Original Medicare

Original Medicare is the federal government’s health insurance program, which is available to most Americans who are 65 and older. It is provided entirely through the government, and beneficiaries can receive treatment and services from any doctor who is enrolled in Medicare.

- Written by Christian Simmons

Christian Simmons

Financial Writer

Christian Simmons is a writer for RetireGuide and a member of the Association for Financial Counseling & Planning Education (AFCPE®). He covers Medicare and important retirement topics. Christian is a former winner of a Florida Society of News Editors journalism contest and has written professionally since 2016.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Michael Jones

Michael Jones

Medicare Expert and Owner of Grand Anchor Insurance Solutions

Michael Jones is a licensed insurance agent who manages his own agency called Grand Anchor Insurance Solutions. In addition to being a Medicare expert, Michael specializes in other insurance products such as voluntary benefits for employees of businesses.

Read More- Published: February 16, 2022

- Updated: April 17, 2025

- 5 min read time

- This page features 6 Cited Research Articles

- Edited By

- Original Medicare is the health plan provided through the government. It is available to most Americans when they turn 65 but can be available earlier if you have ALS or end-stage renal disease.

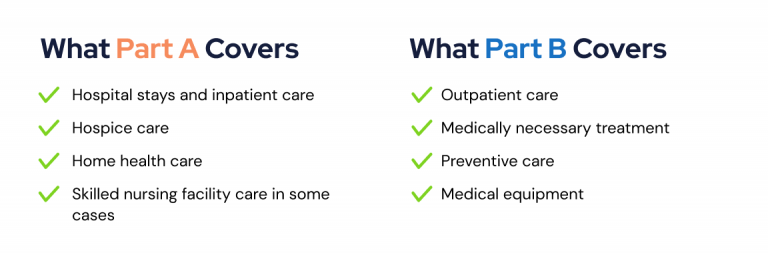

- Original Medicare is divided into Parts A and B. Part A covers hospital stays and inpatient care, while Part B covers medically necessary treatments and services.

- Coverage through Original Medicare is not all-encompassing — there are key areas like vision care, dental care and most prescription drugs that are not covered.

What Is Original Medicare?

Original Medicare can be used to cover your health care needs after you turn 65. The program is available across the country to all Americans who meet certain requirements. Original Medicare covers doctor visits, treatments, services and hospital stays.

Coverage is divided into two parts — Parts A and B — that will each cover different areas of your health care.

Medicare Part A

If you have Original Medicare, Part A is your hospital insurance. It will help cover hospitalizations, as well as stays in a skilled nursing facility or hospice care. Original Medicare does not cover long-term care however, so Part A will not cover a permanent move to a nursing home.

Medicare Part B

Part B covers medically necessary care and preventive services. It will cover your doctor visits, outpatient care and treatments. Part B will also cover some medical equipment as well as tests and screenings, such as diagnostic tests.

Original Medicare Enrollment & Eligibility

Most Americans are eligible for Medicare when they turn 65. To be eligible for premium-free Part A, you must have worked and paid Medicare taxes for at least 40 quarters or have a spouse that is eligible. Some Americans are eligible before they turn 65 if they have certain disabilities, including ALS and end-stage renal disease.

If you are already receiving Social Security when you turn 65, you should automatically be enrolled in Original Medicare. If not, you have a window to enroll that starts three months before the month of your 65th birthday and ends three months after. You will be penalized if you don’t enroll during your initial window.

Original Medicare Deductibles & Costs

If you meet the Medicare tax quarters requirement, then you will be eligible for premium-free Part A coverage. This just leaves you with your deductible, which is $1,676 for 2025.

You will also have to pay a coinsurance of $419 per day starting on your 61st day in the hospital. That figure jumps to $838 for every day after day 90, which are known as lifetime reserve days. If you exhaust all 60 of your reserve days, you will then pay all costs.

If you or your spouse haven’t met the requirement of working for 40 quarters, you can still buy into Original Medicare by paying a premium for Part A.

For Part B, you will pay a monthly premium of $185. You will also have to meet a deductible of $257 before Medicare begins to pay.

Premiums, deductibles and coinsurance costs change every year.

What Does Original Medicare Cover?

Original Medicare covers treatments, services and procedures that are medically necessary. This typically means that a doctor must verify that you do need care.

Under Part A, coverage can include hospital stays and inpatient care. Under Part B, a variety of things are included such as regular doctor visits and lab tests.

- Ambulance Services

- Clinical Research

- Hospital Care

- Medically Necessary Services

- Mental Health

- Preventive Services

- Some Limited Prescription Drugs

Original Medicare also covers mental health services and some limited outpatient prescription drugs.

What Is Not Covered by Original Medicare?

Some of the biggest areas that are not covered under Original Medicare are vision and dental. Coverage for vision and dental is typically only available through Medicare Advantage plans, which are provided by private insurers and can include additional coverage beyond the scope of Original Medicare.

Original Medicare also usually does not cover cosmetic procedures and services, or anything that isn’t of medical significance.

- Dental

- Vision

- Long-Term Care

- Hearing Aids

- Cosmetic Surgery

- Routine Foot Care

- Acupuncture

Hearing aids or exams to fit them are also not covered. More minor services like acupuncture or routine foot care are also typically exempt from coverage.

Frequently Asked Questions About Original Medicare

6 Cited Research Articles

- U.S. Centers for Medicare & Medicaid Services. (2023, October 12). 2024 Medicare Parts A & B Premiums and Deductibles. Retrieved from https://www.cms.gov/newsroom/fact-sheets/2024-medicare-parts-b-premiums-and-deductibles

- U.S. Centers for Medicare & Medicaid Services. (2022). Costs. Retrieved from https://www.medicare.gov/basics/costs/medicare-costs

- U.S. Centers for Medicare & Medicaid Services. (2022). Compare Original Medicare and Medicare Advantage. Retrieved from https://www.medicare.gov/basics/get-started-with-medicare/get-more-coverage/your-coverage-options/compare-original-medicare-medicare-advantage

- U.S. Centers for Medicare & Medicaid Services. (2022). How Original Medicare Works. Retrieved from https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-choices/how-original-medicare-works

- U.S. Centers for Medicare & Medicaid Services. (2022). What’s Not Covered by Part A and Part B. Retrieved from https://www.medicare.gov/what-medicare-covers/whats-not-covered-by-part-a-part-b

- U.S. Centers for Medicare & Medicaid Services. (n.d.). Original Medicare (Part A and B) Eligibility and Enrollment. Retrieved from https://www.cms.gov/Medicare/Eligibility-and-Enrollment/OrigMedicarePartABEligEnrol

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

866-749-5443Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696