use depending on your situation. For reference, most people use the Uniform Lifetime Table.

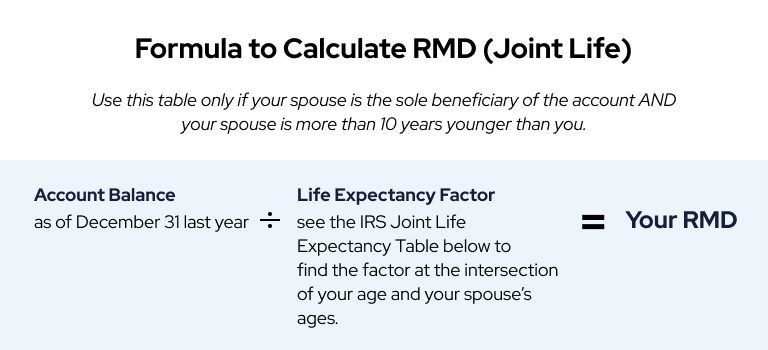

| Joint Life and Last Survivor Table | Use this table if you’re married and your spouse is more than 10 years younger than you are and is the sole beneficiary of your account. |

| Uniform Lifetime Table | Use this table if you’re single, married to someone who isn’t more than 10 years younger than you are or married but your spouse is not the sole beneficiary of your account. |

You will use the same formula to calculate RMDs if your spouse is the sole beneficiary of your account and is more than 10 years younger than you are. However, the life expectancy factors are different.

Required Minimum Distribution Tables 2023

| Age | Life Expectancy Factor |

|---|---|

| 72 | 27.4 |

| 75 | 24.6 |

| 80 | 20.2 |

| 85 | 16.0 |

| 90 | 12.2 |

| 95 | 8.9 |

| 100 | 6.4 |

| Your Age | ||||||||

| Your Spouse's Age | 70 | 71 | 72 | 73 | 74 | 75 | 76 | 77 |

| 45 | 41.5 | 41.5 | 41.4 | 41.4 | 41.3 | 41.3 | 41.2 | 41.2 |

| 46 | 40.6 | 40/6 | 40.5 | 40.5 | 40.4 | 40.4 | 40.3 | 40.3 |

| 47 | 39.7 | 39.7 | 39.6 | 39.5 | 39.5 | 39.4 | 39.4 | 39.3 |

| 48 | 38.8 | 38.8 | 38.7 | 38.6 | 38.6 | 38.5 | 38.5 | 38.4 |

| 49 | 38 | 37.9 | 37.8 | 37.7 | 37.7 | 37.6 | 37.5 | 37.5 |

| 50 | 37.1 | 37 | 36.9 | 36.8 | 36.8 | 36.7 | 36.6 | 36.6 |

| 51 | 36.2 | 36.1 | 36 | 36 | 35.9 | 35.8 | 35.7 | 35.7 |

| 52 | 35.4 | 35.3 | 35.2 | 35.1 | 35 | 34.9 | 34.9 | 34.8 |

| 53 | 34.6 | 34.5 | 34.3 | 34.2 | 34.1 | 34.1 | 34 | 33.9 |

| 54 | 33.8 | 33.6 | 33.5 | 33.4 | 33.3 | 33.2 | 33.1 | 33 |

| 55 | 33 | 32.8 | 32.7 | 32.6 | 32.4 | 32.4 | 32.2 | 32.2 |

RMD Rules & Requirements

You must take your RMDs in a timely manner when you turn 73.

The new rule for 2023 requires you to take your RMDs at 73 instead of 72. You are allowed to withdraw more than the minimum the account requires, but consult with a financial advisor before doing so.

If you turn 72 in 2023, your first RMD date moves to April 1, 2025, which accounts for 2024.

There are also different rules and requirements for RMDs on multiple accounts and inherited IRAs. Consider the various requirements before withdrawing money.

RMD Rules for Multiple Accounts

If you have more than one retirement account that is subject to RMDs, you will need to calculate the distribution for each account separately.

There is an exception for IRAs. In this case, the IRS allows you to take your total IRA RMD from just one IRA account. The same rule applies if you have more than one 403(b) plan, but if you own more than one 401(k) or 457(b) plan, you must pull an RMD from each account separately.

Inherited IRA RMD Rules

Your RMD calculation is different if you inherited an IRA.

To determine your distribution method, you will need the date of death or the original IRA owner and the type of beneficiary you were. If the original owner of the IRA had an RMD due the year of their death, you are now responsible for handling that RMD.

If you are not a spouse, you typically have 10 years to empty the account, according to the IRS. Spouses have more flexibility and can become the account owner.

If you will inherit a Roth IRA, note that RMDs are no longer required starting in 2024.

Strategies for Minimizing Taxes & Penalties on RMDs

There are four key strategies to minimize your taxes and potential RMD penalties.

- Take your RMD distributions early.

- According to Kiplinger, it can take time for your IRA or 401(k) to process your RMD request. If you wait until the last minute, you could miss the deadline.

- Have a financial expert double-check your math.

- Calculating your RMDs can be complex. If you accidentally withdraw the wrong amount or miss the deadline, there are costly consequences.

- Avoid spreading out your RMDs.

- The IRS gives you the option to delay your first RMD until April 1 the year after you turn 72 (or 73 if turning that age in 2023). But if you wait until then, you’re required to take another RMD less than nine months later, by Dec. 1. If your RMDs are large, this could bump you into a higher tax bracket the following year.

- Automate your RMDs.

- To guarantee you will not miss the deadline, you can request for RMDs to automatically be taken out of your account once you have calculated the amount and had it verified by an expert.

If you miss the deadline or do not withdraw the correct amount, you will face an IRS penalty. Because of the SECURE 2.0 Act, starting in 2023, the penalty is a 25% excise tax on the amount not distributed.

For example, if you were required to withdraw $10,000 but only took out $6,000, you would owe a $1,000 penalty (25% of the $4,000 difference), plus income tax on the shortfall.

If you get hit with the 25% IRS penalty, you can ask the IRS to waive it. The IRS may waive the penalty, and the penalty could be reduced to 10% if you correct the RMD within two years.

Required Minimum Distributions FAQs

Writer Lena Borrelli contributed to this article.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

11 Cited Research Articles

- Internal Revenue Service. (2025, January 29). Retirement plan and IRA required minimum distributions FAQs | Internal Revenue Service. https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs.

- United States Senate Committee on Finance. (2022). Secure 2.0_Section by Section Summary 12-19-22 FINAL.pdf. https://www.finance.senate.gov/imo/media/doc/Secure%202.0_Section%20by%20Section%20Summary%2012-19-22%20FINAL.pdf

- Internal Revenue Service. (2024, December 10). Retirement topics - Required minimum distributions (RMDs) | Internal Revenue Service. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

- Internal Revenue Service. (2024, September 10). Publication 590-B (2023), Distributions from Individual Retirement Arrangements (IRAs) | Internal Revenue Service. https://www.irs.gov/publications/p590b

- Internal Revenue Service. (2024, December 10). RMD comparison chart (IRAs vs. defined contribution plans) | Internal Revenue Service. https://www.irs.gov/retirement-plans/rmd-comparison-chart-iras-vs-defined-contribution-plans

- Internal Revenue Service.(2024, November 15). Required minimum distributions for IRA beneficiaries | Internal Revenue Service. https://www.irs.gov/retirement-plans/required-minimum-distributions-for-ira-beneficiaries

- Internal Revenue Service. (2024, August 26). Retirement topics - Beneficiary | Internal Revenue Service. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-beneficiary

- Charles Schwab. (n.d.) Inherited IRA Distribution Rules | Charles Schwab. https://www.schwab.com/ira/inherited-and-custodial-ira/inherited-ira-withdrawal-rules

- Kiplinger. (2016, November 22). FAQs About RMDs for Retirement Accounts | Kiplinger. https://www.kiplinger.com/article/retirement/t045-c001-s003-faqs-about-rmds-for-retirement-accounts.html

- Internal Revenue Service. (2023, December 20), IRS reminds those aged 73 and older to make required withdrawals from IRAs and retirement plans by Dec. 31; notes changes in the law for 2023 | Internal Revenue Service. https://www.irs.gov/newsroom/irs-reminds-those-aged-73-and-older-to-make-required-withdrawals-from-iras-and-retirement-plans-by-dec-31-notes-changes-in-the-law-for-2023

- Fidelity. (n.d.) Making sense of RMDs - Fidelity. https://www.fidelity.com/learning-center/personal-finance/retirement/making-sense-rmds

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-923-9782Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696