Social Security Retirement Benefits

The Social Security Retirement benefit provides retirees or semi-retirees and their qualifying family members with a steady stream of replacement income after they turn 62. You must meet specific qualifications to receive your monthly retirement benefit. Learn more about how your benefit amount is calculated, the average benefit amount for 2025 and how to maximize your benefit.

- Written by Lindsey Crossmier

Lindsey Crossmier

Financial Writer

Lindsey Crossmier is an accomplished writer with experience working for The Florida Review and Bookstar PR. As a financial writer, she covers Medicare, life insurance and dental insurance topics for RetireGuide. Research-based data drives her work.

Read More- Edited By

Lamia Chowdhury

Lamia Chowdhury

Financial Editor

Lamia Chowdhury is a financial content editor for RetireGuide and has over three years of marketing experience in the finance industry. She has written copy for both digital and print pieces ranging from blogs, radio scripts and search ads to billboards, brochures, mailers and more.

Read More- Reviewed By

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Brandon Renfro, Ph.D., CFP®, RICP®, EA

Retirement and Social Security Expert

Brandon Renfro is a Retirement and Social Security Expert and financial planner. He focuses on helping clients create a secure financial future in retirement and co-owns Belonging Wealth Management. He is also a former finance professor and writes for several publications.

Read More- Published: March 3, 2023

- Updated: May 1, 2025

- 9 min read time

- This page features 17 Cited Research Articles

Key Takeaways- The Social Security Retirement benefit provides income replacement for retirees and qualifying family members.

- The estimated average monthly Social Security benefit for all retired workers is $1,976 in 2025.

- While you can start receiving benefit payments once you turn 62, you will get a higher benefit amount if you wait until you are your full retirement age or 70 years old.

Social Security retirement benefits provide a safety net of income replacement for retirees and their qualifying family members.

The Social Security Administration accounts for inflation with annual cost-of-living adjustments, or COLAs. In 2025, Social Security retirement benefits will increase by 2.5%.

If your ex-spouse, current spouse or child meets specific qualifications, they could receive a monthly payment of up to one-half of your retirement benefit amount. This additional payment does not affect your own retirement benefit amount.

Think of these benefits as a part of your retirement plan — you shouldn’t rely on Social Security benefits alone.

Benefits of Collecting Social Security in Retirement- Provides a steady, reliable income for retirees and qualifying family members

- Benefits have cost-of-living adjustments each year to account for inflation

- Can be the first step of your retirement plan

How To Qualify

If you’re 62 or older and have at least 40 credits, you qualify for retirement benefits.

You earn credits by working and paying your Social Security taxes. In 2025, you earn one credit for every $1,810 in covered earnings, according to the Social Security Administration. You can earn up to four credits in one year.

Forty credits typically equate to about 10 years of working. If you haven’t worked long enough to qualify, your spouse’s work history can qualify you for retirement benefits.

Social Security benefits are important for everyone, even those who have sufficient retirement savings. It can provide a stable base of income that isn’t tied to the market, adjusts for inflation and receives favorable tax treatment.How Are Social Security Benefits Calculated?

Generally, two main factors affect how your Social Security benefits are calculated: your lifetime earnings and your age when you start to receive benefits.

“The SSA uses a formula that calculates the average of an individual’s highest 35 years of earning, indexed for inflation,” Andrew Lokenauth, Founder of Fluent in Finance told RetireGuide. ”With retirement benefits, your benefit amount will be lowered if you choose to start receiving benefits before you reach your full retirement age.”

Additionally, Social Security benefits are progressive, which means lower-income workers receive a larger percentage of their pre-retirement income than higher-income workers, Lokenauth said.

2025 Threshold Limits for Retirement Benefits- If you won’t reach your full retirement age until a year later, your threshold limit is $23,400 in 2025. For every $2 in annual work income above $21,240, the Social Security Administration will withhold $1 of your benefits.

- If you will reach your full retirement age in 2025, your threshold limit is $62,160. $1 in benefits will be withheld for every $3 in earnings above the $56,520 threshold.

- After you reach your full retirement age, the threshold goes away, and you can earn as much income as you want with no deduction.

The SSA uses a formula that calculates the average of an individual's highest 35 years of earning, indexed for inflation.3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.Are Social Security Benefits Taxable?

Social Security benefits are taxable. However, this doesn’t mean you’re guaranteed to have to pay taxes on your benefits.

How you file your taxes and your income influence whether your Social Security benefits are taxable.

You may have to pay taxes on your benefits if your total income is more than $25,000 and you file a federal tax return as an “individual.” If you file a joint return, you may have to pay taxes if your combined total income with your spouse is more than $32,000.

Depending on your income, you may have to pay taxes on 50% to 85% of your Social Security income.

Income Tax Rates on Social SecurityFiling Status Combined Income* Percentage of Benefits Taxed Individual $25,000 to $34,000 Up to 50% Individual $34,000 and up Up to 85% Joint $32,000 to $44,000 Up to 50% Joint $44,000 and up Up to 85% Source: Social Security Administration*Combined income includes the total of your adjusted gross income, your non-taxable interest as well as half of any Social Security benefits that you receive for the year.

How Social Security Benefits Pay Out

Your Social Security retirement benefits are paid out monthly. You can receive your benefits through direct deposit or sign up for the Direct Express card program.

Your Social Security payment schedule varies, depending on what day you were born. For example, if you were born in the first 10 days of a month, you can expect to receive your benefit payment on the second Wednesday of each month.

According to the Social Security Administration, you can expect benefits to increase by about $50, due to the 2025 COLA increase of 2.5%.

The Social Security Administration also offers a chart showing retirement benefit calculation examples for workers retiring in 2025. There are examples for potential benefit amounts if you retire before or at your full retirement age.

HOW MUCH WILL YOU RECEIVE?The Social Security Administration lets you check how much you’ve paid into the system every year you’ve worked. It also provides a retirement estimator to give you an approximate idea of how much you can expect to receive each month when you retire.Source: Social Security AdministrationNever Miss Important News or UpdatesGet money-saving tips, hard-to-find info and tactics for a successful retirement in our free weekly newsletter.How to Maximize Social Security Benefits

To maximize your monthly benefits, wait until you’re 70 years old, or at least until you reach full retirement age, to start collecting payments. Although you can start to claim your benefits once you turn 62, the benefits will be 30% to 35% less than if you were to wait until you reached your full retirement age.

John Clark, CLTC®, NSSA® | 1:04 What impact does taking my Social Security early (or delaying it) have on my retirement? Never Miss Important News or UpdatesReplay VideoJohn Clark, licensed insurance advisor and owner of Senior Solutions Insurance Agency, explains what impact taking Social Security early — or delaying it — has on your retirement.

Never Miss Important News or UpdatesReplay VideoJohn Clark, licensed insurance advisor and owner of Senior Solutions Insurance Agency, explains what impact taking Social Security early — or delaying it — has on your retirement.If you wait until past your full retirement age to start collecting Social Security benefits, your monthly benefits will increase by 8% every year until you’re 70. If you want the highest benefit amount possible, wait to collect your Social Security benefits until you turn 70.

For example, if you were born in 1959, your full retirement age would be 66 years and 10 months. Let’s say you’re entitled to $1,000 a month at full retirement age. The amount you can receive varies by hundreds of dollars a month based on when you choose to retire.

If you were to choose an early retirement at 62, you would receive only $708 per month. If you were to wait until you reach your full retirement age at age 66 and 10 months, you would receive the full $1,000. However, you’d receive the highest benefit of $1,253 per month if you were to delay retirement until you turn 70.

Full Retirement Age Based on Birth YearYear of Birth Full Social Security Retirement Age 1937 or earlier 65 1938 65 and 2 months 1939 65 and 4 months 1940 65 and 6 months 1941 65 and 8 months 1942 65 and 10 months 1943 to 1954 66 1955 66 and 2 months 1956 66 and 4 months 1957 66 and 6 months 1958 66 and 8 months 1959 66 and 10 months 1960 and later 67 Source: Social Security AdministrationThe decision of when to begin claiming Social Security benefits is an extremely important part of your retirement plan. It determines how much Social Security you will receive every month for your entire time in the program.

Before you decide when to apply for Social Security benefits, consider what other retirement savings or benefits you have available to you, how long you expect to live in retirement and whether you plan to continue to work while you collect Social Security.

You can continue working and start receiving Social Security benefits to maximize your benefit amount. Know that if you start to receive benefits before you reach your full retirement age, there is a limit on how much you can earn.

What Are the Biggest Social Security Mistakes People Make?

Three of the biggest Social Security mistakes you can make are collecting benefits too early, assuming you only need Social Security as your income and not checking your earnings record.

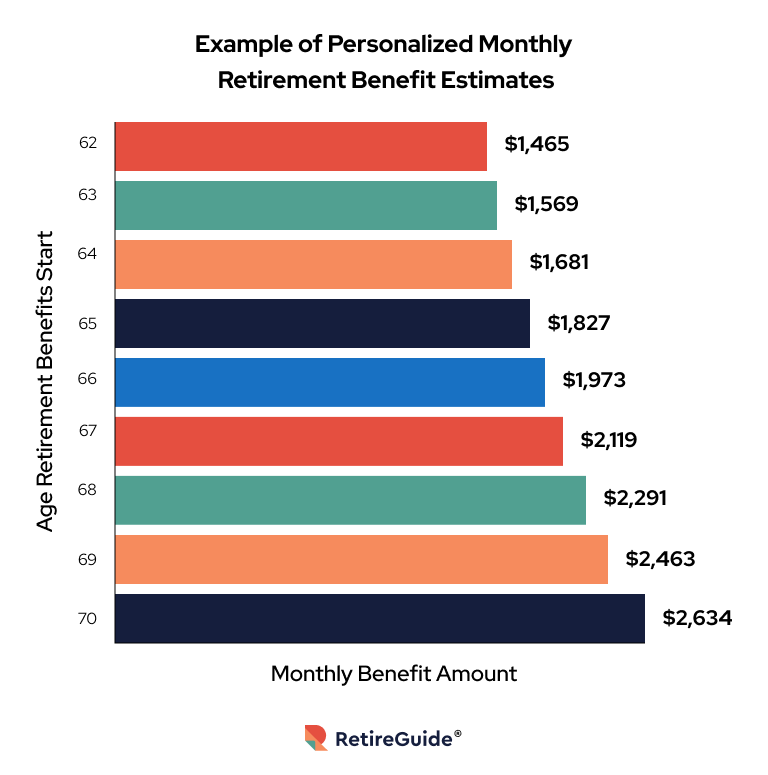

If you start collecting your benefits when you turn 62, you’ll be shorting yourself of potential income. Below is an example of a personalized monthly retirement benefit estimate, which will be in your Social Security statement.

You can access your statement online, or have it mailed to you. The statement will show potential benefit amounts, personalized to you, to show how much you could make if you wait until you turn 70.

Social Security benefits are likely to cover only about 37% of past income, according to the Center on Budget and Policy Priorities. If you rely only on Social Security and don’t have other savings or resources to fund your retirement, you’re likely to struggle to be financially comfortable.

Your earnings record is what qualifies you for Social Security retirement benefits. If you don’t have enough work credits, or you don’t pay Social Security taxes, you could find yourself at risk of not qualifying for benefits. Confirm that you’re on track to qualify for benefits so you don’t end up risking ineligibility.

3 Minute Quiz: Can You Retire Comfortably?Take our free quiz & match with a financial advisor in 3 easy steps. Tailored to your goals. Near you or online.Does Social Security Recalculate Benefits?

If you had any earnings within the previous year, the Social Security Administration will recalculate your benefits. Benefits are recalculated annually, according to AARP.

Your benefit amount will only change if your latest income was one of your highest. Your benefits are calculated from the 35 best paying years of income. If your earnings from the previous year weren’t high compared to previous years, your benefit amount shouldn’t be affected.

Did You Know?Each year, you’ll see a shift in your benefit amount due to the annual cost-of-living adjustment. The annual COLA can increase or decrease your benefit, depending on inflation. In 2025, you will see a slight increase of 2.5%.Source: Social Security AdministrationFrequently Asked Questions About Social Security Retirement Benefits

Can you be eligible for food stamps if you’re receiving retirement Social Security benefits?Yes — you can be eligible for food stamps while collecting Social Security benefits. The government counts income from all sources, including Social Security, in determining eligibility. Certain rules make it easier for people 60 and older to qualify for food stamps.Are Social Security benefits going to run out?Social Security is expected to run out of cash reserves in 2035, according to the 2022 annual report of the Social Security Board of Trustees. This is a year later than the previous estimate. However, this doesn’t mean the program would be bankrupt and unable to pay out benefits. If Congress does nothing to reform the system by 2035, Social Security would still be able to pay 74% of promised benefits until 2096.What happens to unused Social Security benefits?Unused Social Security benefits are held in the Social Security trust funds and invested in Treasury bonds guaranteed by the federal government. The Social Security trust funds are financial accounts in the U.S. Treasury with the sole purpose to pay benefits and administrative costs.Which states tax Social Security benefits?Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia tax some or all of their residents’ Social Security benefits.What income reduces Social Security benefits?The yearly earnings limit is $23,400 if you’re under full retirement age in 2025. If you will reach full retirement age in 2025, the limit on your earnings is $62,160. Once you reach your full retirement age, there is no income limit that will lower your benefits.Writer Anna Baluch contributed to this article.

AdvertisementConnect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

Last Modified: May 1, 2025Share This Page17 Cited Research Articles

- Lisa, A. (2023, January 2). Can You Collect Social Security and Be Eligible for Food Stamps? Retrieved from https://www.yahoo.com/now/collect-social-security-eligible-food-110032964.html

- Social Security Administration. (2023, January). Understanding the Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10024.pdf

- Social Security Administration. (2023). Benefits Paid by Type of Beneficiary. Retrieved from https://www.ssa.gov/OACT/ProgData/icp.html

- Social Security Administration. (2023). Social Security Credits. Retrieved from https://www.ssa.gov/benefits/retirement/planner/credits.html

- Social Security Administration. (2023). Income Taxes and Your Social Security Benefit. Retrieved from https://www.ssa.gov/benefits/retirement/planner/taxes.html

- Social Security Administration. (2023). Cost-of-Living Adjustment (COLA) Information for 2023. Retrieved from https://www.ssa.gov/cola/

- Social Security Administration. (2023). Normal Retirement Age. Retrieved from https://www.ssa.gov/oact/progdata/nra.html

- Social Security Administration. (2023). If You Are the Survivor. Retrieved from https://www.ssa.gov/benefits/survivors/ifyou.html

- Social Security Administration. (2023). Receiving Benefits While Working. Retrieved from https://www.ssa.gov/benefits/retirement/planner/whileworking.html

- Social Security Administration. (2023). Benefits For Your Family. Retrieved from https://www.ssa.gov/benefits/retirement/planner/applying7.html

- AARP. (2022, December 28). Which States Tax Social Security Benefits? Retrieved from https://www.aarp.org/retirement/social-security/questions-answers/which-states-do-not-tax-social-security-benefits.html

- AARP. (2022, December 23). What Is Social Security’s Special Earnings Limit Rule? Retrieved from https://www.aarp.org/retirement/social-security/questions-answers/social-security-first-year-rule.html

- AARP. (2022, December 20). How Are Social Security Disability Benefits Calculated? Retrieved from https://www.aarp.org/retirement/social-security/info-2021/ssdi-benefit-calculation.html

- AARP. (2022, October 13). How Often Does Social Security Recalculate Benefits Based on Earnings? Retrieved from https://www.aarp.org/retirement/social-security/questions-answers/how-often-does-ssa-recalculate-benefits.html

- Nesbit, J. (2022, October 13). Social Security Benefits Increase in 2023. Retrieved from https://blog.ssa.gov/social-security-benefits-increase-in-2023/

- Social Security Administration. (2022, June 1). Your Social Security Statement. Retrieved from https://www.ssa.gov/myaccount/assets/materials/statement-redesign-si-bw.pdf

- Center on Budget and Policy Priorities. (2022, March 4). Top Ten Facts About Social Security. Retrieved from https://www.cbpp.org/sites/default/files/atoms/files/8-8-16socsec.pdf

- Edited By

Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696