Inflation on Track to Push Social Security COLA over 10% in 2023

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Published: August 2, 2022

- 5 min read time

- This page features 9 Cited Research Articles

- Edited By

The highest inflation rate in 41 years is expected to drive the largest Social Security Cost-of-Living Adjustment (COLA). Social Security benefits are expected to increase 10.5% starting in January 2023, according to the League of Senior Citizens — a nonprofit, Virginia-based consumer organization.

This means, the average monthly check of about $1,658 would increase to a little over $1,833 in January, if the inflation rate remains steady.

The Consumer Price Index (CPI) — the United States’ gauge of inflation — released on July 13, surged to 9.1% over the same time last year. That’s the highest inflation rate since November 1981.

The Social Security COLA is adjusted each year based on the rate of inflation. The Social Security Administration does not announce the new year’s COLA until October. The inflation rate is based on the previous 12 months, so it may change — either rise or fall — between now and when Social Security calculates the 2023 COLA.

Depending on whether inflation continues climbing or if it cools off, the Social Security COLA could be as high as 11.4% or as low as 9.8%, according to the League. That would put it in the same ballpark as the 11.2% increase in 1981 or the 14.3% hike in 1980.

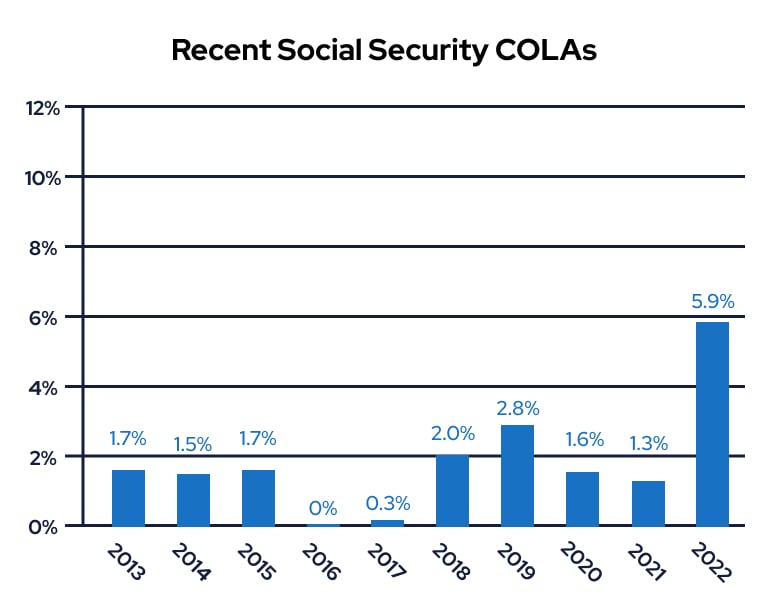

In any scenario, the COLA is expected to be well above all the increases over the past 10 years.

Inflation’s Other Impacts on Retirees

Inflation creates a cascading set of problems for retirees beyond Social Security.

Inflation with rising Medicare premiums can eat away at your Social Security benefits over time and the COLA can end up costing some people in higher taxes.

Like everyone else, inflation reduces retirees’ buying power — diminishing your retirement savings and forcing you to tweak your retirement planning goals.

Impact on Medicare Premiums

Medicare Part B premiums shot up 14.5% for 2022 — from $148.50 to $170.10. It was the fourth largest percentage increase in Part B Medicare costs in the past 20 years, according to the Kaiser Family Foundation.

Most of this increase was due to the cost of covering a new Alzheimer’s drug — Aduhelm. But Medicare overestimated its cost for the drug and is expected to adjust the 2023 Medicare Part B medical insurance premium downward in 2023.

“After receiving [the Centers for Medicare and Medicaid Services’] report reevaluating the 2022 Medicare Part B premiums, we have determined that we can put cost-savings directly back into the pockets of people enrolled in Medicare in 2023,” Health and Human Services Secretary Xavier Becerra said in a statement.

Part B premiums are typically withheld directly from Social Security benefits before you get your monthly Social Security check, so the adjustment could mean even more cash in your bank account from SSA each month.

But that doesn’t mean the extra cash will help you keep up with inflation.

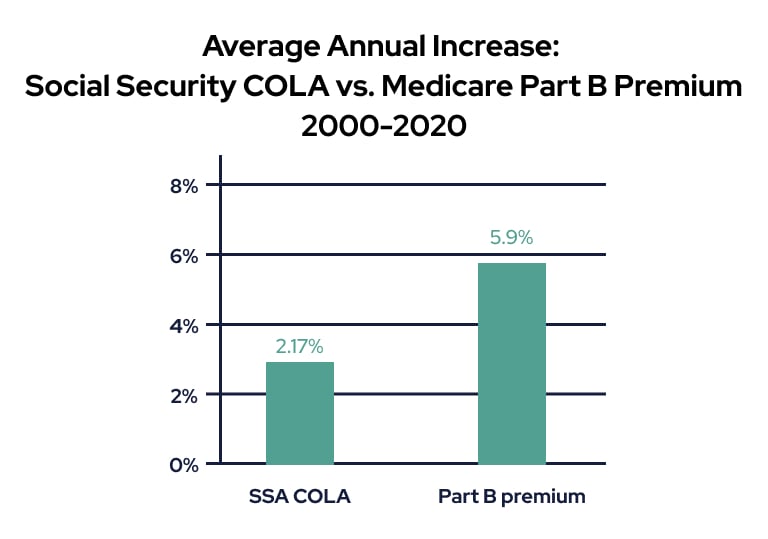

Medicare Part B medical insurance premiums rose almost three times faster than the Social Security COLA between 2000 and 2020, according to a 2021 study from the Center for Retirement Research at Boston College.

Source: Center for Retirement Research at Boston College

Researchers found that the COLAs were losing ground in the long run to higher premium costs.

Higher Social Security Payments May Increase Your Tax Bill

While the Social Security COLA is indexed for inflation, taxes on your Social Security benefits are not.

Large percentage increases in the Social Security COLA in 2022, and expected again in 2023, are pushing more Social Security recipients over tax thresholds — meaning, they must pay higher income taxes.

Since 1984, Social Security beneficiaries have had to pay income taxes on their benefits if they make more than $25,000 as an individual or $32,000 as a couple. But the threshold has never changed. To give perspective, $32,000 in 1984 would be equal to around $90,000 today.

In 1984, only about 8% of beneficiaries had to pay. By 2020, it was up to 56%. The CBO predicts the number will increase 10% in 2022 and then at least another 10% based on expected 2023 benefits.

Inflation Deflates Your Buying Power

Social Security benefits have lost 40% of their buying power since 2000, according to a May 2022 study from the Senior Citizens League. In other words, it would cost you $100 today to purchase what $60 would have in 2000.

This is the core effect of inflation on all consumers, but it shows how Social Security COLAs have not kept up with rising costs over time. Retirees also face reduced buying power from their retirement savings they’ve socked away — sometimes for decades.

Four out of five Americans now cite recession and inflation worries as their top retirement concerns, according to a July 2022 survey of 2,025 Americans ages 45 through 75 from the nonprofit Alliance for Lifetime Income.

Top Concerns of Americans Planning for or Already in Retirement

- 87% — Market trends will reduce potential retirement income

- 84% — Retirement income driven down by recession

- 81% — Worried about dual impact of increasing inflation and reduced spending power

Source: Alliance for Lifetime Income

There’s also a new emphasis on finding ways to hedge against inflation in retirement. A second ALI study found that 82% of financial professionals surveyed cited inflation as the leading reason they changed their approach to retirement planning in 2022.

How Is the Social Security COLA Calculated?

Though the Consumer Price Index (CPI) is running at 9.1%, the Social Security COLA is now expected to be a higher 10.5%.

This is because the Social Security Administration uses a specific database of the Consumer Price Index (CPI) to determine the COLA.

The 9.1% inflation rate is based on the CPI-U from the Bureau of Labor Statistics. This is what you generally hear reported when the Consumer Price Index numbers are announced. The CPI-U tracks retail prices that affect all urban consumers — about 87% of the United States’ population.

Social Security relies on another measure of CPI from the Bureau of Labor Statistics — the Consumer Price Index for Urban Wage Earners, or CPI-W. This measures the monthly change over time in prices urban wage and clerical workers pay for a very specific list of consumer goods and services.

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696