Senior Scams: The Complete Guide

Every year, roughly 7 million adults 65 and older fall victim to senior scams, according to data from Comparitech. The best way to avoid losing money or confidential information to a scammer is by learning to recognize the different types of fraud and when you may be the target.

- Written by Terry Turner

Terry Turner

Senior Financial Writer and Financial Wellness Facilitator

Terry Turner has more than 35 years of journalism experience, including covering benefits, spending and congressional action on federal programs such as Social Security and Medicare. He is a Certified Financial Wellness Facilitator through the National Wellness Institute and the Foundation for Financial Wellness and a member of the Association for Financial Counseling & Planning Education (AFCPE®).

Read More- Edited By

Lee Williams

Lee Williams

Senior Financial Editor

Lee Williams is a professional writer, editor and content strategist with 10 years of professional experience working for global and nationally recognized brands. He has contributed to Forbes, The Huffington Post, SUCCESS Magazine, AskMen.com, Electric Literature and The Wall Street Journal. His career also includes ghostwriting for Fortune 500 CEOs and published authors.

Read More- Published: September 29, 2021

- Updated: October 20, 2023

- 13 min read time

- This page features 7 Cited Research Articles

- Edited By

Contrary to popular belief, recent data from the Federal Trade Commission shows that seniors are 20 percent less likely than younger people to fall for scams. However, when senior scams do occur, the median loss is often much greater.

Losing large sums of money as a senior is typically more detrimental than losing small amounts in your 20s, as most older adults are retired and living off of their nest egg rather than continuing funds from employment.

Once you understand the main warning signs and different types of fraudulent practices, you’ll be better able to protect yourself and maintain your financial wellness.

How To Avoid Being Scammed

While there are specific warning signs for different types of scams, many are relatively similar and can be applied no matter the situation. One of the best things seniors can do is to protect their confidential information. This includes bank account and social security card numbers, as well as private Medicare details.

Before giving this type of information to anyone, always verify the person’s identity. You also never want to give sensitive information over the phone unless you initiated the call and you received the phone number from a verified source, such as a government website. Here are a few other ways to avoid being scammed as an older adult:

- Never rush into anything. Take a minute to compose yourself and take in the whole situation before deciding what to do next.

-

Never send money to someone you’ve never met, unless:

- It is a verified government official or other party.

- You initiated the call and received the number from a verified source. If you found it online, make sure the website had a .gov, .org or other reliable domain extension and is secure. Website URLs that start with HTTPS:// are more secure than those that start with HTTP://.

Types of Scams

As technology has progressed, financial fraud has unfortunately become both more common and easier to perform. This is done in many different ways, including:

- Impersonation scams

- Online and digital scams

- Unexpected money scams

- In-person scams

- Debt-related scams

These are a few of the basic, most common scams you’ll come across. However, there are variations of each. Scam artists will change their tactics to whatever makes the most sense to get your private and financial information.

*Ad: Clicking will take you to our partner Annuity.org.

Impersonation Scams

Impersonation acts are just one of the common crimes against the elderly. These scams happen when one person pretends to be another — be it a government official, caregiver or grandchild — and tricks you into giving them money or other confidential information.

Grandparent Scams

When a fraudster knows you have grandchildren, they may call and pretend to be one of them. When they call, they often say they’re in some kind of emergency and need money right away. To make it more realistic and believable, many scammers can make their voice sound like the grandchild’s voice.

This can be detected more easily for grandparents raising their grandchildren, since they’ll typically have a better idea of the grandchild’s whereabouts and if they actually would need money or other help. However, even grandparents who don’t live with or raise their grandchildren can easily protect themselves from this type of senior scam.

- A “grandchild” calls requesting a need for money.

- The scammer tries to rush you into sending funds.

- Verify your grandchild’s whereabouts by calling their full-time guardian or contacting the grandchild directly.

- Never send money over the phone.

Government Personnel Scams

These scams most often occur when someone is trying to get hold of sensitive government information or collect money. The scam artist may call, email or send a letter in the mail while acting as a Social Security, Medicare or IRS official. The goal of contacting you this way is to elicit fear by telling you your Medicare benefits have stopped, you owe taxes or are in a similar dilemma.

It’s important to remember that legitimate government officials will never ask you to give them confidential information over the phone unless you initiate the call. Similarly, they will often contact you in the mail before reaching out over the phone.

- You receive an unsolicited call, letter or email from someone saying they are a government official.

- The person you received the call, letter or mail from asks for confidential information.

- They elicit fear in any form, often by including some type of threat.

- Verify the legitimacy of the claim by contacting the appropriate government entity.

- Never send money over the phone or by mail before authenticating the claim made against you.

- Never give private information to “government officials” who call you first.

*Ad: Clicking will take you to our partner Annuity.org.

Online & Digital Scams

More seniors are using technology on a regular basis. According to a study conducted by the Pew Research Center, four out of 10 adults aged 65 or older own a smartphone.

This same study shows that internet usage among seniors has also increased 53 percent since 2000. The rise of seniors using technology has opened more opportunities for swindlers to strike. These digital and online scams come in many shapes and forms.

Online Dating Fraud

In 2020 alone, romance scams accounted for $304 million lost, according to data from the FTC. Half of these scams reportedly started through social media.

In contrast to most other scams that happen quickly, online dating fraud can occur over several months before anyone loses money. Often the scammer will spend time building trust and getting to know the person first.

- They make promises that are too good to be true.

- They ask for money.

- They claim they need the money for an honorable cause (i.e., an emergency, a plane ticket to come see you, etc.).

- They make unexpected contact with you.

- They quickly develop strong feelings for you.

- Keep your conversations on the dating platform.

- Never send money to someone you’ve only met online.

- Check to make sure the photos they use on their profile are actually of them by using the Google Image Search tool. Download the photo to your computer and then drag and drop the image into Google’s search bar.

- Since these scammers often use scripts, copy and paste messages from them into Google to see if the messages have been used elsewhere.

Tech Support Scams

According to the FTC, seniors were five times more likely to fall for tech support scams in 2019. When someone is trying to get money from you in this way, they’ll often send a popup on your computer saying you have a virus or other issue. They will include a phone number for you to call and pressure you into sending them money to fix a fake problem.

- You receive an unsolicited pop-up message from a fake tech company, oftentimes with misspelled words or incorrect grammar.

- The message tells you to call the number on your screen.

- Verify the company’s legitimacy by using a different device to search for their website. (If the person claims to be from a well-known tech company, be wary. Big tech companies won’t initiate contact)

- Never call the number on the pop-up, click on any links or give another person access to your device.

- Install a reputable antivirus software to your devices.

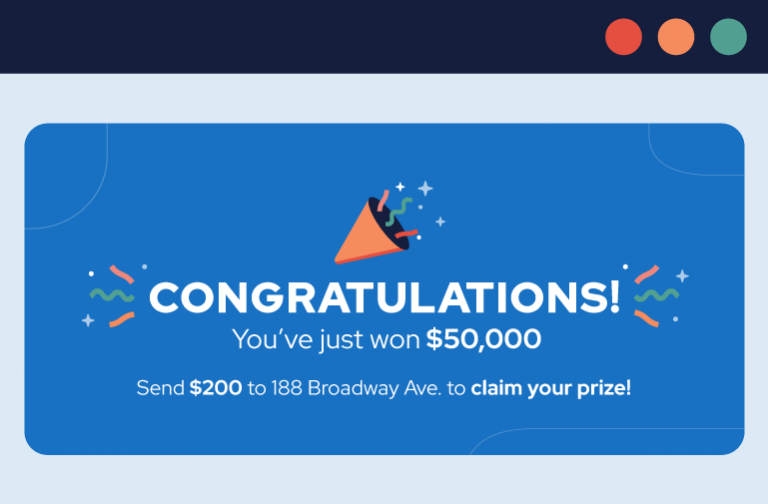

Unexpected Money Scams

Who wouldn’t want to hear they’ve won 1 million dollars from doing nothing? Scammers know that many people would love to receive a large sum of money at the drop of a hat — that’s why these scams are often effective in getting your money.

Whether the scammer attempts to contact you over the phone, via email or by letter in the mail, remember that if you didn’t enter to win anything then you didn’t actually win anything.

Lottery Scams

While there are many different ways fraudsters can trick you into losing money, lottery scams are one of the most common ways of doing so. If you receive a phone call, letter in the mail, pop-up message or email saying you’ve won money or an otherwise expensive item, be wary.

The chances of winning anything you didn’t enter to win is highly unlikely. You’ll also recognize this as a scam if you’re asked to wire money to the organization first to receive what you’ve won.

- You’re told you’ve won money but never entered a contest or bought a lottery ticket.

- You need to wire money to the organization to receive your winnings.

- Never wire money to any organization that tells you they need to receive a small fee from you before you receive your winnings.

- Never give out your bank account number or other private information if you’re told you’ve won money or a large-ticket item.

- If you’re contacted over the phone, hang up if you feel pressured to act immediately.

In-Person Scams

Scammers who are great with people often perform in-person fraud. These types of senior scams can be especially successful with older adults who are isolated or lonely.

Having someone to talk to can bring a sense of relief, even if it’s with a perfect stranger. The person may be charming or have a good sense of humor, but be cautious of people trying to sell you something or collect money in any way.

Donations to a Fake Cause

Swindlers will often prey on your emotions to get you to fall for their scam. This includes creating fake charities and asking for your donation to support their cause. Fake charity scammers may come knocking at your door, send you flyers in the mail or call you on the phone.

These schemes occur most often around the time of a disaster. If you would like to donate to a good cause, do thorough research first and never let someone rush you into giving them money.

- You feel rushed to contribute.

- The supposed charity doesn’t have a website or the website doesn’t provide contact information.

- Check for the charity on the Better Business Bureau Wise Giving Alliance or Charity Navigator.

- If you would like to donate money to a good cause, do so through a secure service and only to charities you are familiar with.

Fake Products

The goal of fake product scams is to convince you that your life will be better with a certain good or service. You then pay for it expecting to receive the good or service, but you never do. Instead, your hard-earned money goes straight to the fraudster’s pocket and you likely never hear from them again.

- The salesperson rushes you into making a decision.

- You can’t find a website for the company or the website doesn’t provide contact information.

- Always check for a reputable website before making any purchases. Such websites will have contact information, an about page and HTTPS at the beginning of their URL.

- If you’re purchasing something online, check for an about page and contact information to verify the site’s credibility.

- If you’re unsure if something is a scam, search online for the company name to find additional information.

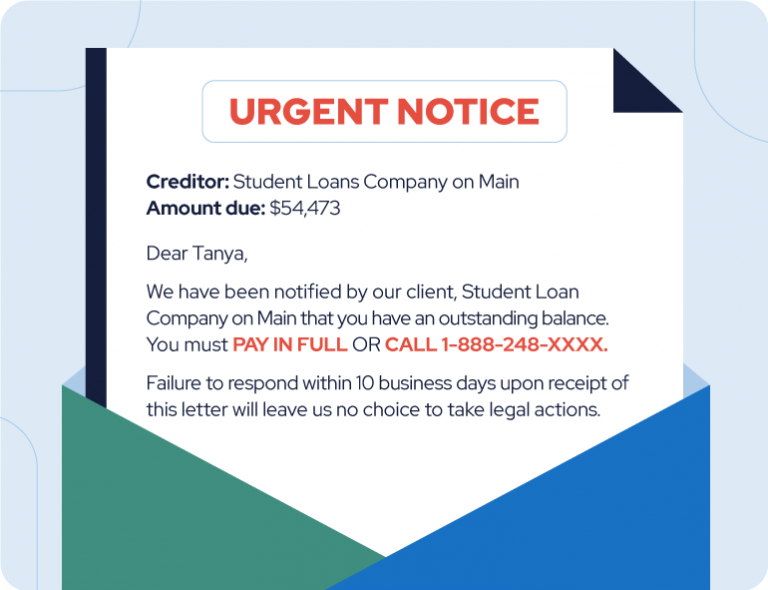

Debt-Related Scams

Debt is an increasing part of society and can bring about some of our strongest emotions, particularly for those who owe a large amount of money. One study by Frontiers in Psychology shows that debt can increase the risk of depressive disorders. It’s no surprise then that scammers use these negative emotions to trick you into falling for their scheme.

According to a study by Experian, the baby boomer generation (those 56–74 years old) has an average debt of $97,290, making this generation susceptible to debt-related senior scams.

Debt Relief

The goal of this type of scam is to make you believe that your debt can be reduced. The scammer will often charge a large upfront fee to help you lower your debt-repayment responsibility, only to disappear shortly after you’ve paid the fee. You’re then left with the same amount of debt and less money to help pay it off.

When dealing with debt settlement companies, be aware that the Federal Trade Commission requires companies to provide these items for you before signing up for their services:

- Fees and terms of service

- Timelines for results

- Potential negative consequences

- The amount you have to save for the company to pay creditors on behalf of your debt

- The money in the account is yours, including interest and it can be withdrawn at any time

- You’re offered debt relief through a robocall.

- The scammer demands fees to be paid up front.

- Hang up on robocalls.

- Never pay fees before signing up for the service.

- Always verify the validity of companies or people who offer unsolicited services.

- If you’re looking for debt relief, consider contacting your creditors directly, rather than looking for third parties to step in.

Debt Collection

- A debt collector contacts you out of the blue.

- Said debt collector leaves you with frightening threats.

- Regularly review your credit report to view outstanding debts. You can receive a free credit report once a year from each of the three major credit bureaus: Experian, Equifax and TransUnion.

- Always verify the credibility of the scammer by asking them for the name and address of the agency they work for. If you’re unsure it’s a scam, it’s always best to call the agency directly and ask about outstanding debts.

How To Recover From Being Scammed

Unfortunately, once you’ve given a scammer your money it’s unlikely you’ll ever see it again. If you send money through a wire transfer or prepaid card, it’s almost impossible to track down — one reason scammers often request to receive their money this way.

Once you realize you’ve been scammed, follow these steps:

- Stop communication with the scammer and report the fraud to the FTC.

- Call your bank or financial institutions immediately and request they freeze your accounts.

- If the scammer has sensitive information, such as your Social Security number or Medicare number, notify the appropriate institutions.

- Contact a trusted family member for support.

By reporting the scam to the FTC, you can help prevent others from losing their money or confidential information.

Recognizing the different types of senior scams will help you better protect yourself and your money. By never sending money or confidential information, such as your Medicare details or Social Security card number, over the phone to unverified companies and taking time to do research rather than rush into a decision, you’ll be on your way to outsmarting the fraudsters that try to take advantage of you.

Connect With a Financial Advisor Instantly

Our free tool can help you find an advisor who serves your needs. Get matched with a financial advisor who fits your unique criteria. Once you’ve been matched, consult for free with no obligation.

7 Cited Research Articles

- Federal Trade Commission. (2021, June 30). Consumer Sentinel. Retrieved from: https://public.tableau.com/app/profile/federal.trade.commission/viz/ConsumerSentinel/Infographic

- Fletcher, E. (2021, February 10). Romance scams take record dollars in 2020. Retrieved from: https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2021/02/romance-scams-take-record-dollars-2020

- Fletcher, E. (2020, October 21). Scams starting on social media proliferate in early 2020. Retrieved from: https://www.ftc.gov/news-events/data-visualizations/data-spotlight/2020/10/scams-starting-social-media-proliferate-early-2020

- Federal Trade Commission (2020, October 18). Protecting Older Consumers. Retrieved from: https://www.ftc.gov/system/files/documents/reports/protecting-older-consumers-2019-2020-report-federal-trade-commission/p144400_protecting_older_adults_report_2020.pdf

- Bischoff, P. (2020, August 26) The United States of Edler Fraud — How Prevalent is Elder Financial Abuse in Each State? Retrieved from: https://www.comparitech.com/blog/vpn-privacy/elder-fraud-by-state/

- Frontiers in Psychology. (2020 July, 10). Relationship Between Debt and Depression, Anxiety, Stress, or Suicide Ideation in Asia: A Systematic Review. Retrieved from: https://www.frontiersin.org/articles/10.3389/fpsyg.2020.01336/full

- Federal Trade Commission. (2018, March). Getting Out of Debt. Retrieved from: https://consumer.ftc.gov/articles/getting-out-debt

Calling this number connects you to one of our trusted partners.

If you're interested in help navigating your options, a representative will provide you with a free, no-obligation consultation.

Our partners are committed to excellent customer service. They can match you with a qualified professional for your unique objectives.

We/Our Partners do not offer every plan available in your area. Any information provided is limited to those plans offered in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

844-359-1705Your web browser is no longer supported by Microsoft. Update your browser for more security, speed and compatibility.

If you need help pricing and building your medicare plan, call us at 844-572-0696